March 2024

Speculation on the influence of Artificial Intelligence (AI) pervades every corner today. Few industries seem untethered from its potential impact, likewise global productivity. BNY Mellon’s Global Economic and Investment Analysis (GEIA) team outlines its view on the economic implications of the new technology wave.

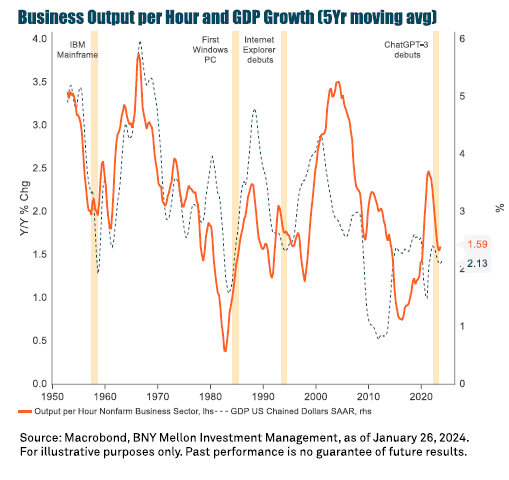

The hype and excitement of AI is being felt across everyday lives today, but its very real economic impact has only just begun. According to BNY Mellon’s Global Economic and Investment Analysis (GEIA) team, widespread AI adoption may result in a more than 1.5% rise in global productivity growth in the next decade.

In analyzing the AI movement, GEIA economists Jake Jolly and Seb Vismara explored its market and economic impact, outlining in their view probable scenarios. One headline assertion in their analysis is the likelihood of its substantial impact on productivity growth. This in turn could have a positive influence on earnings growth and operating margins, given they are typically correlated to productivity growth (a key driver of GDP growth), the two say.

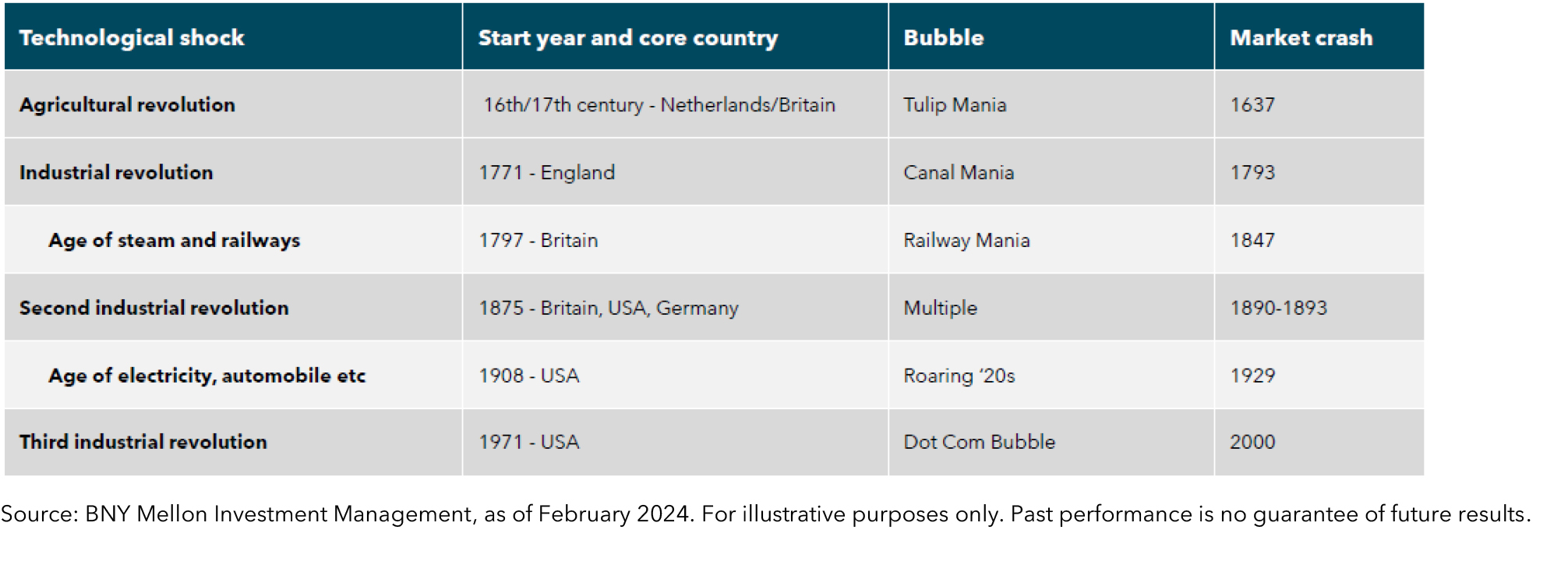

“Generative AI could potentially spur a new industrial revolution as it can automate and augment many non-routine tasks less impacted by previous innovations.1 Like the steam engine, electrification and computers, AI could fundamentally reshape industrial organization and work.”

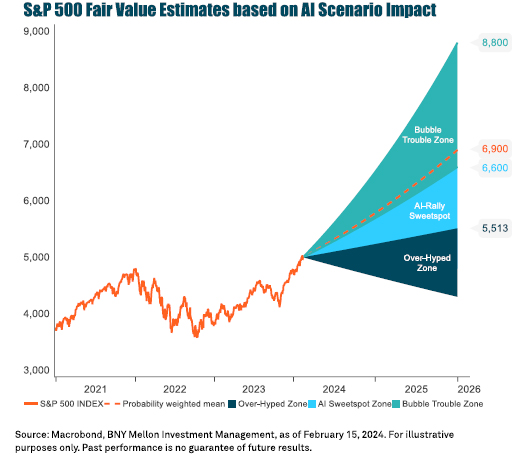

While stock markets have already seen gains influenced by the AI story, the GEIA team believes as potential AI benefits become clearer, its market impact may be starker. This could result in boosting the S&P 500 Index over 6,500 in the next few years – up from its position at just over 5,000 today (February 2024), in their view. But like innovations in the past that led markets up, is this just a bubble in the making? Not just yet, say Jolly and Vismara.

They say: “The tech rally seen in markets since November 2022 has been significant but not yet unsustainable. Realized returns are attractive, but not extreme,” they note. However, they add: “Every major innovation since the 17th century led to the formation of a market bubble so at the very least, one should consider the probability of a bubble is elevated.”

Given significant uncertainty around AI adoption/impact, Jolly and Vismara believe it’s more intellectually honest to focus on probability weighted ranges for the equity outlook. “We think an ‘AI-rally sweet spot’ lies between 5,500 and 6,600 through 2025.”

But will it just be tech companies that win from any AI boost? Maybe initially, purports the GEIA team’s analysis. Past innovation cycles certainly bear that argument out, with those directly involved the biggest winners – at least in the short run, Jolly and Vismara say. However, when it comes to AI its application may be broader and which it may benefit and which it may disrupt remains to be fully seen. It may also result in new industries entirely.

“New technologies can fundamentally alter the cost structure of a given industry and the way inputs are combined. This allows for a redefinition in the way goods and services are provided to the public (there is a change in the production function, as economists would say), and new business models emerge.”

Beyond technology, Jolly and Vismara say other beneficiaries of AI could be communication services, financials and healthcare, and at a country level, the US followed by Taiwan/Korea and several European countries.

1 Generative AI refers to AI-created content including text, audio and synthetic data.

IMPORTANT INFORMATION

FOR INSTITUTIONAL, PROFESSIONAL, QUALIFIED INVESTORS AND QUALIFIED CLIENTS. FOR GENERAL PUBLIC DISTRIBUTION IN THE U.S. ONLY.

This material should not be considered as investment advice or a recommendation of any investment manager or account arrangement, and should not serve as a primary basis for investment decisions. Any statements and opinions expressed are those of the author as at the date of publication, are subject to change as economic and market conditions dictate, and do not necessarily represent the views of BNY Mellon or any of its affiliates. The information has been provided as a general market commentary only and does not constitute legal, tax, accounting, other professional counsel or investment advice, is not predictive of future performance, and should not be construed as an offer to sell or a solicitation to buy any security or make an offer where otherwise unlawful. The information has been provided without taking into account the investment objective, financial situation or needs of any particular person. BNY Mellon and its affiliates are not responsible for any subsequent investment advice given based on the information supplied. This is not investment research or a research recommendation for regulatory purposes as it does not constitute substantive research or analysis. This information may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or expectations will be achieved, and actual results may be significantly different from that shown here. The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Past performance is no guarantee of future results. Information and opinions presented have been obtained or derived from sources which BNY Mellon believed to be reliable, but BNY Mellon makes no representation to its accuracy and completeness. BNY Mellon accepts no liability for loss arising from use of this material.

All investments involve risk including loss of principal.

Not for distribution to, or use by, any person or entity in any jurisdiction or country in which such distribution or use would be contrary to local law or regulation. This information may not be distributed or used for the purpose of offers or solicitations in any jurisdiction or in any circumstances in which such offers or solicitations are unlawful or not authorized, or where there would be, by virtue of such distribution, new or additional registration requirements. Persons into whose possession this information comes are required to inform themselves about and to observe any restrictions that apply to the distribution of this information in their jurisdiction.

Issuing entities

This material is only for distribution in those countries and to those recipients listed, subject to the noted conditions and limitations: For Institutional, Professional, Qualified Investors and Qualified Clients. For General Public Distribution in the U.S. Only. • United States: by BNY Mellon Securities Corporation (BNYMSC), 240 Greenwich Street, New York, NY 10286. BNYMSC, a registered broker-dealer and FINRA member, and subsidiary of BNY Mellon, has entered into agreements to offer securities in the U.S. on behalf of certain BNY Mellon Investment Management firms. • Europe (excluding Switzerland): BNY Mellon Fund Management (Luxembourg) S.A., 2-4 Rue EugèneRuppertL-2453 Luxembourg. • UK, Africa and Latin America (ex-Brazil): BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V4LA. Registered in England No. 1118580. Authorised and regulated by the Financial Conduct Authority. • South Africa: BNY Mellon Investment Management EMEA Limited is an authorised financial services provider. • Switzerland: BNY Mellon Investments Switzerland GmbH, Bärengasse 29, CH-8001 Zürich, Switzerland. • Middle East: DIFC branch of The Bank of New York Mellon. Regulated by the Dubai Financial Services Authority. • Singapore: BNY Mellon Investment Management Singapore Pte. Limited Co. Reg. 201230427E. Regulated by the Monetary Authority of Singapore. • Hong Kong: BNY Mellon Investment Management Hong Kong Limited. Regulated by the Hong Kong Securities and Futures Commission. • Japan: BNY Mellon Investment Management Japan Limited. BNY Mellon Investment Management Japan Limited is a Financial Instruments Business Operator with license no 406 (Kinsho) at the Commissioner of Kanto Local Finance Bureau and is a Member of the Investment Trusts Association, Japan and Japan Investment Advisers Association and Type II Financial Instruments Firms Association. • Brazil: ARX Investimentos Ltda., Av. Borges de Medeiros, 633, 4th floor, 5

Rio de Janeiro, RJ, Brazil, CEP 22430-041. Authorized and regulated by the Brazilian Securities and Exchange Commission (CVM). • Canada: BNY Mellon Asset Management Canada Ltd. is registered in all provinces and territories of Canada as a Portfolio Manager and Exempt Market Dealer, and as a Commodity Trading Manager in Ontario.

BNY MELLON COMPANY INFORMATION

BNY Mellon Investment Management is one of the world’s leading investment management organizations, encompassing BNY Mellon’s affiliated investment management firms and global distribution companies. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the corporation as a whole or its various subsidiaries generally. • Mellon Investments Corporation (MIC) is a registered investment advisor and subsidiary of The Bank of New York Mellon Corporation. MIC is composed of two divisions: Mellon, which specializes in index management, and Dreyfus, which specializes in cash management and short duration strategies. • Insight Investment - Investment advisory services in North America are provided through two different investment advisers registered with the Securities and Exchange Commission (SEC) using the brand Insight Investment: Insight North America LLC (INA) and Insight Investment International Limited (IIIL). The North American investment advisers are associated with other global investment managers that also (individually and collectively) use the corporate brand Insight. Insight is a subsidiary of BNY Mellon. • Newton Investment Management - “Newton” and/or the “Newton Investment Management” brand refers to the following group of affiliated companies: Newton Investment Management Limited (NIM) and Newton Investment Management North America LLC (NIMNA). NIM is incorporated in the United Kingdom (Registered in England no. 1371973) and is authorized and regulated by the Financial Conduct Authority in the conduct of investment business. Both Newton firms are registered with the Securities and Exchange Commission (SEC) in the United States of America as an investment adviser under the Investment Advisers Act of 1940. Newton is a subsidiary of The Bank of New York Mellon Corporation. • ARX is the brand used to describe the Brazilian investment capabilities of BNY Mellon ARX Investimentos Ltda. ARX is a subsidiary of BNY Mellon. • Walter Scott & Partners Limited (Walter Scott) is an investment management firm authorized and regulated by the Financial Conduct Authority, and a subsidiary of BNY Mellon. • Siguler Guff – BNY Mellon owns a 20% interest in Siguler Guff & Company, LP and certain related entities (including Siguler Guff Advisers LLC). • BNY Mellon Advisors, Inc. is an investment adviser registered as such with the U.S. Securities and Exchange Commission (“SEC”) pursuant to the Investment Advisers Act of 1940, as amended. BNY Mellon Advisors, Inc. is a subsidiary of The Bank of New York Mellon Corporation.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. All information contained herein is proprietary and is protected under copyright law.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE |

©2024 THE BANK OF NEW YORK MELLON CORPORATION

MARK-503500-2024-02-22

GU-530 -30 August 2024