Practical advice for every life stage — actionable insights and tactical strategies, forecasting tools and calculators, along with world-class investments and retirement solutions — so you can build a better retirement.

Retirement Planning

Whether you're years away from retirement, planning on retiring, or already retired, it's important to have a plan.

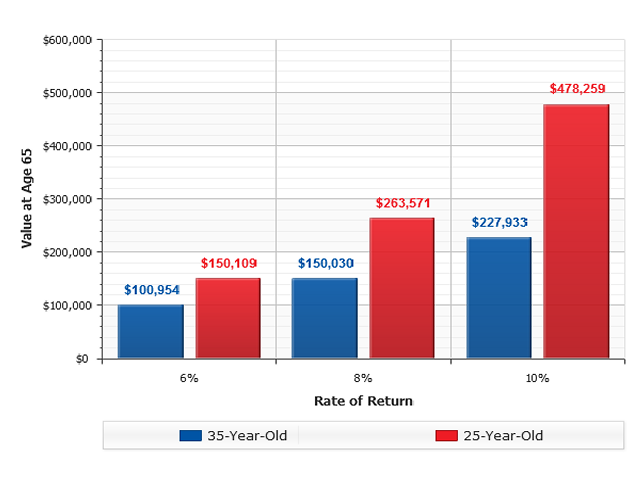

Everyone talks about how important it is to save for retirement. Starting early is a good idea, but if you haven’t, it’s not too late.

Retirement may seem far away, but early planning is crucial. It's true that some of your expenses may decrease when you retire, but others, like health care, travel, and leisure activities, may rise. And with life expectancies increasing and the power of inflation, you want to make sure you don't outlive your assets.

Social Security is the most common source of retirement income, with 88% of retirees saying they rely on the steady stream of payments and 55% calling Social Security a major source of their retirement income. With the future of Social Security in jeopardy, it's extremely important to save and invest on your own. The earlier you start, the more money you can accumulate and the greater chance you'll have of reaching your goals.

By starting early and saving moderate, even small amounts each year, you'll be better prepared to live comfortably in retirement. If you wait, you'll have to save much higher amounts each year in order to save the same amount, and you run a greater risk of not having enough money to retire at the age you'd like. It's never too late, though. Even if retirement is in your near future, you can still take steps now to save and invest.

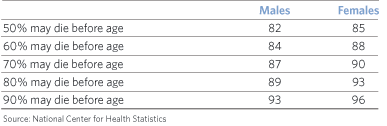

If you've retired in your 60s, you can reasonably expect to enjoy another 20-30 years in retirement. The challenge now is to make sure your assets last long enough to span your lifetime.

One of the most challenging aspects of retirement income planning is making a reasonable estimate of life expectancy. Investors building their retirement plans around average life spans may risk outliving their nest egg, while investors who are less conservative with their life expectancy and hope to live well past the average may fare better in the long run.

If an investor's nest egg is large enough, or if their income needs are small, life expectancy may never enter into the equation — investment income alone may be sufficient to meet expenses, and the investor may be able to rely on income year after year without ever tapping investment principal. Of course, such cases are all too rare.

More commonly, investors will need to draw down their principal gradually in order to meet income needs while safeguarding their income stream. The key in achieving this balance may be a less conservative estimate of life expectancy.

The old adage tells us to "hope for the best, but plan for the worst." But retirees might be wise to plan for the best – a long, healthy life – in order to help avoid the worst-case scenario of outliving their retirement income streams.

WHEN THE AVERAGE ISN'T AGRESSIVE ENOUGH

The average life expectancies for those at age 65 are well established. Men live an average of just over 17 years after their 65th birthday, while women live an additional three years on average more than men. Based on these statistics, a 65-year-old woman with a $500,000 nest egg might conclude that, if her investments grew 6% per year, she could withdraw $44,000 per year and still have a small amount left for her heirs upon her death at age 85.

There are several flaws in this line of reasoning, but perhaps the most egregious is the assumption that the investor will have an exactly average life expectancy. In reality, the typical 65-year-old has a 50-50 chance of living longer — in some cases, far longer — than the average. This means that retirees building an income plan based on the average may draw on their investments too aggressively. The investor in the example above, for instance, may find herself in serious financial straits if she lived to age 85 or beyond, something which is quite possible.

A careful examination of life expectancy figures reveals that the average retiree has a fair chance of living well beyond the average, a fact that should influence any retirement income plan.

It's best to talk with your financial advisor about your individual situation. If you don't already have one, call us at 1-800-896-2645 for assistance.

As millions of Americans prepare for their transition into retirement, the number one concern is the fear of outliving their retirement savings. Get tips on how to be proactive and reduce the risk of prematurely depleting your nest egg.

OPTIONS AND TRADE-OFFS

One of the first factors to consider is that most strategies designed to extend the life of your retirement savings portfolio come with trade-offs. Accordingly, the secret lies in understanding the various options available so that you can identify the strategy that provides the type of trade-offs with which you are most comfortable.

PORTFOLIO ALLOCATION

One of the first steps you can take when addressing the ability of your portfolio to go the distance is to review your overall portfolio allocation strategy to ensure that it is appropriate for your current age, risk profile, and retirement income objectives.

This may be best done in partnership with your financial advisor who has the knowledge and expertise in constructing portfolios for purposes of generating retirement income. The skill set needed to construct a portfolio strategy for retirement income is more robust than the skill set typically needed to construct a portfolio strategy for accumulation. Simply put, there are more variables to consider when planning for retirement income.

Even the experts don’t always agree on what is the best portfolio construction for retirement income. While conventional wisdom typically has called for a major shift towards fixed income as one nears retirement, a contrary school of thought has taken root in recent years as some financial experts argue that a greater degree of equity exposure is warranted in retirement if one wishes their income to keep pace with inflation over a retirement horizon that can easily extend beyond 25 or even 30 years for some households.

SYSTEMATIC WITHDRAWALS

For most retirees, setting up a retirement income stream from a portfolio of investments requires a plan for identifying how much you can afford to withdraw from your portfolio on a monthly or annual basis. While selecting a reasonable withdrawal level at the time you start taking withdrawals is critical, it is only the first step.

One of the surest ways to deplete your portfolio prematurely is failing to devise a method for monitoring your withdrawal rate in the future to determine if, and when, adjustments may be warranted (either upward—to keep pace with inflation or in response to positive market conditions, or downward—to proactively adjust your withdrawal rate in response to poor market conditions).

While few people like to contemplate the prospect of giving themselves a “pay cut” in retirement, a small adjustment downward (or even simply taking a pass for a year or two on your annual cost-of-living adjustment) can be far more palatable than finding yourself in a situation where drastic reductions are necessary in the future.

When it comes to determining how you will monitor your withdrawal rate (and make midstream adjustments, if necessary) the alternatives, as you might suspect, vary. Talk to your financial advisor to see what approach he or she recommends. Consider factors such as your spending habits and personal disposition, and then settle in on a strategy that feels right for you. Even in the event you elect to change your mind down the road, you’ll be miles ahead simply due to having implemented some type of formalized process for monitoring your withdrawal rate on an ongoing basis.

AN OUNCE OF PREVENTION

Given that the life expectancy for today’s average retiree is greater than the life expectancy for his or her counterpart 30 years ago, concern about outliving retirement savings is a legitimate concern that warrants attention. Fortunately, there are proactive strategies available to reduce this risk and reduce the corresponding stress that often accompanies the risk.

While the best strategy will vary for each individual, the fundamental strategy of being proactive—vs. reactive—is appropriate for all.

Diversification and asset allocation cannot ensure a profit or protect against a loss in declining markets.

Withdrawals are taxed at then-current income tax rates. Consult your tax advisor to assist with a withdrawal strategy. Contact your BNY Mellon Advisor for more information and to review your individual investment plan.

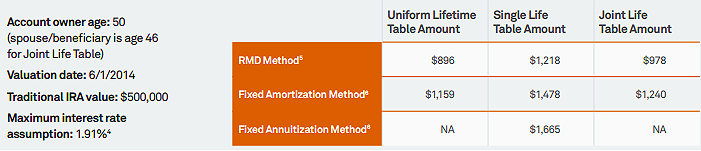

If you need access to your retirement assets before age 59½, a 72(t) distribution allows for withdrawals from Individual Retirement Accounts (IRAs) without Internal Revenue Service (IRS) penalties.

If you want to retire early and start a new business or are faced with a job loss and need income, your advisor can help you determine if taking 72(t) distributions may be right for you. You should also consult with your tax or legal advisor before taking any distributions from a retirement plan to determine if the distributions meet the requirements for the exception to the premature distribution tax.

HOW 72(T) DISTRIBUTIONS WORK

Generally, taking distributions from a Traditional IRA before age 59½ will result in an IRS early withdrawal tax penalty. Under Section 72(t), the 10% IRA premature distribution penalty is waived for IRA distributions that are:

Part of a series of substantially equal periodic payments made on a regular basis—at least annually1

Calculated according to one of the three IRS-approved methods: Required Minimum Distribution (RMD), fixed amortization or fixed annuitization methods2

Continued for at least five years or until the account owner reaches age 59½—whichever is longer

Any variation from the calculated distribution—taking more or less—will result in a 10% premature distribution tax penalty, plus interest, on all past distributions unless the account owner dies, becomes disabled or the account is depleted. State tax implications may also apply. However, if you selected either the fixed amortization or fixed annuitization method, you are allowed a one-time, irrevocable switch to the RMD calculation method without incurring penalties.

While you can take 72(t) distributions from Roth IRAs, it may not be necessary because Roth IRA contributions can be withdrawn free of federal taxes or penalties at any time. In addition, amounts that were converted to a Roth IRA can also be distributed federal tax and penalty free as long as the Roth IRA was held for five years. 72(t) distributions would apply only to earnings in a Roth IRA, which would be taxable and incur a 10% penalty if the account was not held for five years and the owner is younger than 59½ (or other exceptions apply).

You should discuss the financial impact of taking 72(t) distributions with your tax or legal advisor. The following example shows the monthly distribution amounts for the three different calculation methods.3 Additionally, there are three different life expectancy tables that the IRS allows you to use when calculating your substantially equal periodic payments with the Fixed Amortization or the RMD methods.

CONSOLIDATE RETIREMENT ASSETS

If you need to set up 72(t) distributions, a rollover IRA can help you consolidate assets from any former employer’s plan and provide a more holistic picture of your retirement assets. You may want to also consider allocating your overall retirement investments to two IRAs, one for taking 72(t) distributions and one that can continue to grow tax-deferred. This may allow you to maintain maximum flexibility and take distributions from the second IRA as needed in the future.

TALK TO YOUR FINANCIAL PROFESSIONAL TO FIND OUT MORE

You should consult with your tax or legal advisor before taking any distributions from a retirement account. While 72(t) distributions provide one of the most advantageous ways to access IRA assets early, dipping into retirement savings can have serious consequences and should be done only if necessary. Early withdrawal reduces the growth potential of your overall retirement portfolio and increases the risk of outliving your income in retirement. You should also consider whether you may return to the workforce in the future, which affects the size of the distribution you can take and the calculation method you use. Your advisor can help you identify any potential risks to your retirement strategy.

There are fees, expenses, taxes and penalties associated with IRAs. Taxable amounts withdrawn prior to age 59½ may be subject to an additional 10% penalty tax.

1Any variation from the calculated distribution amount—taking more or less—will result in a 10% tax penalty, plus interest, retroactively applied to all past distributions through the end of the year of the modification unless the account owner dies, becomes disabled or the account is depleted.

2Account owners who have selected either the fixed amortization or fixed annuitization methods are allowed a one-time, irrevocable switch to the RMD method without incurring penalties.

3For illustrative purposes only. You must choose a life expectancy table, but you must continue taking distributions based on the life expectancy table you initially chose. There are three different life expectancy tables that may be used for calculating substantially equal periodic payments. Example assumes that distributions occur for the five-year period, ending on the fifth anniversary of the first distribution until age 59½.

4The maximum interest rate cannot be more than 120% of the federal mid-term rate as published monthly by the IRS.

5The RMD Method is recalculated each year. This amount is for year one, and subsequent years will vary.

6This method of calculation determines a fixed distribution amount. The amount is calculated in the first year and that amount is taken for subsequent distribution years.

DISTRIBUTIONS BEFORE AND AFTER AGE 59 1/2

If you withdraw money from a Traditional IRA, Rollover IRA or a SEP-IRA, you must pay income taxes on the money. You'll also be assessed a 10% federal penalty tax unless you meet the special criteria below. This penalty tax applies only to the taxable amount of the distribution, not the amount attributable to non-deductible contributions.

If you withdraw money from a Roth IRA and you are under age 59½, you will not be taxed or pay a penalty on the contributions you withdraw, but your earnings will be taxed as income and you will pay a penalty tax on the income, unless you own the account for at least five years and you meet one of the exceptions listed below.

EXCEPTIONS TO THE 10% EARLY DISTRIBUTION PENALTY TAX

Under Section 72(t) of the Internal Revenue Code, you can avoid the 10% penalty tax that applies to early distributions from an IRA if you:

Die or become disabled.

Use the distribution for qualified higher education expenses such as tuition for you or your dependents.

Use the distribution for a first-time home purchase ($10,000 lifetime limit).

Use the distribution for deductible medical expenses, or to pay medical insurance premiums while you are unemployed.

Use the distribution for an IRS levy on the IRA.

Take the distribution in a series of substantially equal annual payments for five years or until age 59½, whichever comes later.

Take the distribution as a timely removal of an excess contribution.

Please contact your tax advisor before making any distribution decisions.

After you reach age 59½, you can take money out of a Traditional, Rollover IRA or SEP-IRA whenever you want for any reason without any early distribution tax penalty. However, you must pay ordinary income tax on any tax-deductible contributions you previously made and on all accumulated earnings that are included in your distribution.

If you're age 59½ and you've owned a Roth IRA for at least five years, you can withdraw funds tax-free. If you've owned a Roth IRA for less than five years, you will pay income taxes on the earnings, but no penalty tax.

REQUIRED MINIMUM DISTRIBUTIONS AT AGE 70 1/2

As with other tax-deferred retirement savings vehicles, you are required to take at least a minimum distribution from your Traditional IRA, Rollover IRA, and SEP-IRA each year beginning with the year you turn 70½. (There is a 50% penalty tax on amounts that are not distributed.) The distribution for the year you turn 70½ may be delayed until April 1 of the following year. The distribution for each year after you turn 70½ must be taken by December 31. If you wait until April 1 to take the first distribution, you will have to take two distributions in the same year.

It is a requirement that 10% of your Traditional, Rollover and Sep-IRA distributions be withheld for federal income tax purposes unless you elect not to have taxes withheld. This withholding applies to the total amount of each distribution even if part of it is attributable to nondeductible contributions.

If you opt out of withholding or do not have enough tax withheld, you may have to pay taxes and you may incur penalties if estimated tax payments are insufficient.

If you are entitled to receive a distribution from a retirement plan, the plan administrator is required to provide you with a detailed notice explaining the applicable tax rules. For more specific information about distribution rules — including information on the required minimum distribution regulations and how they apply to your particular situation — contact your financial advisor, and/or tax professional.

There are fees, expenses, taxes and penalties associated with IRAs. Taxable amounts withdrawn prior to age 59 1/2 may be subject to an additional 10% penalty tax.

Wealth transfer planning isn't just about money — it's about creating a plan to help your loved ones navigate the process of what to do when you're gone. It's likely something you'd rather not think about now, but with proper planning you can make sure your wishes are known and carried out later.

Steps you can take now — organize your files, add or update beneficiaries to your accounts, create a will — can help make things a bit easier for your survivors. We can help. Call 1-800-896-2645 to receive our Wealth Transfer Kit or download the kit components listed below.

KIT COMPONENTS

GUIDE TO INITIATING IMPORTANT CONVERSATIONS

FIVE COMMON ESTATE PLANNING MISTAKES

A CHECKLIST FOR SURVIVING LOVED ONES

If you have any questions regarding adding a beneficiary to your account or if you would like the Transfer on Death Registration form mailed to you, please call us at 1-800-896-2645. If you are a Brokerage Account client, please call us at 1-800-843-5466.

Retirement Savings Plans

Plan for retirement with the IRA or retirement plan choice that's right for you.

Traditional IRA investors can benefit from tax-deferred earnings, regardless of their income level.

A traditional IRA works very simply. You can contribute up to $6,000 per year, but not more than your earned income for the year (less any contribution made to a Roth IRA), and invest it in one or more options that you select. Over time, the aim is that your account grows as the value of your investments rises. The earnings on your contributions are not taxed until you withdraw them in retirement, so your account can grow faster than a taxable account.

If you are 50 years of age or older, you may have the additional benefit of catch-up contributions, which allows you to invest an extra $1,000 per year.

WHO SHOULD OPEN A TRADITIONAL IRA?

The ideal person to invest in a Traditional IRA is someone who thinks his/her federal income tax bracket will drop in retirement?

If you meet the following criteria, your contributions will be either fully or partially deductible from your current taxable income, so you can potentially save on your income taxes for the year:

- Your contributions will be fully deductible if neither you nor your spouse is an active participant in an employer-sponsored retirement plan;

- If you are covered by a retirement plan at work, a deduction for contributions to a Traditional IRA will be reduced (phased out) if your modified adjusted gross income (MAGI) for 2022 exceeds $109,000 for a married couple filing a joint return. If you are single your AGI cannot not exceed $68,000 and if your spouse, but not you, is an active participant in an employer-sponsored retirement plan, and (subject to certain phaseout provisions) your MAGI is less than $204,000.

If you are married and file a joint tax return, you may also set up and contribute to a Spousal IRA for a non-working spouse. You can contribute up to $12,000 total to these two IRAs, but not more than your combined earned income, and not more than $6,000 to either one for the 2022 tax year.

IRA COMPARISON CHART

The major advantage of a Roth IRA is that you will be eligible for tax-free distributions if you make a qualified withdrawal.

A Roth IRA is similar to a Traditional IRA in that you can invest up to $6,000 annually for 2022 and enjoy tax-deferred growth on your earnings. But there are some important differences. First, contributions are not tax-deductible, but can be withdrawn anytime without paying taxes. Second, earnings withdrawn after five years are tax-free if you meet one of the following criteria:

- You attain age 59½

- Become disabled

- The distribution is made for a first-time home purchase (up to $10,000)

- The distribution is made to a beneficiary after your death

If you are 50 years of age or older, you may have the additional benefit of catch-up contributions, which allows you to invest an extra $1,000 per year.

You can contribute the full $6,000 if you're single and your MAGI does not exceed $144,000or if you're married filing jointly and your MAGI does not exceed $214,000. Your eligibility to contribute phases out if you're single with an AGI between $129,000 and $144,000, or if you're married filing jointly with an AGI between $204,000 and $214,000.

IRA COMPARISON CHART

WHO SHOULD OPEN A ROTH IRA?

The ideal person for a Roth IRA is someone who thinks he/she might be in a higher tax bracket during retirement, may not need the money and wants to leave it to heirs or may want to withdraw original contributions before retirement.

CONVERTING TO A ROTH IRA

If you currently have retirement dollars invested in a Traditional IRA but want the benefits of a Roth IRA — including potential tax-free access to your money in the future — you can convert some or all of your Traditional IRA savings to a Roth IRA.

To make a conversion, you have to convert some or all of your Traditional IRA to a Roth IRA. This is considered a taxable event, so you will have to pay income taxes on the amount you convert. If you use part of your IRA money to pay this income tax, you may have to pay an additional 10% penalty tax on that amount.

If you decide to withdraw money from your Roth IRA within five years after the conversion, the taxable portion of the distribution will be subject to a 10% penalty tax, unless an exception applies.

A Rollover IRA is a Traditional IRA that you can move money into from other retirement plans (an old 401(k), 403(b) or another IRA) and maintain tax-deferred growth.

A Rollover IRA is basically a Traditional IRA into which you can move money from other retirement plans and accounts and still maintain tax-deferred growth. You can roll over amounts distributed from your employer's retirement plan, from another IRA, a 403(b) account and from certain 457(b) accounts. For instance, if you're retiring or changing jobs, you can transfer your existing retirement savings accounts into a Rollover IRA, which can simplify managing your funds, possibly save you money on fees, and keep your funds growing on a tax-deferred basis.

A great feature of a Rollover IRA is that there are no taxes or penalties on amounts rolled into it. So, if you're in the process of receiving a distribution from a retirement plan and want to avoid the mandatory 20% federal income tax withholding, simply have the retirement plan directly transfer your proceeds into a Rollover IRA (retirement plans must withhold 20% unless the distribution is a Direct Rollover).

Consider rolling over your existing retirement accounts and distributions from retirement plans into a Rollover IRA. Investors may choose this option to maintain tax-deferred growth, enjoy a variety of investment options, benefit from investment management expertise, and be able to better oversee your retirement planning progress because all of your funds will be consolidated into a single account.

WHO SHOULD OPEN A ROLLOVER IRA?

The ideal person for a Rollover IRA is someone seeking to maintain the tax deferral on a distribution from his or her retirement plan, or seeking to consolidate tax-deferred assets.

IMPORTANT CHANGE TO INDIRECT IRA-TO-IRA ROLLOVERS (60 DAY ROLLOVERS)

Effective January 1, 2015, the IRS implemented a new rule governing indirect IRA-to-IRA rollovers. An IRA participant will be restricted to one indirect rollover across all IRAs they hold per 12-month period. Previously the restriction applied between two specific IRAs. As an alternative, the IRS is advocating trustee-to-trustee transfers as a means for moving money between IRA accounts, tax-free without restriction. For more information, please speak with your tax advisor.

A SEP-IRA Retirement Plan offers a valuable investment opportunity for self-employed individuals and small business owners.

A Simplified Employee Pension IRA (SEP IRA) is similar to a Traditional IRA, but is specifically designed for small business owners or self-employed individuals. Aside from the higher contribution limit than a Traditional or Roth IRA, SEP-IRAs are generally subject to the same rules governing Traditional IRAs and are inexpensive for employers to offer — there is virtually no administration and the cost is minimal.

CONTRIBUTION LIMITS

The employer is the sole contributor and may contribute, on the employee's behalf, up to 25% of the employee's compensation or $61,000 (for 2022), whichever is less.

TAX ADVANTAGES

Contributions to a SEP IRA are generally 100% tax deductible and investment earnings in a SEP IRA grow taxed deferred. Withdrawals after age 59 1/2 are taxed as ordinary income. Withdrawals prior to age 59 1/2 may incur a 10% IRS penalty as well as income taxes.

A SIMPLE IRA Retirement Plan for small businesses can serve as a valuable retirement savings alternative to a traditional 401(k) plan.

A SIMPLE IRA for small businesses provides employers and employees with a simplified and inexpensive way to contribute toward retirement.

Similar to a traditional 401(k) Plan but without the administrative complexities, a SIMPLE IRA allows employees to contribute on a tax-deferred basis through convenient payroll deductions. The employer will also contribute to each individual's account by matching a portion of the employee contributions or contributing a fixed percentage of all eligible employees' pay.

Tax law provides an opportunity for owner-only businesses and self-employed individuals to save more for retirement when compared to other retirement plan alternatives. Contributions, in the form of salary deferrals and profit sharing contributions, can total as much as $58,000 in 2021 ($64,500 if age 50 or older). In addition to these higher contribution limits, other advantages include the ability to take a loan from the plan and the limited administration required with an individual 401(k) plan.

The 403(b)(7) advantage: specifically designed for your retirement

As an employee of an educational or non-profit organization, you have an opportunity to save for your future by investing in a 403(b)(7) plan. This plan enables you to conveniently build assets for retirement through automatic salary deduction — while enjoying significant tax benefits today.

A SIMPLE IRA Retirement Plan for small businesses can serve as a valuable retirement savings alternative to a traditional 401(k) plan.

A SIMPLE IRA for small businesses provides employers and employees with a simplified and inexpensive way to contribute toward retirement.

Similar to a traditional 401(k) Plan but without the administrative complexities, a SIMPLE IRA allows employees to contribute on a tax-deferred basis through convenient payroll deductions. The employer will also contribute to each individual's account by matching a portion of the employee contributions or contributing a fixed percentage of all eligible employees' pay.

Tax law provides an opportunity for owner-only businesses and self-employed individuals to save more for retirement when compared to other retirement plan alternatives.

In addition to these higher contribution limits, other advantages include the ability to take a loan from the plan and the limited administration required with an individual 401(k) plan.

Tax law provides an opportunity for owner-only businesses and self-employed individuals to save more for retirement when compared to other retirement plan alternatives. Contributions, in the form of salary deferrals and profit sharing contributions, can total as much as $61,000 in 2022 ($67,500 if age 50 or older).

In addition to these higher contribution limits, other advantages include the ability to take a loan from the plan and the limited administration required with an individual 401(k) plan.

The 403(b)(7) advantage: specifically designed for your retirement

As an employee of an educational or non-profit organization, you have an opportunity to save for your future by investing in a 403(b)(7) plan. This plan enables you to conveniently build assets for retirement through automatic salary deduction — while enjoying significant tax benefits today.

Retirement Guides

Guides to help you prepare for and live in retirement. Contact a BNY Mellon Funds Representative at 1-800-896-2649 for additional information or assistance on how this information may fit into your financial plan.

Contact Us

IRA's (Traditional, Roth, SEP, Rollover)

Call to learn more about how a Traditional IRA, Roth IRA, SEP IRA and/or a Rollover IRA can help you meet your retirement plans.

Individual 401(K), SIMPLE IRA

Call to learn more about an Individual 401(k) or SIMPLE IRA.

403(b)(7) Plans

Call us to speak with a Retirement Specialist to learn more about the 403(b)(7) plan.

This information is general in nature and is not intended to constitute tax or estate-planning advice. Please consult your tax and/or estate-planning advisor for more detailed information and advice on your specific situation.

There are fees, expenses and penalties associated with different types of retirement plans.

Since 2006, certain retirement plans have been permitted to allow participants to designate some or all of their deferral contributions as "Roth deferral contributions." Roth contributions may only be rolled over to a Roth IRA.

DRD-248746-2022-02-16