The Case for Fixed Income

Fixed Income Still Matters.

Now more than ever.

Everyone is likely questioning their investment strategy given the current environment. While recent events and continued uncertainty is unnerving, the case for an appropriate fixed income allocation in your clients’ portfolios is still strong. Why?

- Diversification

- Income

- Relative Stability of Capital

- Tax Advantages

BNY Mellon Investment Management provides a variety of solutions across the fixed income landscape. We are committed to partnering with you, now more than ever, to ensure your clients have the investments they need for the long term. By putting our clients’ motivations front and center, in 2018 we became the 3rd largest fixed income manager in the world.*

We stand ready to continue the journey.

Why BNY Mellon Investment Management

Municipal Bonds

Taxable and Non-Taxable Investors Alike May Benefit From Municipal Bonds

News, Views & More

Insights on the Fixed Income Opportunity Set

Taking advantage of Tomorrow

Recent volatility reveals unprecedented levels of fear while markets struggle to gauge the extent of Covid-19’s economic damage.1 As investors turn to safe haven assets for liquidity2 and pandemic-fueled lockdowns create a grim outlook for companies, as well as their ability to pay back debt, is there still a place for fixed income?

Read More

Going the Distance with Core Plus

Providing portfolio ballast and downside protection are key attributes of a core fixed income portfolio. However, ultrashort and intermediate duration fixed income do not provide the same level of benefits from these attributes. Overtime, having a duration that’s too short can potentially have adverse effects on a portfolio.

Read MoreLearn more about our Fixed Income Strategies

BNY Mellon Core Plus Fund

Focus on high-quality, investment-grade credit.

Security selection is key driver of strategy performance.

Intermediate duration, in line with Barclays Agg benchmark.

BNY Mellon Global Fixed Income Fund

Prefers the US and higher-quality markets over areas such as EMD.

Ability to tactically tilt the portfolio in response to changing global dynamics.

Global strategy can provide attractive returns with similar risk to US fixed income.

Hedges currency risk to USD

BNY Mellon International Bond Fund

Prefers the US and higher-quality markets over areas such as EMD.

Ability to tactically tilt the portfolio in response to changing global dynamics.

Global strategy can provide attractive returns with similar risk to US fixed income.

Unhedged currency exposure

BNY Mellon AMT Free Muni Bond Fund

BNY Mellon Opportunistic Muni Bond Fund

BNY Mellon High Yield Municipal Bond Fund

BNY Mellon Short-Intermediate Muni Bond Fund

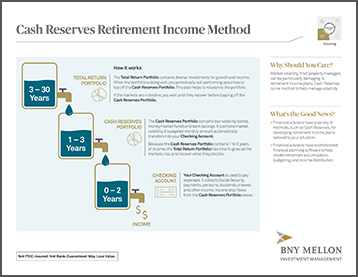

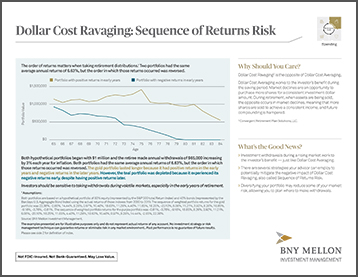

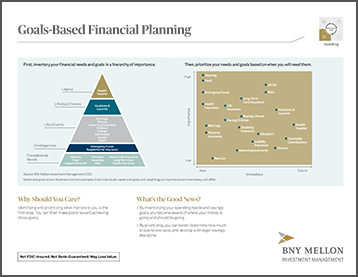

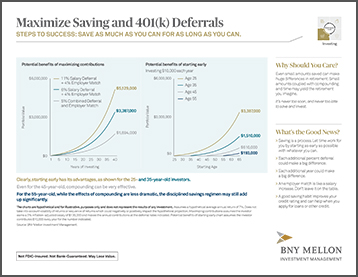

Helping Transform The Way America Retires

Retirement is not just a goal, but a series of ever-changing milestones. Planning for it deserves bold ideas and powerful solutions along the way.

Our mission is to help transform the way America retires by partnering with financial professionals to offer an array of insights, tools and solutions to help target better retirement outcomes.

Contact Us

If you would like to learn more about BNY Mellon Investor Solutions, please send us an email and we will respond shortly.

1.877.334.6899

Monday-Friday 8:30am-6pm EST

BNY Mellon Investment Management encompasses BNY Mellon’s affiliated investment firms, wealth management services and global distribution companies, including BNY Mellon Securities Corporation and The Bank of New York Mellon. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular investment, strategy, investment manager or account arrangement. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Please consult a legal, tax or investment advisor in order to determine whether an investment product or service is appropriate for a particular situation. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. BNY Mellon Investment Adviser, Inc. and BNY Mellon Securities Corporation are subsidiaries of BNY Mellon.

MARK-49578-2019-02-06