June 2023

Some extravagant employee perks may be on the decline, but this change could mean more money in investors pockets. Newton’s Jim Lydotes thinks shareholders have been overlooked by certain companies in recent years, but some sectors are leading the way in capital discipline, enabling them to pay dividends.

Highlights

- Some companies are paying more in dividends while cutting elaborate employee perks

- Payout ratios have climbed particularly in the pharmaceutical and utility sectors

- Tech companies have historically struggled with capital discipline, but the tide is starting to turn

For the past decade many companies have been ill-disciplined, piling profits into quirky and extravagant employee perks at the expense of returning cash to shareholders, according to Newton head of equity income and global infrastructure income portfolio manager Jim Lydotes. But he thinks this is changing and sees a positive outlook for dividends, particularly in pharmaceuticals and utilities.

Lydotes says one of the most decadent examples of an employee benefit over recent years is a Puppytorium where, as the name suggests, puppies are brought into the office and employees play with them to de-stress. “It almost felt like we were back in the tech bubble,” he says of this extravagance.

Lydotes thinks such elaborate perks were introduced to attract and retain staff against a backdrop of low unemployment. But, he adds, every dollar being spent on things like Puppytoriums is a dollar not going back to shareholders. “One thing we need to continuously remember is as equity holders, we are owners of the business,” he adds. “We need to start to emphasize that again.”

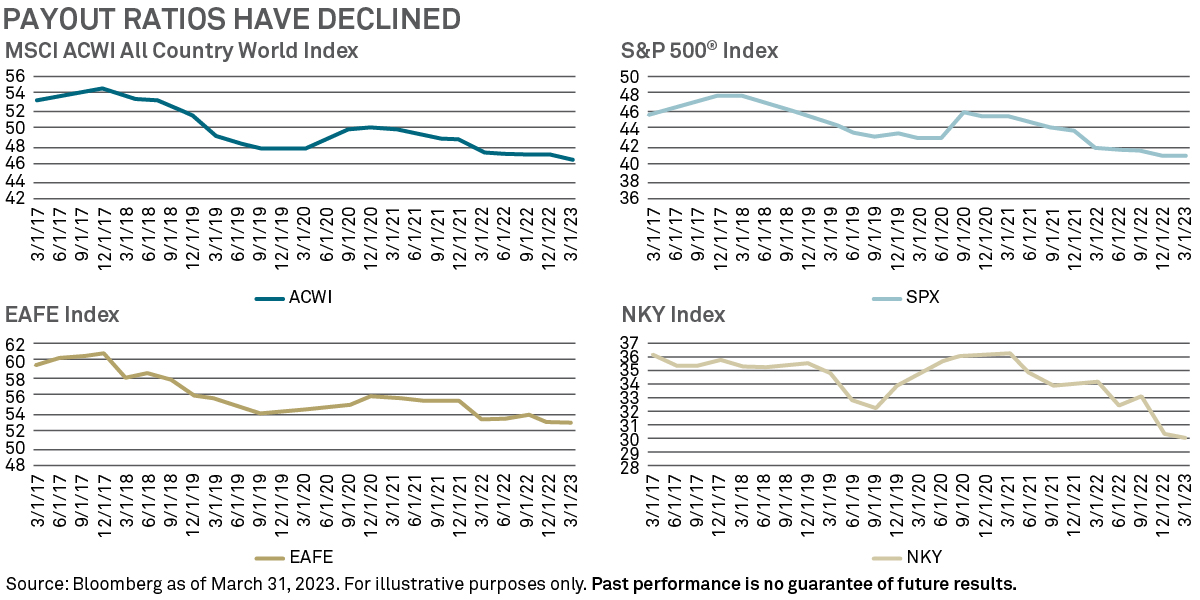

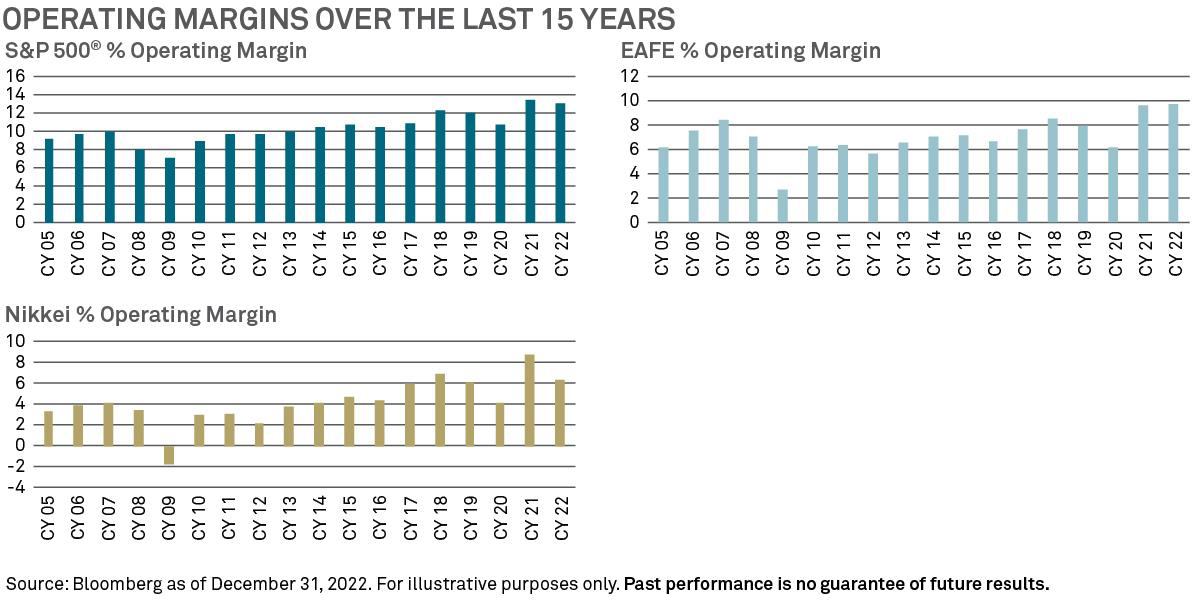

This is evident in the payout ratio for global equities (MSCI ACWI All Country World Index) over last six years which has fallen from around 54% in 2017 to about 46%.1 Yet the profitability of companies based on their operating margins has improved.

For example, Lydotes says in 2006 the operating margin for the S&P 500 was about 9% but it reached about 13% by 2022. Even in Japan where people talk about slow growth and detrimental demographic trends, profitability has gone from about 3% in 2006 to about 6% in 2022, he notes.

Payout winners

Lydotes says there are some sectors doing it well. In particular, he says payout ratios have climbed in the pharmaceutical sector. Lydotes says 20 years ago large pharmaceutical businesses tended to invest the proceeds from drug sales back into research and development (R&D) while giving little to shareholders as dividends. However, he says it is now common for R&D to be funded by venture capital and/or private equity before the pharma company steps in to take the asset to commercial relevance.

“They miss some of the early wins from the early-stage development, but it creates a business that is more predictable and investing in assets that are much more proven. The company is therefore able to generate more cash and give more back in the form of dividends.”

Another sector Lydotes flags is utilities. He says the business models here often involve investing a large sum of capital upfront to build, say, a pipeline or a power plant, but once the asset is in place it could last 50 years or more and during that time, does not tend to require large upkeep costs. In the meantime, these assets can generate cash to fund dividends, he adds.

Efficiency on the rise

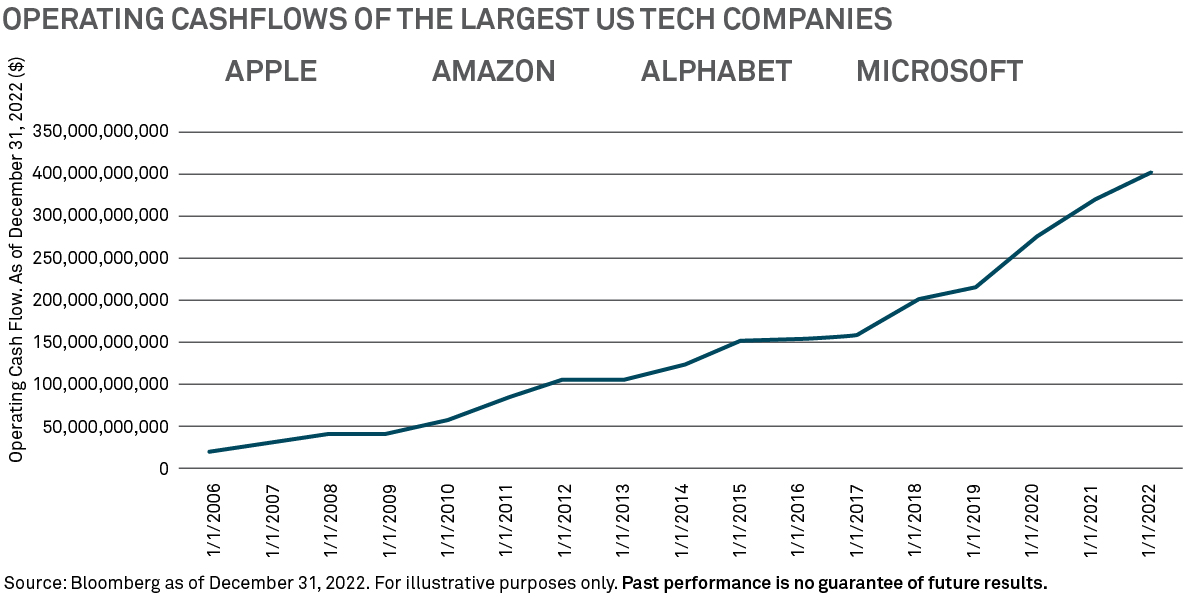

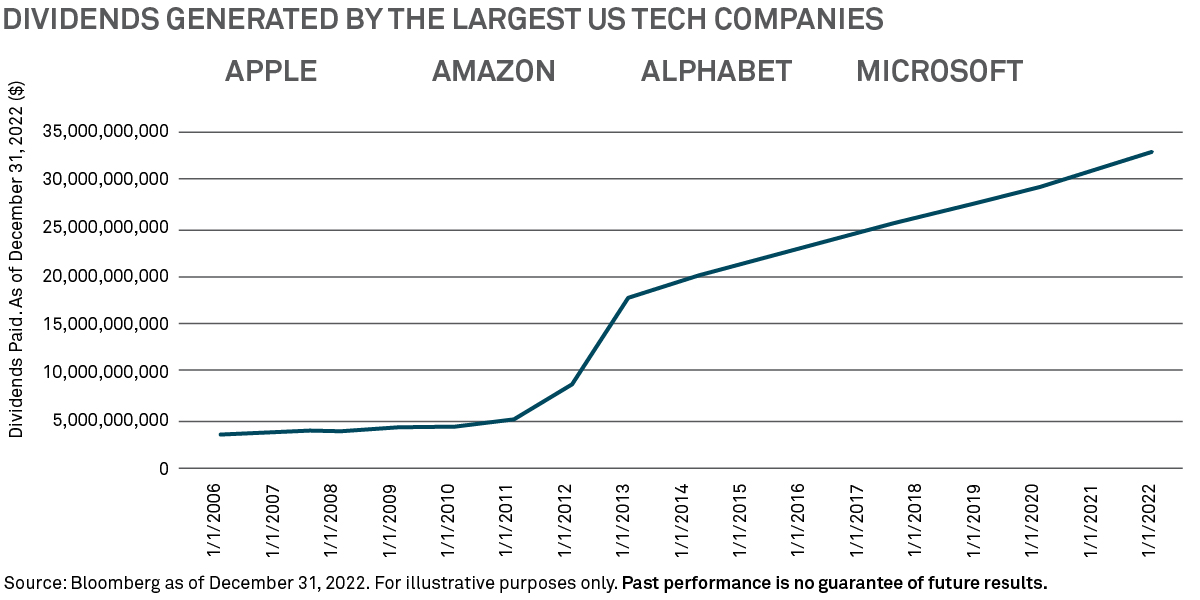

On the other hand, Lydotes says the tech industry “did not get the memo.” He points to the fact Apple, Amazon, Alphabet and Microsoft, none of which he holds, have seen a 10x increase in operating capital since 2007, with the four companies having a joint operating cashflow of US$350bn which is equal to the GDP of Pakistan. However, less than 10% of that, equivalent of the US state of Vermont’s GDP, is being returned to shareholders. “They don’t have a dividend policy that forces discipline in capital allocation,” adds Lydotes.

For all that though, Lydotes says there is evidence that the tone around capital discipline is starting to change. He says some tech companies have taken steps to operate in a more efficient way such as cutting non-viable projects. There are also examples of biotech companies not suffering even after missed drugs trials, he adds, which shows even in areas like tech and biotech fiscal responsibility is becoming more important.

Lydotes concludes: “Companies have not had a lot of capital discipline for the past 10 years, but it is changing, and can be imparted on a company through its dividend policy. I think that is something we need to focus on a lot more than the market has over the past 10 years.”

1 Bloomberg, as of January 2023.

All investments involve risk, including the possible loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing.

Past performance is no guarantee of future results

“Newton” and/or the “Newton Investment Management” brand refers to the following group of affiliated companies: Newton Investment Management Limited (NIM) and Newton Investment Management North America LLC (NIMNA). NIM is incorporated in the United Kingdom (Registered in England no. 1371973) and is authorized and regulated by the Financial Conduct Authority in the conduct of investment business. Both Newton firms are registered with the Securities and Exchange Commission (SEC) in the United States of America as an investment adviser under the Investment Advisers Act of 1940. Newton is a subsidiary of The Bank of New York Mellon Corporation. Newton’s investment advisory businesses are described in their Form ADVs, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request.

Equities are subject to market, market sector, market liquidity, issuer, and investment style risks to varying degrees. Small and midsized company stocks tend to be more volatile and less liquid than larger company stocks as these companies are less established and have more volatile earnings histories. Investing in foreign denominated and/or domiciled securities involves special risks, including changes in currency exchange rates, political, economic, and social instability, limited company information, differing auditing and legal standards, and less market liquidity. These risks generally are greater with emerging market countries.

BNY Mellon Investment Management is one of the world’s leading investment management organizations, encompassing BNY Mellon’s affiliated investment management firms and global distribution companies. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the corporation as a whole or its various subsidiaries generally.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions. Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances. Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change.

The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Not FDIC-Insured | No Bank Guarantee | May Lose Value

© 2023 BNY Mellon Securities Corporation, distributor, 240 Greenwich Street, 9th Floor, New York, NY 10286

MARK-390113-2023-06-05