A tool for advisors: greater portfolio insights that

enhance conversations with your clients.

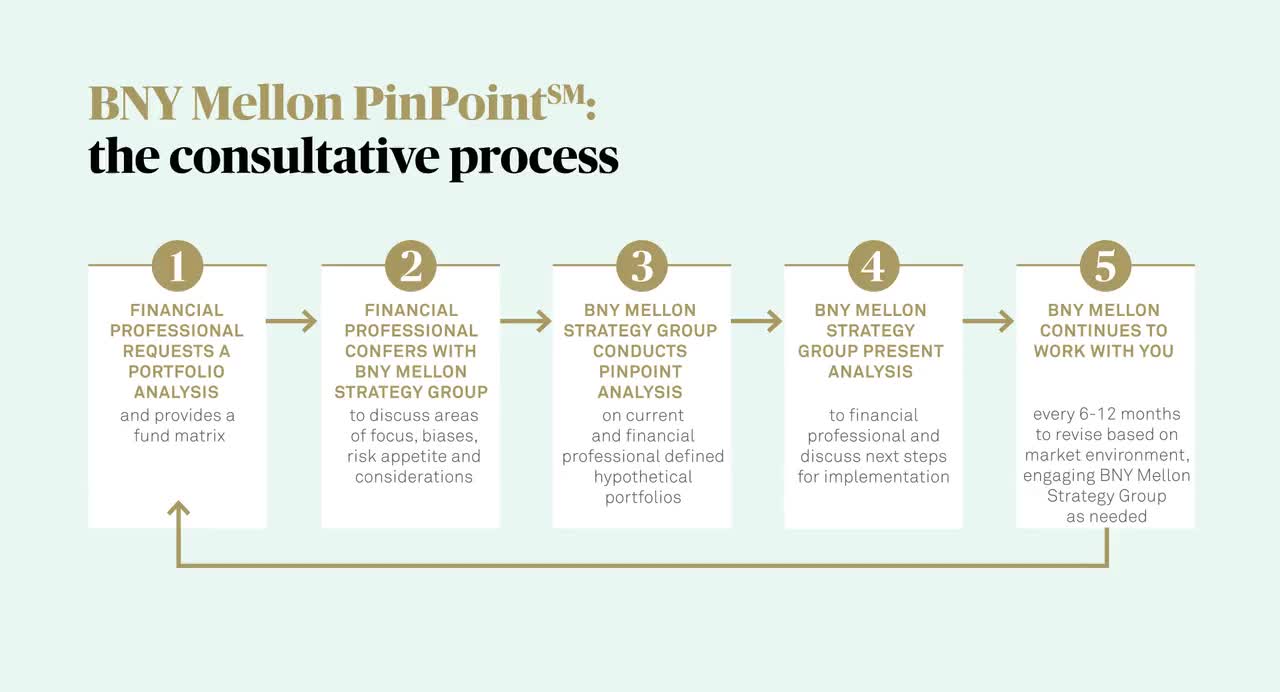

BNY Mellon PinPointSM is a robust consultation service for advisors, powered by a dynamic analytical tool, designed to give you greater portfolio insights that enhance conversations with your clients.

Our team of investment professionals will work with you to analyze your clients’ portfolios which will help you to assess their needs, based on their investment objectives, appetite for risk, and their unique circumstances.

2023 FinTech Award1

BNY Mellon Investment Management is the proud recipient of the 2023 FinTech Breakthrough Award in the “Best Overall FinTech Software”

for our digital Client Experience (CX) program, with its focus on data, transparency and accessibility. The flagship in our CX program is

BNY Mellon PinPointSM, an analytical tool designed to give advisers greater insights into portfolios.

What do you get?

A bespoke report that lets you talk to your clients about how to potentially enhance their portfolios

Harnesses a wide range of risk

and performance analytics.

Uncover opportunities.

Exposes structural weaknesses.

Helps to ensure that each portfolio has exposure to an appropriate level of risk to seek the desired return

BNY Mellon PinPointSM in under 3 minutes

BNY Mellon PinPointSM provides a wide

range of services, including:

- Analysis on total portfolio asset allocation

- Analysis on specific asset classes

- Manager research

- Outcome or objective-based investing

- Macro-environmental trends and risks

- Adviser-specific risk analysis

- Tactical insights

- Working with you, for you and your clients

Working with you, for you and your clients

As an advisor, I need... |

BNY Mellon PinPointSM helps me to... |

|---|---|

Partnership with experts, with an experience that is personalized to my needs |

BNY Mellon PinPointSM has been designed and developed by professionals across BNY Mellon Investment Management specifically to meet advisor’s needs. Your engagement with BNY Mellon PinPointSM is tailored to suit you. This is a truly collaborative process in which we work with you to analyze your clients’ portfolios which will help you to assess their needs, based on their investment objectives, appetite for risk, and their unique circumstances. |

Detailed but clear analytics of my clients’ investments. I want to understand ways to improve and make more robust portfolios |

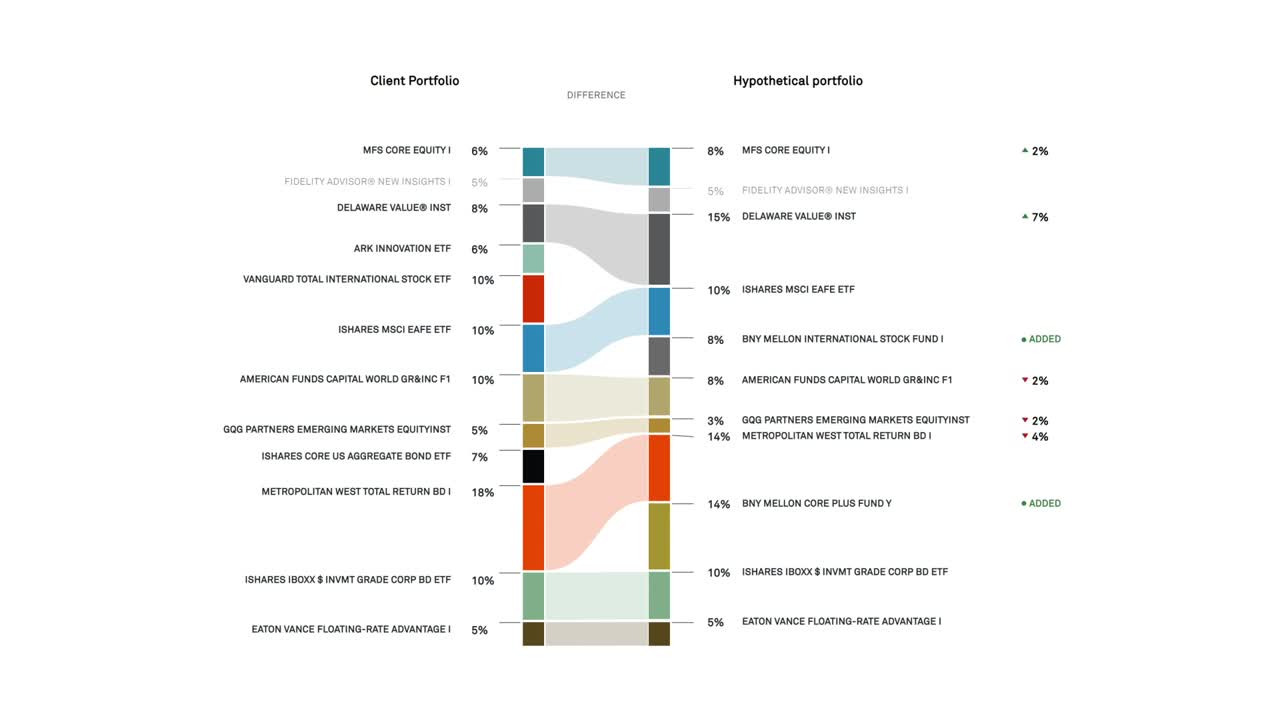

BNY Mellon PinPointSM analyzes the existing portfolio using a comprehensive range of risk and portfolio analytics to identify opportunities and structural weaknesses. It drills down to gain an in-depth understanding of each portfolio to create a comprehensive snapshot. This analysis encompasses sector, market capitalization, regional exposure, style, duration, credit quality and maturity. |

To understand how my clients’ portfolios will perform under periods of market stress |

BNY Mellon PinPointSM stress-tests the portfolio to see how it might behave in response to a wide range of market scenarios. We can use our own market views and incorporate your own ideas into the scenarios. |

The ability to communicate portfolios insights with my clients |

As well as a consultation, BNY Mellon PinPointSM gives you comprehensive insights that you can use to help manage your next meeting or in conversations with your clients. |

An experience that is highly personalized,

dynamic and visual

This is designed to be a long-term partnership between us and the advisor, in which we revisit the analytical process regularly – typically every six to twelve months – to reassess the portfolio, based on the prevailing market backdrop and the client’s evolving needs.

Identify opportunities, highlight structural weaknesses, and understand the right amount of risk exposure for the desired return

Meaningful Analysis that delivers practical solutions

BNY Mellon PinPointSM is designed to deliver insights that will lead to better, more informed decisions and ultimately to more resilient, refined portfolios for your clients.

BNY Mellon PinPointSM looks through your portfolio to analyse its underlying holdings, thereby gaining a full picture of its strengths, weaknesses, possible opportunities and potential threats.

One of its key functions includes “What if..?” analysis in which the portfolio is stress-tested against varying market situations to see how it might behave. These situations include typical scenarios seen throughout the economic cycle – from bull or bear markets to scenarios of high or low growth, high or low volatility, and rising or falling interest rates – and also a range of exceptional historical events such as specific currency crises, oil crashes, and sovereign debt crises.

Your bespoke report from BNY Mellon PinPointSM

Comprehensive and clear with real substance

BNY Mellon PinPointSM’s exhaustive analysis culminates in a bespoke report that can be tailored for

each advisor to provide them with their preferred content and level of detail.

This comprehensive report includes:

- Performance and risk analysis

- Key performance drivers/attribution

- “What if…?” scenario analysis

- Portfolio breakdown analysis

- Fund analysis

- Portfolio snapshot

What makes BNY Mellon PinPointSM different?

Your Portfolio Report

Highly engaging visual design that contains only the most relevant content for advisors to provide a more compact, efficient leave-behind.

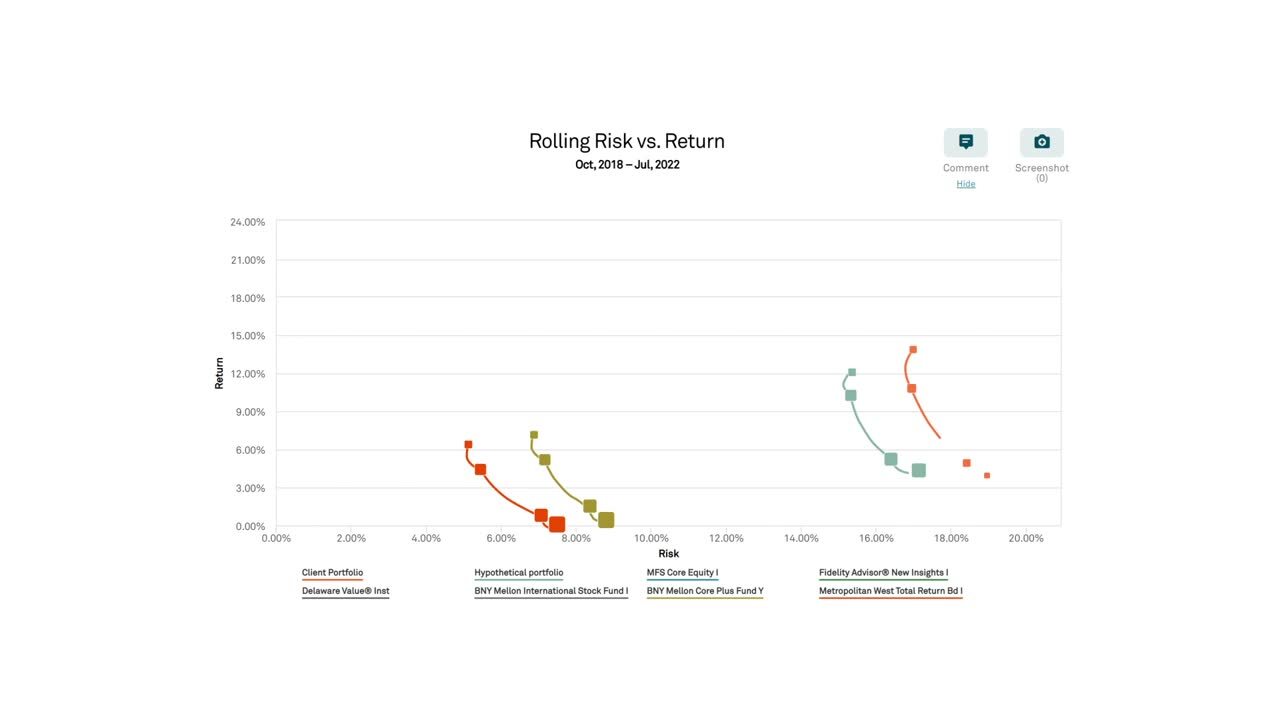

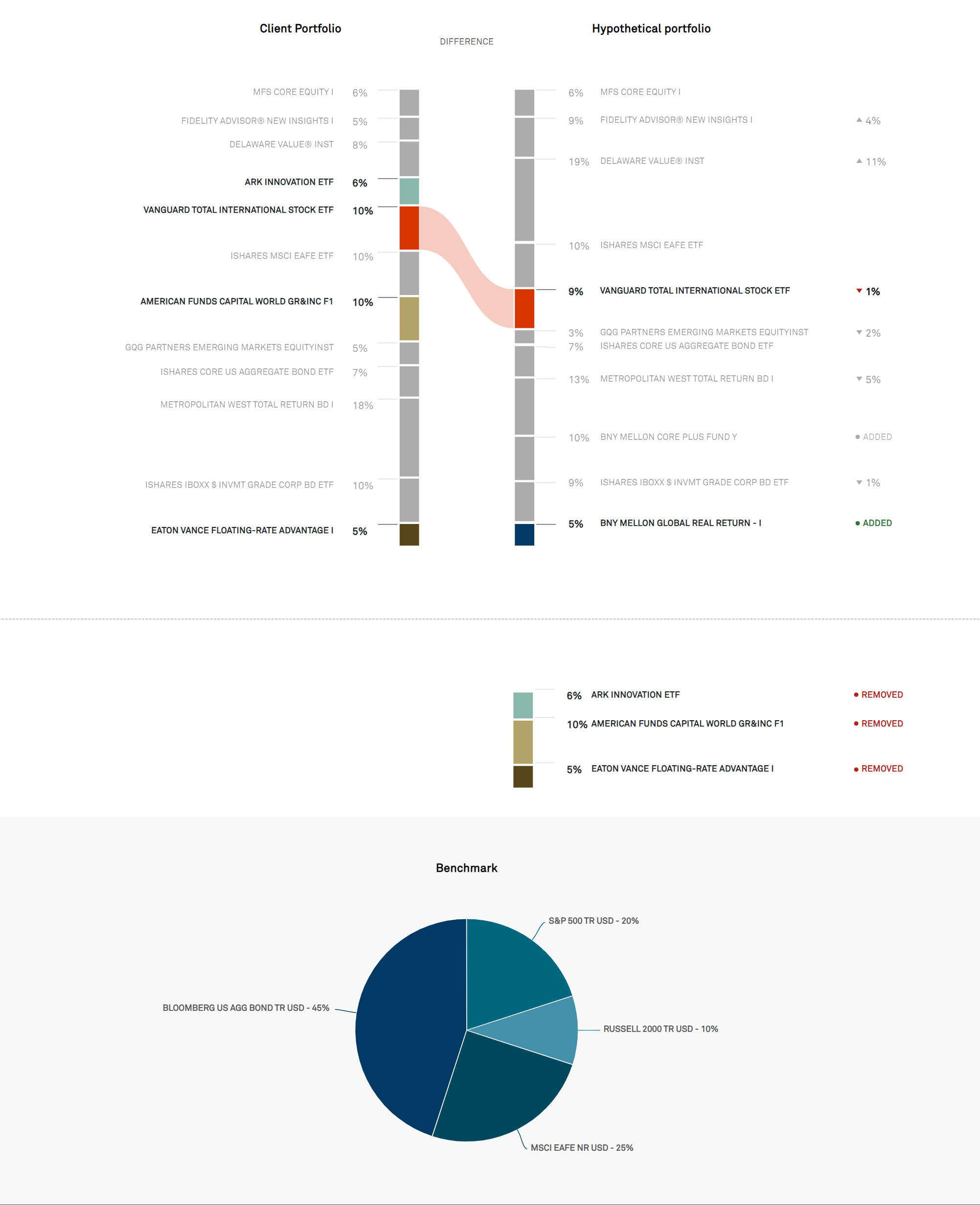

Dynamic and Visual

Dynamic, interactive, visual charts that summarize the changes between current and hypothetical portfolios, packaged for you in your report.

What-IF...? Scenarios

Includes a wide variety of “What-if...?” scenarios to compare performance between benchmark, current, and hypothetical portfolios to illustrate how they would have performed under various scenarios.

Meet the team

Our onward journey – together

BNY Mellon PinPointSM is a comprehensive tool that offers valuable insights that can lead to better, more informed

decisions and ultimately to more resilient, refined portfolios for your clients.

The relationship between BNY Mellon PinPointSM and you is designed to be a genuinely collaborative, organic, long-term partnership – with you in control.

Take the first step in our journey together and talk to your BNY Mellon Regional Consultant to find out how to develop more resilient portfolios that are better positioned to meet your clients’ needs.

1 FinTech Award: The FinTech Award was open to all individuals, companies and organizations involved in producing FinTech products and services. FinTech Breakthrough judges have earned a reputation for fairness and credibility, and are committed to determining the BREAK THROUGH nominations for each award category. Judges are senior-level, experienced FinTech professionals that have personally worked within the financial services space, including journalists, analysts and technology executives with experience in a range of financial technologies and perspectives. From successful technology startups to veteran industry leaders, the panel of judges bring a balanced perspective of evaluation for the award nominations.

BNY Mellon PinPointSM is intended for and available for use by Financial Professionals only. Members of the General Public cannot access or have the availability to use this tool. All investments involve risk including the possible loss of principal. Asset allocation and diversification cannot assure a profit or protect against loss. There can be no assurance that an investment strategy based on the tool will be successful.

Important: The projections or other information generated by the tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time. The tool cannot predict a portfolio’s risk of loss due to, among other things, changing market conditions or other unanticipated circumstances.

The tool will be used with a financial professional who will set the parameters of the analysis, and is not a proposed investment strategy or a comprehensive financial plan. This tool is being provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions.

The tool does not take into account the particular investment objectives, restrictions, or financial, legal or tax situation of any specific investor, nor does it purport to be comprehensive or intended to replace the exercise of an independent review regarding any investment, asset class or other financial decision. Financial professionals are responsible for making their own independent judgment as to how to use this information.

BNY Mellon and its affiliates are not responsible for any subsequent investment advice given based on the information supplied. This is not investment research or a research recommendation for regulatory purposes as it does not constitute substantive research or analysis. BNY Mellon accepts no liability for loss arising from use of this tool.

BNY Mellon Investment Management is one of the world’s leading investment management organizations, encompassing BNY Mellon’s affiliated investment management firms and global distribution companies. BNY Mellon Securities Corporation, 240 Greenwich St., New York, NY 10286 is the distributor of BNY Mellon funds and is a registered broker-dealer and subsidiary of The Bank of New York Mellon Corporation.

IS-343113-2023-01-27