June 2023

Higher interest rates are here to stay but that is not necessarily a bad thing, according to BNY Mellon Investment Management chief economist Shamik Dhar. In fact, investors should embrace resulting volatility as it is likely to create asset allocation opportunities, he says.

Highlights

- A recession in the next 12 months is more likely than not

- Interest and inflation rates are expected to remain high

- Aging demographics are putting pressure on interest rates

- Artificial intelligence (AI) could spark productivity growth

The global economy is going through a profound transition to a world of higher interest rates and inflation, according to BNY Mellon Investment Management chief economist Shamik Dhar. This will create heightened levels of market and economic volatility, but it also means a more rational world for asset allocation, he adds.

Dhar says his short-term outlook on the global economy is gloomy. He thinks recession in some of the major western economies is more likely than not in the next 12 months, with the risks to gross domestic product (GDP) skewed to the downside.

He expects inflation to stay high, meaning a bumpy path for central banks over the next few years as they target a 2% rate. As such, Dhar thinks interest rates will stay high to help generate the economic slack required to pull inflation back down.

Interest rates up, asset prices down

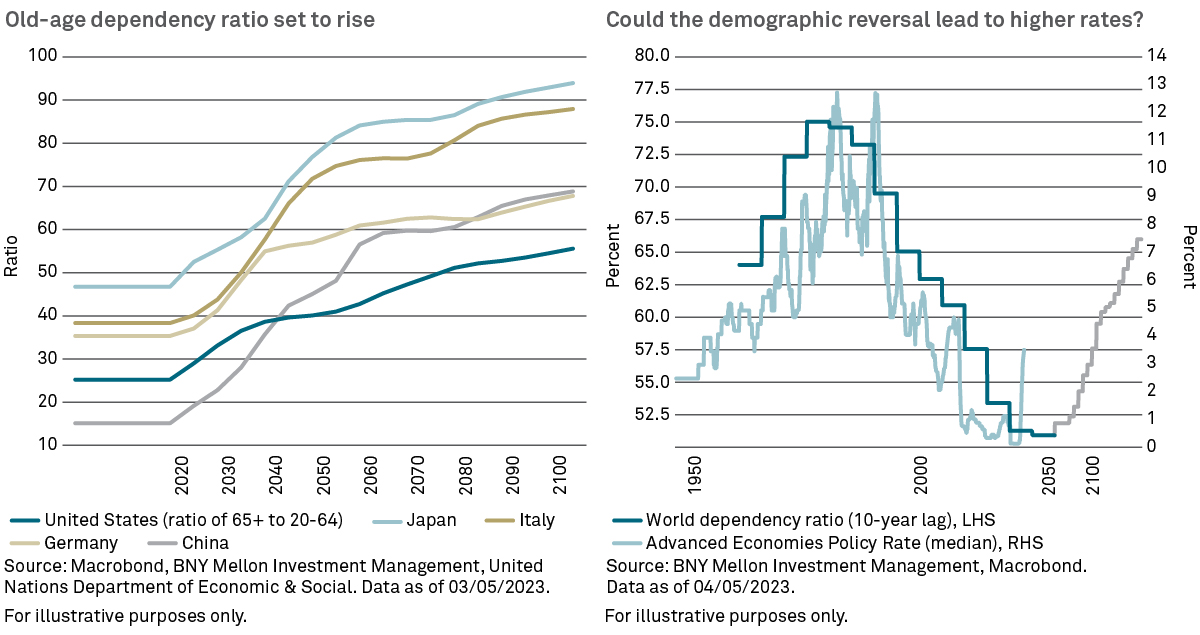

Aside from inflation, Dhar says there are other forces at play affecting the outlook on interest rates and asset prices. One is ageing demographics. For several countries the dependency ratio (the ratio of people aged over 65 to people of prime working age) is rising quickly. Dhar notes older people tend to run down their assets quickly and this depletion of savings could put upward pressure on interest rates, though rising longevity works in the opposite direction. Dhar thinks this pressure could be exacerbated as the control of global GDP shifts, broadly speaking, from older people living in rich countries to younger people in poorer countries who will have to provide the goods and services older people need.

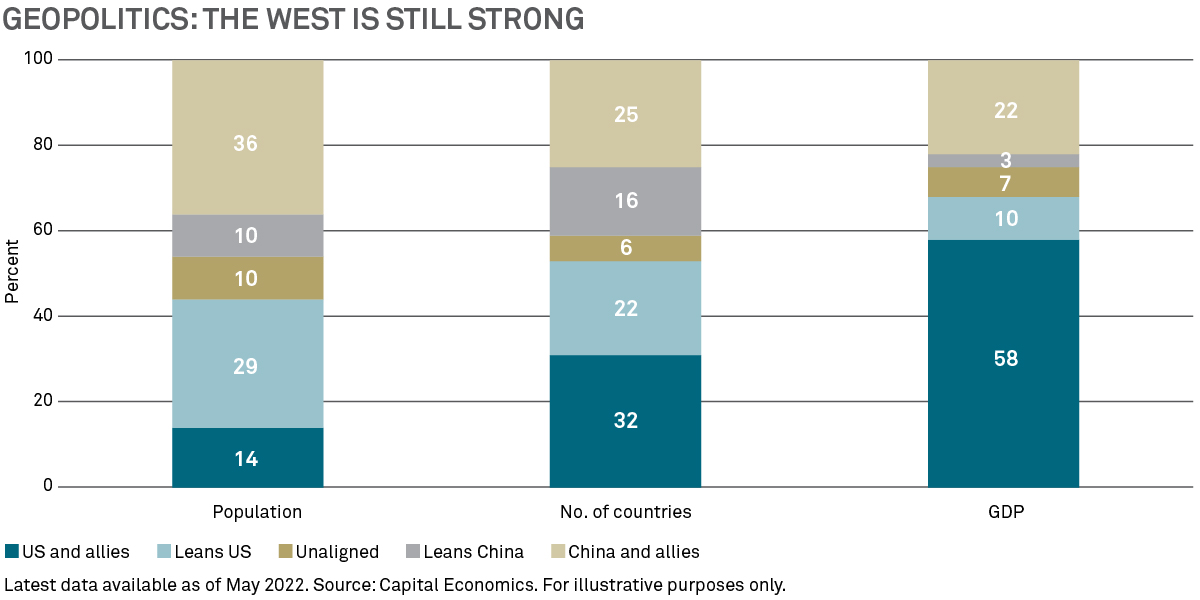

Another factor is deglobalization, says Dhar. “We are emerging from a hyper globalized world to one in which, essentially, there are two blocs: US-aligned western countries and China-aligned eastern countries,” he explains. Dhar notes how allegiance to these two blocs is currently split evenly on a country and population basis, but the western bloc generates roughly two-thirds of global GDP.

“That balance of power will remain in place for a while but clearly the geopolitical situation is going to become choppier and that may contribute to economic and market volatility more frequently,” says Dhar.

Elsewhere, Dhar notes how investment opportunities could arise from the US$100 trillion of investment required between now and 2050 to reach net zero1, a sum that represents about 3% of global GDP. He notes energy, utilities and airlines are the sectors most at risk of policy change that will affect their transition rate. Meanwhile, about two thirds of that global investment must come from emerging economies.

AI and productivity

Dhar notes that productivity performance has been poor ever since the Global Financial Crisis. He is optimistic about the future, however, thanks to the growth in artificial intelligence (AI) which Dhar describes as a general-purpose technology, akin to the internal combustion engine or steam power. He says AI will change industries and technologies and has the potential to revolutionize the way we work in unpredictable ways.

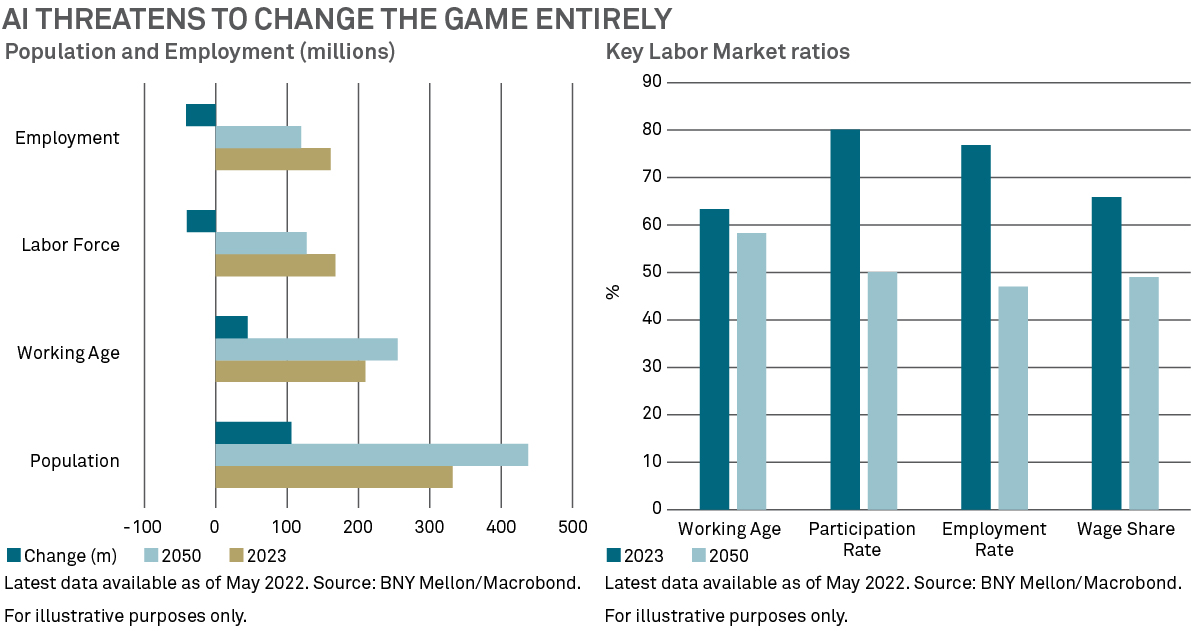

One impact of AI could be job losses. Dhar says, hypothetically, as many as 40 million jobs in the US could be lost over the next 30 years as the levels of employment, labor force and wages as a share of national income fall, while the working age population and overall populations rise. “That is why policy makers are going to have to get involved and that could have implications for asset prices across the board,” says Dhar.

But the widespread adoption of machines could boost productivity growth to perhaps 5% a year on average, adds Dhar. If that is the case, he thinks it would be necessary to “tax or nationalize the robots” to compensate those who lose out. “We would need to see an income transfer of about US$7 trillion from the robots back to us which could finance a universal basic income per head of US$15,000,” he says.

Overall, Dhar thinks lot of these global trends point towards higher real interest rates which he thinks is the key economic and market transition we need to get used to. “Higher rates are here to stay; embrace the idea because it will be a better world for asset allocation,” he concludes.

A more rational world

“Economic volatility means market volatility,” says Dhar and, as such, he foresees a choppy outlook for markets in the short to medium term. He thinks risk assets could take a leg down at some point following a good first six months of 2023.

When it comes to fixed income, he says sovereign and investment grade bonds seem to be the place to be in the short to medium term because they have the potential to offer income. Additionally, he says bonds could be supported should rates start to come down and they will probably act as a better hedge against equity exposure in a way they were not able to during 2022. But Dhar suspects high yield to be more volatile, like equities.

“Ultimately, we are transitioning into a more rational world for investors and asset allocators,” says Dhar. “A world in which bond yields consistently offer 2-3% is a more sensible world in which to do asset allocation. It is also a world in which equities must outperform on the basis of their fundamental profit performance, not just because interest rates are low.”

1 BNY Mellon and Fathom Consulting. An investor’s guide to net zero by 2050. Published 2022.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions. Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances. Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change. This information may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or expectations will be achieved, and actual results may be significantly different from that shown here. The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

All investments involve risk including loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing.

Bonds are subject to interest rate, credit, liquidity, call and market risks, to varying degrees. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes and rate increases can cause price declines. High yield bonds involve increased credit and liquidity risk than higher rated bonds and are considered speculative in terms of the issuer’s ability to pay interest and repay principal on a timely basis.

Asset allocation and diversification cannot assure a profit or protect against loss.

BNY Mellon Investment Management is one of the world’s leading investment management organizations, encompassing BNY Mellon’s affiliated investment management firms and global distribution companies. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the Corporation as a whole or its various subsidiaries generally.

Not FDIC-Insured | No Bank Guarantee | May Lose Value

©2023 BNY Mellon Securities Corporation, distributor, 240 Greenwich St., New York, NY 10286.

MARK-387719-2023-05-26