Gentry Lee

CEO and CIO

Fayez Sarofim & Co

Jenny Chou

Equity Product Strategist

BNY Mellon Investment Management

Fayez Sarofim & Co.

- Founded in 1958

- Headquarters in Houston, TX

- $32 billion assets under management (as of 12/31/2023)

- 100% independent, employee-owned

- Stable team with a team-based approach. Average investment professional tenure is nearly two decades

- Time-tested process and philosophy across U.S. and global equities

Fayez Sarofim & Co. (Sarofim) is a global, research-driven investment manager that invests in high-quality, large-capitalization companies with a long-term perspective. Sarofim is an independent firm and provides advisory services for BNY Mellon’s Appreciation and Worldwide Growth equity strategies.

Jenny Chou, BNY Mellon equity product strategist, sat down with Gentry Lee, CEO and CIO of Fayez Sarofim & Co., to discuss the organization’s singular investment approach and sustainable growth philosophy. Gentry describes Sarofim’s competitive advantages and how the firm’s strategies have withstood tough markets.

What differentiates Sarofim from other investment managers?

Our organization is built towards long-term investing, and everything we do is focused on that goal. We have a singular investment approach, which seeks to find what we believe are dominant companies in structurally attractive industries that display superior financial characteristics and shareholder-friendly capital deployment strategies. Our firm is private, independent, and 100% owned by employees and the Sarofim family. This structure enables us to remain focused through the cycle, without any distractions or pressures from external ownership. Lastly, we think of ourselves as owners of businesses and not traders of stocks, which also sets us apart from peers.

How have you built your investment team? What makes it unique?

The heritage of this company is a team-based approach, so it is important for us to continue recruiting and retaining that team. Currently, we have 22 investment professionals who have been with the firm more than 20 years, on average.

We have seen a significantly lower turnover rate in our professional staff than the industry average, which we think is reflective of our ability to invest our client’s money-making sound decisions with an eye for the long term.

We tend to hire our research analysts early in their career, upon business school graduation or earlier, which allows us to instill our investment philosophy and find alignment in an individual’s skills and cultural fit. We develop our research analysts across industries and, over time, add portfolio management or client service responsibilities. We believe are able to recruit and retain great talent because our firm is intellectually stimulating, and our compensation is competitive. Also, our professionals earn ownership in the firm and the opportunity to invest alongside our clients over the long-term, which we think is a great way to motivate our team and manage risks. We put a lot of resources behind our research analysts so that they can, in our view, develop superior knowledge and insights.

What is Sarofim’s investment criteria?

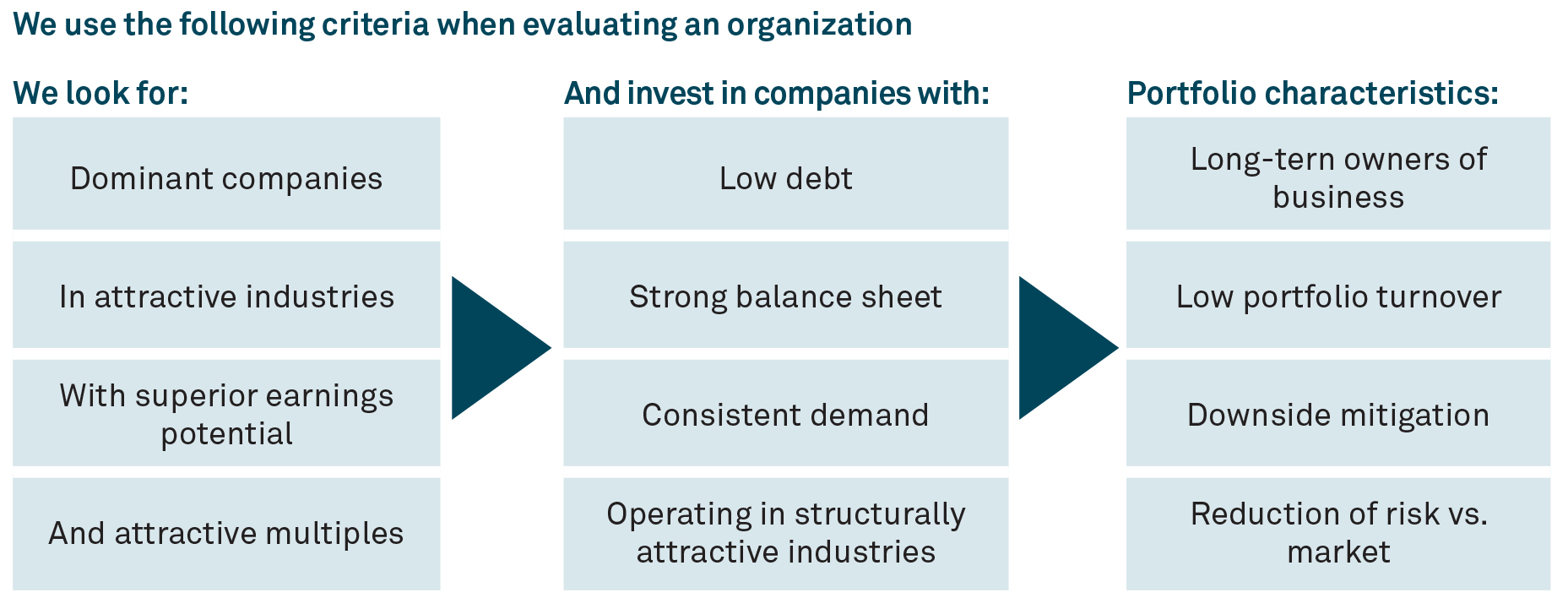

Our process originates with the firm’s foundational philosophy: we aim to provide risk-adjusted returns for our clients over the long-run, potentially benefiting from compounding earnings over time. Our strategy has four primary pillars, which are to invest in (1) what we believe are dominant companies that are (2) in structurally attractive industries, and (3) have in our view positive financial characteristics, including high growth, high margins, high returns, and strong balance sheets with low levels of debt and high levels of cash. Finally, (4) we seek companies that have attractive valuations. Our strategies have a quality orientation, which we believe, tends to provide better sustainability and an educated approach to outcomes, as well as being better positioned in more challenging economic times. Our process is based on bottoms-up research by our research analysts. This criteria has been helpful in building a portfolio that has driven more advantageous returns over the long-run, in an effort to mitigate the riskier parts of the economy during that time.

In our view, Microsoft is one of the best examples of our investment approach. It is a name that a lot of people are familiar with in their personal and professional lives. Microsoft owns one of the world’s most important software platforms and runs a leading cloud-computing platform through its Azure business. In each, we believe the company has high market share but still has opportunity to grow volumes, units and price with functionality, as it is doing through new AI offerings and its relationship with OpenAI. Microsoft benefits from a sticky1 system with barriers to entry, superb capital allocation and accretive acquisitions. We think the future for Microsoft is bright.

How should an investor think about Sarofim’s portfolios?

We have a long-term focus, which considers where businesses can grow in the coming years and be substantially more valuable in the future than today. We have built a diversified portfolio of such companies that we believe can provide positive investment returns over the long-term.

Many industries are very interesting to us, including technology, communications services, non-bank financials, and health care. For example, in health care we are seeing companies like Novo Nordisk and Eli Lilly use innovation to treat obesity with therapies originally used to treat diabetes. Demand for obesity treatment is growing in the developed and developing world, and we think these companies are positioned to benefit over the long-term with consistent earnings growth.

We also strive to mitigate risks in the markets, and to avoid sectors that are more capital-intensive, energy-intensive or labor-intensive. We think these factors are threats to profitability in our current economic environment.

What kind of markets does this strategy thrive in?

Our firm has historically displayed a consistent pattern, depending on where we are in an economic cycle. Of course, it is hard to know when such cycles begin and end, so this pattern is mostly clear in hindsight.

As past cycles have shown, the initial stages of a cycle show more speculative investment, which is not our focus. This tends to benefit the types of companies that may have had a harder time during previous downturns, usually smaller or capital-constrained companies.

We believe our investments often outperform as the cycle transitions into sustainable expansion. Typically, these periods are marked by risk aversion, competitive advantages, and normalized conditions – factors that are beneficial for our style of investing.

And the last phase of a cycle, which may be a recession or contraction, is where we believe, the potential competitive advantages of our investments come to the fore and create competitive differentiation for us. In our view, these characteristics, such as strong cash flows, sustainable revenue streams, and well-capitalized balance sheets, can help the companies in our portfolio mitigate outsized risk, or even enable them to gain market share in a downturn.

Our portfolio is always playing a balance of offense and defense, and we want to retain as much as possible in downturns while participating as much as we can in times of growth.

What are some key reflections for 2023 and views on opportunities for 2024?

One observation coming out of 2023 is how hard it is to know what is coming around the corner. In many ways, 2023 performed in an opposite way to 2022. In 2022, the more growth-oriented, speculative and risky parts of the markets had the most challenging time, as the Fed (Federal Reserve) was raising short-term interest rates. In 2023, those dynamics reversed, and suddenly the most conservative parts of the market had a more challenging time, while growth-oriented areas demonstrated the most expansion.

This re-emphasizes to us our need to maintain focus on the longer-term time frame, on well-capitalized companies that we believe can perform without significant impact from macro factors, and on companies with strong management teams who do not overreact to short-term changes.

This year, Sarofim is celebrating a client’s 50-year anniversary. As we reflect on that landmark, we consider that this client opened their account during a period of heightened geopolitical risk and other uncertainties – perhaps not dissimilar in some regards to uncertainties we face in 2024, with the upcoming presidential election and ongoing geopolitical tensions. Despite investing in an uncertain backdrop, we remained committed to providing the best possible service over this period.

This anecdote serves to reinforces our long-term orientation and the importance of investing in companies that can better tolerate volatility, potentially benefit from long-term growth, and expand with secular trends.

1 Sticky – Resistant to change.

This interview was conducted with a representative of Fayez Sarofim & Co., a firm unaffiliated with The Bank of New York Mellon Corporation. The views expressed are those of author stated and may not reflect those of The Bank of New York Corporation, other managers or its affiliates. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the corporation as a whole or its various subsidiaries generally.

Fayez Sarofim & Co. is registered under the Investment Advisers Act of 1940. Fayez Sarofim & Co. is an independent firm not affiliated with BNY Mellon

Past performance is no guarantee of future results. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment.

All investments involve risk, including the possible loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions. Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances.

The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

© 2024 BNY Mellon Securities Corporation, distributor, 240 Greenwich Street, 9th Floor, New York NY, 10286.

MARK-499160-2024-02-13

0141-0070-LGRNQAHO-0324