August 2023

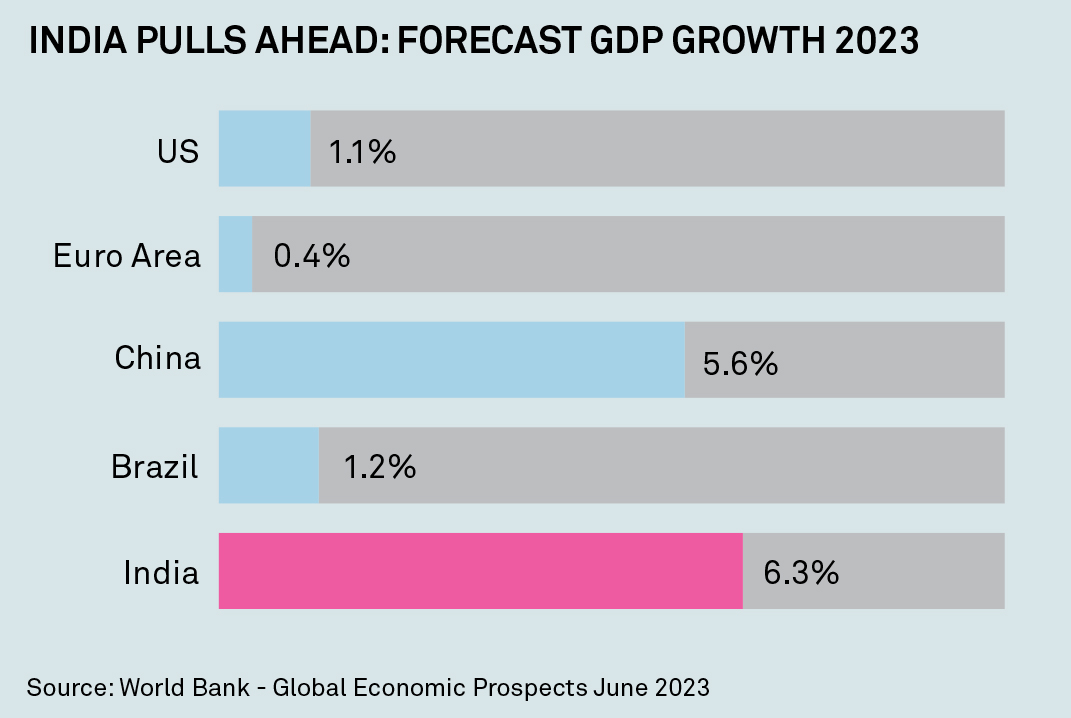

Long in the shadow of neighboring China, India is projected to be the world’s fastest growing economy in 2023 and 2024.1 Walter Scott investment manager Alan Lander and investment analyst Connor Graham spent two weeks in the country, speaking to management teams and taking the pulse of Asia’s “other superpower.” Here, they share key takeaways and first-hand views from their recent trip.

We have been regular visitors to India for more than 30 years, witnessing in that time economic transformation on an epic scale. Surpassing China in 2023 as the world’s most populous nation, there is a growing sense that India stands on the cusp of an exciting new stage in its development.

Our conversations with both domestic and global businesses throughout our visit allowed us to dig deeper into what we think could be some new and potentially interesting investment candidates. Many of these businesses have strong product or service offerings in parts of the Indian economy currently enjoying macro and geopolitical tailwinds, whether that be the country’s fast-growing middle class, alignment with government policy or the diversification of global supply chains. Even if they don’t translate directly into portfolio investments, we think the insights afforded by these meetings will prove valuable in our ongoing research and analysis back in Edinburgh.

A New Age of Prosperity

For Prime Minister Narendra Modi, the transformative moment seems to have arrived for the Indian economy. Modi believes the years ahead will likely see the country “ascend to new heights of prosperity” and there is no denying he is deploying considerable resource in its service.2 Evidence of this investment was abundantly clear in Mumbai, our first stop. Whether it is a new eight-lane road set to halve the northsouth travel time across the city, or the ongoing expansion of the metro rail network, construction is everywhere you look.

One focus of Modi’s initiatives is manufacturing. Long in the shadow of India’s service sector, manufacturers are benefiting from government actions aimed at facilitating investment, easing barriers, fostering innovation and encouraging onshore capacity expansion. The hope is these measures will not only support import substitution, but also help grow exports.

One company leveraging all of this is speciality chemicals business, Aarti Industries. Considered a trusted partner to large international players such as Bayer, BASF and DuPont, Aarti has built a reputation in its production of a diverse range of chemical compounds. Focusing on areas where it can command a significant share of the global market, the business has built roughly a 35% share in most product categories and is typically a top-three supplier globally.

Rising Incomes, Growing Opportunities

As well as an important manufacturing hub, Mumbai is also India’s financial center and home to the country’s insurance industry. Life insurance in India remains a nascent market —penetration stood at only 3.2% of the population in 2021—but the long-term opportunity could be enormous.3 As the country’s 1.4 billion population grows more affluent, demand for wealth protection products will also grow. While this same narrative is playing out across the developing world, few markets hold the potential of India.

The benefits of this shift in focus were clear when we spoke with ICICI Prudential Life (IPLIC). Four years ago, IPLIC set out to double its Value of New Business (an important measure of profitability for life insurance companies) by 2023. Today, the business is on course to hit its target, despite the disruption wrought by Covid-19 in the intervening years. Importantly, this push for greater penetration also aligns with Indian government policy, which bodes well for future growth.

From Mumbai, via stops in Hyderabad and Ahmedabad, we traveled to Bengaluru, where we met with United Spirits, a drinks company majority owned by Diageo. Under Diageo’s guidance, it has evolved into a value-led operation with a focus on efficiency and margin expansion and the long-term opportunity in India’s drinks market. Positive demographics, rising incomes among Indian consumers, and a less-regulated approach to alcohol sales – a slow but seemingly inevitable process – we believe will enable United Spirits to not only sell more of Diageo’s global brands in India, but also take greater share of the higher-margin premium end of the market.

Reflections

One of the enduring benefits of trips such as these is the chance to take the pulse of a country and of those involved in the ‘day-to-day’ of its economic life.

From our meetings in India, a picture emerged of a nation confident in itself and its future, both in the near and long term. And while it would be unwise to underestimate the scale of the challenge that lies ahead for the country as it aims for developed nation status by 2047 – India remains beset by high levels of corruption, poverty and inequality – it would be equally misguided to downplay the considerable efforts now underway to accelerate the country’s development. Progress may not prove linear, but these are undoubtedly exciting times for India Inc.

1. World Bank – Global Economic Prospects, June 2023.

2. Business Today, India. November 2022.

3. Invest India, BFSI - Insurance, India is projected to become the 6th largest insurance market by 2032, as of June 2023.

All investments involve risk, including the possible loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing. Company information is mentioned only for informational purposes and should not be construed as investment or any other advice. The holdings listed should not be considered recommendations to buy or sell a security.

BNY Mellon Investment Management is one of the world’s leading investment management organizations, encompassing BNY Mellon’s affiliated investment management firms and global distribution companies. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the corporation as a whole or its various subsidiaries generally.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions.

Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances. Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change.

The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Walter Scott & Partners Limited (“Walter Scott”) is an investment management firm authorized and regulated in the United Kingdom by the Financial Conduct Authority in the conduct of investment business. Walter Scott is a subsidiary of The Bank of New York Mellon Corporation.

Not FDIC-Insured | No Bank Guarantee | May Lose Value

© 2023 BNY Mellon Securities Corporation, distributor,

240 Greenwich Street, 9th Floor, New York, NY 10286

MARK-408125-2023-07-25