January 2024

In 2023, members of the Walter Scott investment team visited Indonesia and Hong Kong. Here, they share insights on the challenges and opportunities from two uniquely positioned regions, both on transformative paths toward growth and stability.

Indonesia: Not fragile after all these years

Fraser Fox, Investment Manager and Michael Scott, Investment Analyst

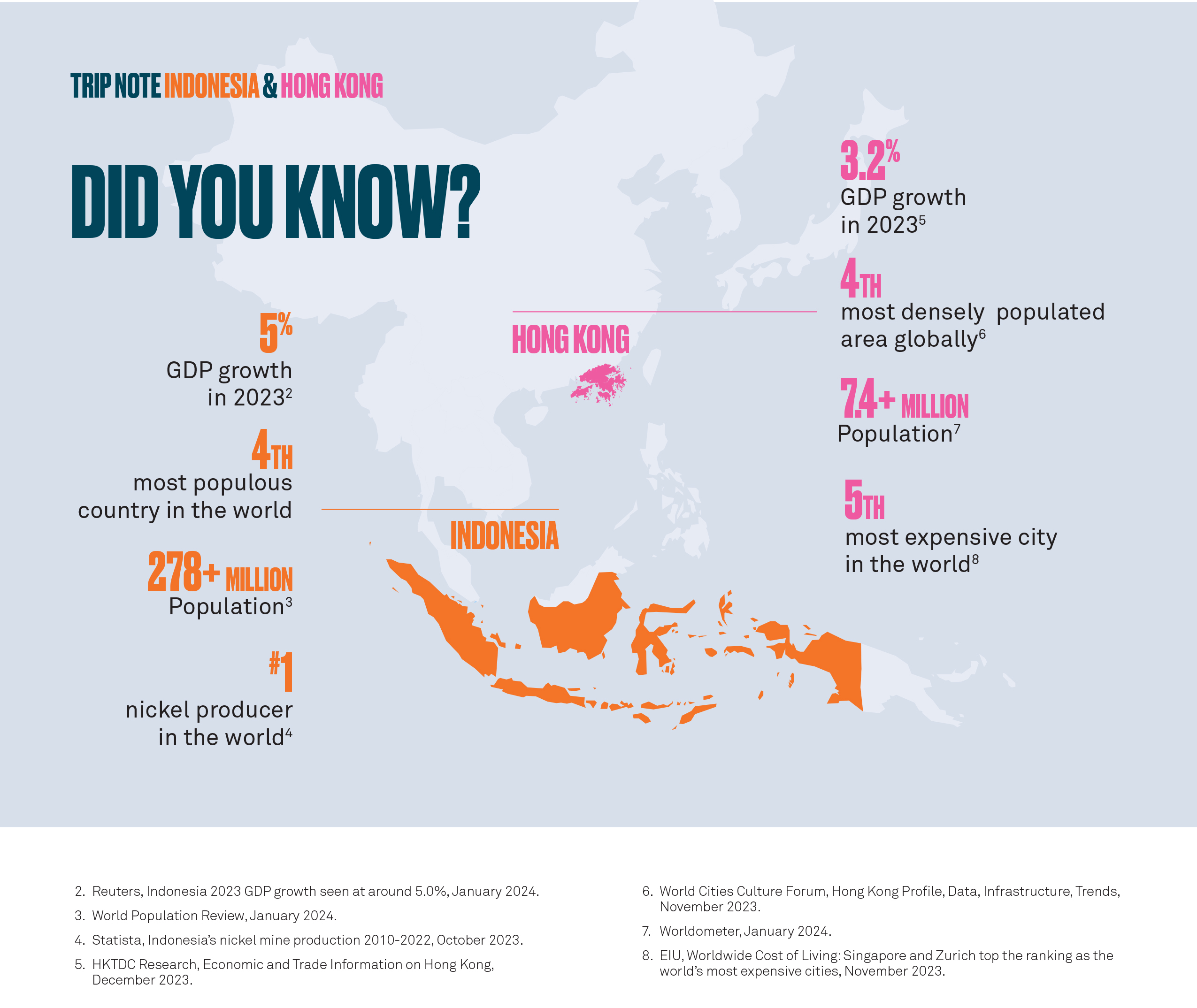

Indonesia, the largest economy in South-East Asia and fourth most-populous country in the world, is experiencing a sustained period of growth and stability.

It’s been 10 years since the Federal Reserve rattled financial markets by hinting that it might begin the process of scaling back its post-Great Financial Crisis asset purchase program. One country at the sharp end of the upheaval was Indonesia, which alongside Brazil, India, Turkey and South Africa (the so-called “Fragile Five”) was considered particularly vulnerable to abrupt reversals in capital flows due to a large current account deficit and heavy reliance on external funding.

In the intervening years, however, Indonesia has undergone an impressive economic transformation, shedding its unwanted ‘fragile’ label in the process. Today Indonesia enjoys investment-grade status and is experiencing a sustained period of growth and stability. Of the world’s major economies, only India is projected to eclipse Indonesia for growth in 2024 and 2025.

Travel to Indonesia and it’s common to hear this economic turnaround attributed to the astute stewardship of Joko Widodo, the country’s long-serving president. Known colloquially as “Jokowi,” he is credited with instigating a program of infrastructure investment and regulatory reform that has helped to energize the Indonesian economy. Even more important have been measures aimed at unlocking the full potential of the country’s huge mineral reserves, particularly nickel.

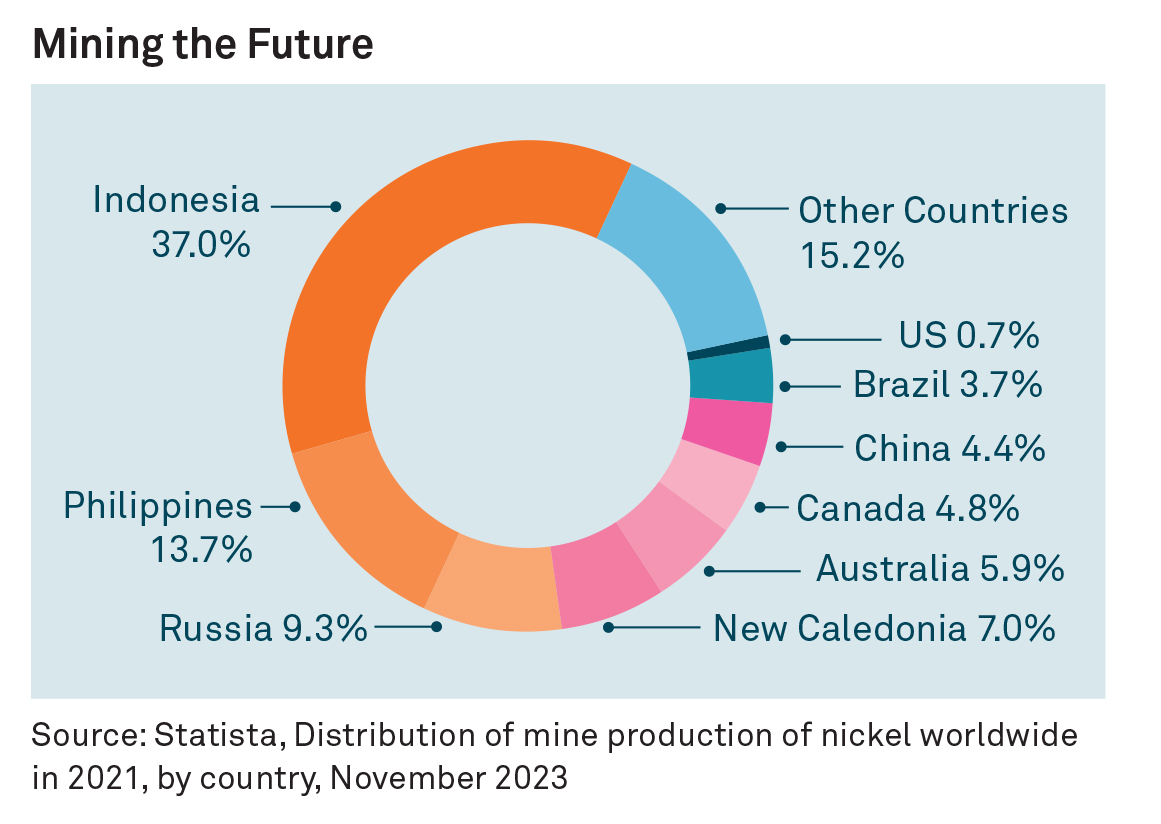

As the world’s largest nickel producer, Indonesia has benefited in recent decades from increased demand from China, and more recently from the electric-vehicle battery sector.

However, it was Jokowi’s decision in 2020 to ban the export of nickel ore that turbo-charged revenues. By mandating that all nickel must be processed domestically, Indonesia has been able to attract greater foreign investment and capture more of the nickel value chain. By 2022, nickel-related revenues had reached an estimated US$30 billion, a more than ten-fold increase from 2013. 1

Little wonder that Jokowi remains so popular with voters despite having been in power for almost 10 years. Jokowi will be stepping down in 2024 but policy continuity appears likely, particularly regarding infrastructure investment. Inadequate infrastructure is a headwind to productivity anywhere but given the sheer dispersion of the Indonesian archipelago, the impact has been particularly acute, in our view. To address this, Jokowi established the National Strategic Projects initiative in 2016, pouring billions into long-term transport and energy works.

Nowhere is the influence of this investment more evident than in the capital Jakarta, where the infamous traffic congestion is showing marked signs of improvement. While in Jakarta, we met with a company that’s been integral to the overhaul of the city’s transport network, Jasa Marga. As the major toll-road operator in Indonesia, Jasa Marga has a pipeline of projects that should keep it busy well into the next decade.

Of course, this capital-intensive work carries significant long-term execution risk. To compensate for this and to further encourage private investment, the Indonesian government has put in place a supportive industrial structure. For Jasa Marga this includes multi-decade concessions (often up to 50 years), regular inflation-based tariff adjustments and financial support for land acquisition and clearance.

The investment case for Indonesia does not begin and end with infrastructure and minerals, however. Many of the structural trends underpinning the investment narrative for the wider South-East Asia region also apply: incomes are rising, the middle class is growing and demographics are favorable. Furthermore, the relative under-penetration of markets and trends presents companies with significant growth opportunities.

Avian Brands, for example, is a market leader in the Indonesian paint industry. Avian generates the bulk of its revenues from home renovations – a market with a strong tailwind from rising levels of prosperity.

Another play on rising household incomes is the convenience-store operator Alfamart. Alfamart’s management team sees plenty of scope for further expansion as customers shift from traditional to more modern retail formats.

The stronger, more diversified and resilient Indonesian economy that has emerged in recent years is well-placed to enjoy a prolonged period of growth. From being very much a leveraged commodity play, there are now more strings to the Indonesian bow. Commodities should of course continue to be vitally important but the abundance of ‘new’ commodities – cobalt, nickel, copper – and a greater share of the value chain should serve to mitigate the impact of the inevitable cycles. Foreign direct investment, meanwhile, is booming and corporate confidence is high, in our view.

1 The Economist, Indonesia embraces resource nationalism, January 2023.

Hong Kong: Not another Chinese city

Alan Lander, Investment Manager, Head of Research

A turbulent few years for Hong Kong has led many observers to suggest the city’s star is on the wane, particularly with Beijing exerting greater influence on daily life.

Although no one would argue that recent years have been testing for Hong Kong, we heard a very different message during our visit. Across a series of meetings with business leaders and company management teams, the story told was one of confidence and optimism, both from an economic and socio-political perspective. Yes, Hong Kong has changed, but contrary to received wisdom in the West, this is not necessarily a bad thing.

The pessimistic view of Hong Kong’s prospects appears to rest largely on two connected issues: the national security law introduced by Beijing in 2020 and the encroaching ‘Sinicization.’ Neither appeared to hold much fear for those we met with, however. Most spoke positively about the national security law, arguing that it had restored some much needed stability and helped to clarify what is and what is not the remit of the Hong Kong government.

On the creeping ‘Sinicization’ of the city, there was also minimal concern. While the increase in Chinese influence is clear to see post pandemic, this was always the ultimate direction of travel. And although Hong Kong is becoming a more Chinese city, it is not becoming another Chinese city. Beijing understands that the differences between Hong Kong and Mainland China are fundamental to its role as an international gateway. As such, we should expect the status quo for those doing business to endure.

Perhaps one of the most compelling pieces of evidence in support of the improving backdrop is the steady flow of people back to the city. Hong Kong shed a lot of talent due to onerous Covid-19 restrictions and the British National Overseas visa scheme but some of that talent is now starting to return. Ex-pats who left for Singapore are being attracted back by the reopening of the city’s borders and a reduced cost of housing relative to Singapore.

Former residents are returning to a city that is not currently firing on all cylinders from an economic perspective, a fact acknowledged by everyone we spoke to. This has nothing to do with the national security law or Sinicization, however, and everything to do with China’s muted recovery from Covid-19, the ongoing issues in the country’s real estate sector and the volatile geopolitical backdrop. Activity in Hong Kong remains highly dependent on China and activity in the former won’t fully recover until the latter finds its feet again. For now, investor sentiment toward both remains depressed. From a fundamental perspective, however, the outlook for many companies is much brighter.

AIA Group is one such example and a meeting with the longstanding CFO and other senior representatives of the life insurance giant confirmed that its impressive post-pandemic recovery remains on track. Visitor numbers from mainland China – the biggest source of revenue for AIA’s Hong Kong business – are recovering and average case sizes are now nearly double pre-pandemic levels. The domestic Hong Kong market is also showing good momentum. While insurance enjoys relatively high levels of penetration in Hong Kong, poor levels of state provision could mean there are always opportunities to sell more to existing customers.

Business in mainland China is also progressing well, despite the economy’s well documented challenges. If anything, the group’s exclusively high-net-worth Chinese customer base is actually saving more, while new customers are finding their way to AIA, attracted by the highest-quality offering in the market. The launch of a new tax-deductible pension product, the first of its kind in China, has been a great success, with good uptake from new and existing customers alike. Regulatory endorsement was reflected in a request to AIA’s peers to develop similar products.

There is no question that Hong Kong’s reputation has taken a knock in recent years, nor that it is facing some near-term economic challenges. Look beyond the next couple of years, however, and there is ample cause for optimism.

The city sits at the nexus of a number of the Chinese government’s long-term projects. Renminbi internationalization and the Greater Bay Area and Belt and Road initiatives potentially represent multi-decade opportunities. With its characteristic vigor, we expect Hong Kong to harness these opportunities and continue its pivotal role in securing China and Asia’s long-term prosperity.

All investments involve risk, including the possible loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing. Company information is mentioned only for informational purposes and should not be construed as investment or any other advice. The holdings listed should not be considered recommendations to buy or sell a security.

BNY Mellon Investment Management is one of the world’s leading investment management organizations, encompassing BNY Mellon’s affiliated investment management firms and global distribution companies. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the corporation as a whole or its various subsidiaries generally.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions.

Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances. Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change.

The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Walter Scott & Partners Limited (“Walter Scott”) is an investment management firm authorized and regulated in the United Kingdom by the Financial Conduct Authority in the conduct of investment business. Walter Scott is a subsidiary of The Bank of New York Mellon Corporation.

Not FDIC-Insured | No Bank Guarantee | May Lose Value

© 2024 BNY Mellon Securities Corporation, distributor, 240 Greenwich Street, 9th Floor, New York, NY 10286

MARK-475917-2024-01-05