May 2024

It’s not hard to understand the growing appeal that exchange-traded funds (ETFs) have for investors. Such securities offer a wide diversity of assets and investment optionsat moderately low transaction costs. ETFs have become so popular that this financial “wrapper” pulled in more than $580 billion for the full year 2023.1

In terms of history, the first US ETF was introduced in 1993; it was benchmarked to the S&P 500.2 Fast forward to 2008 when the Securities and Exchange Commission first issued3 exemptive orders4 for fully transparent active products. This gave rise to the conditions for the first active ETF to be launched that year. Since then, it’s been a progression of variants on passive and active funds.

In the US, there are more than 2,300 ETFs available, and of those more than 1,300 are active ETFs.5 As of the end of March 2024, US ETFs had over $8.9 trillion in assets under management.6

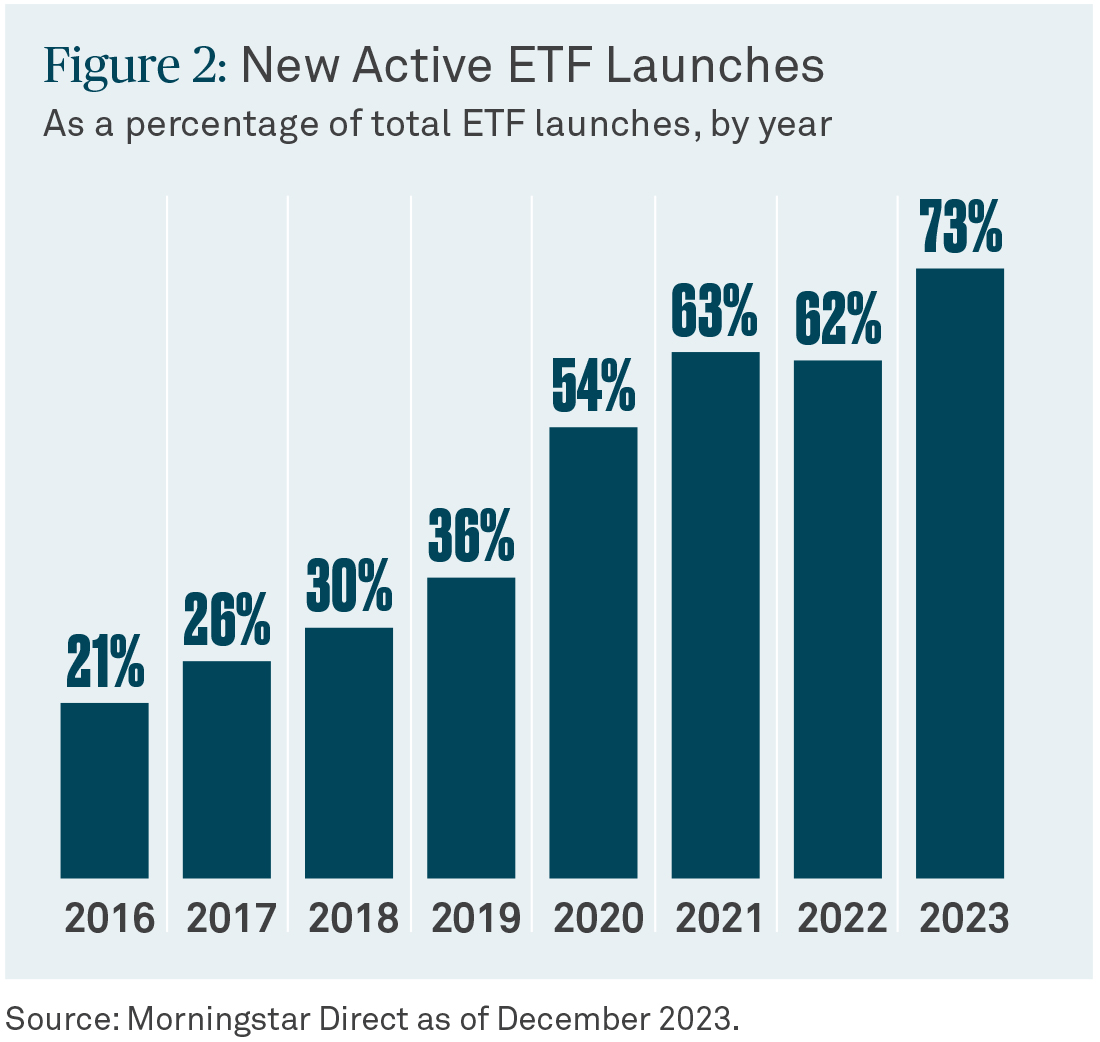

Not only has there been growing interest in ETFs, there also was a notable shift in the proportion between passive and active ETFs. Beginning in 2020, active ETF launches outpaced passive launches. While by 2023, more than 70% (386) of the ETFs launched were actively managed according to Morningstar Direct Asset Flows data.

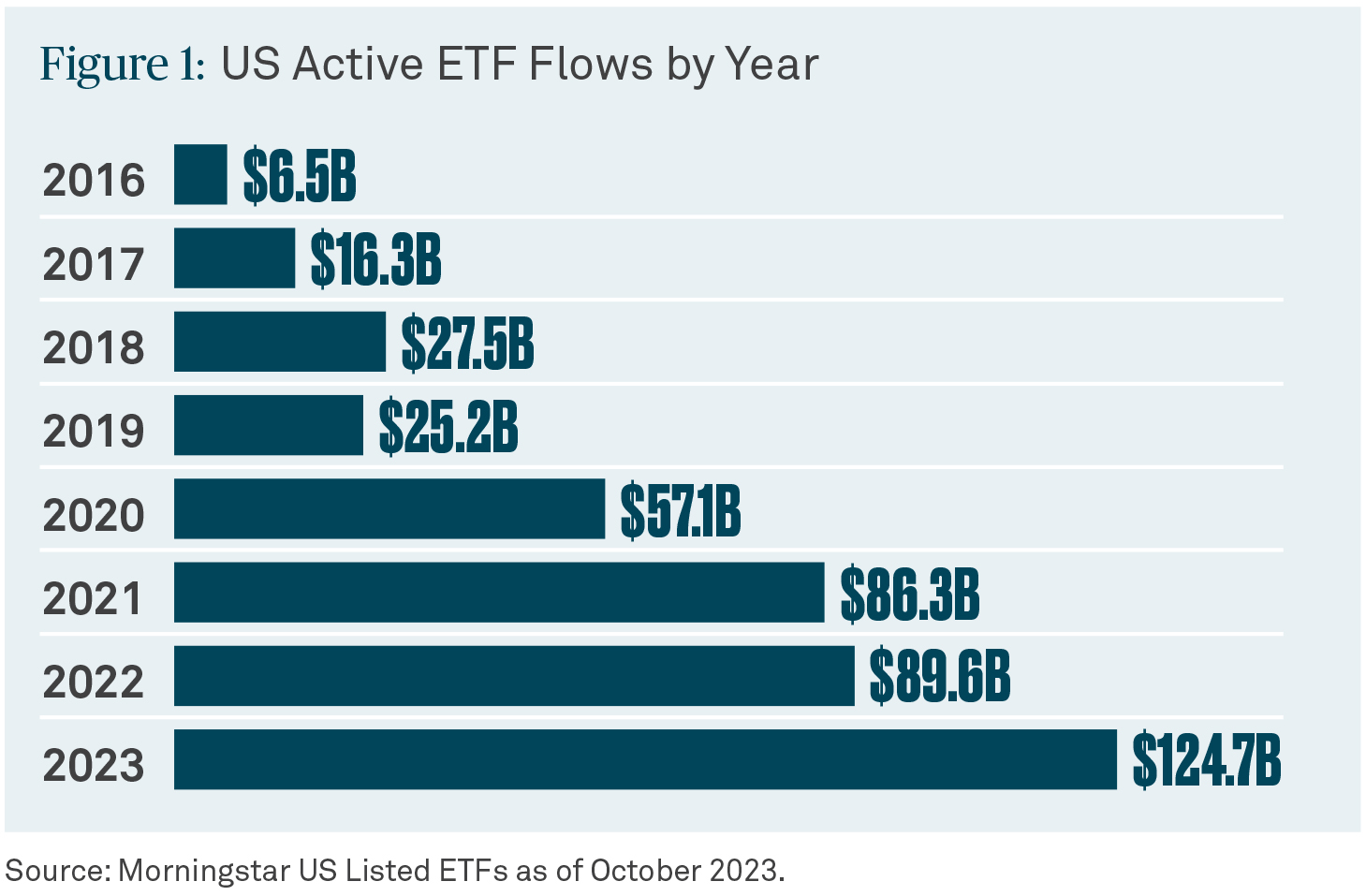

In addition, investors poured nearly $125 billion into US actively managed funds through December 2023, according to Morningstar Asset Flows data. That’s nearly 21% of net US ETF flows to a segment that comprises only a slim percentage of the total asset base 6

One of the reasons for this surge of interest, in our view, is that investors are more and more recognizing the versatility of an ETF. Perhaps consider it this way: imagine you’re offered the choice to invest in a structurally sound — i.e., designed to bear its loads — financial “chassis” on top of which you can conceptually assemble nearly any kit of assets that will fit. That’s what an ETF is like. The passive fund is the autonomous vehicle which typically shadows an index, making rules-based adjustments on a predetermined cadence. An active ETF — that has a driver, and that’s when active investing, especially during market volatility, has the potential to generate alpha.

What are the benefits of an ETF?

Most ETFs disclose their holdings every day; a mutual fund, in comparison, usually does so at a minimum quarterly. This type of transparency allows investors to know what they own daily across an asset-allocation mix.

In addition, because ETFs are traded like stocks, an investor can move in and out of various ETFs in real-time during market hours, instead of waiting for a mutual fund to calculate its price at the end of the day. An ETF’s price is market-determined and generally aligns with the prices of the underlying asset; it also can be used as a price-discovery tool during times of market stress. That kind of liquidity may be appealing not only to managers but also to non-institutional investors who seek financial accessibility.

Then there is the tax efficiency7 of this product. Many ETFs avoid, or at least minimize, capital gains by doing in-kind exchanges (which is not a taxable event), effectively sheltering the fund from any need to sell securities to meet redemptions and thus incurring capital gains. In 2023, 46% of active equity mutual funds paid a capital gain compared to only 6% of active equity ETFs.8

Finally, investor access of the ETF structure is relatively simple, too, as ETF transactions take place between market participants on exchanges and do not require a minimum investment amount.

How does an ETF work?

ETFs typically are structured as open-end funds (i.e., their capital structure is not closed). An ETF operates similarly to a mutual fund, except that it is listed on an exchange where it can be bought and sold throughout the day.

Every shareholder of an ETF has an ownership stake in the assets of the fund. The ETF is designed to track the price movement of the underlying assets it owns, but sometimes market events can cause an ETF to trade at a price greater or lesser than the value of the assets it owns.

In an attempt to keep this from happening, an innovation of the ETF is its arbitrage mechanism, which is designed to keep the share price near its NAV (this is the creation and redemption process, which takes place in the primary market). When the prices deviate, authorized participants (such as market makers) can use arbitrage to make a profit. So in effect arbitrageurs readjust the equilibrium of the ETF’s supply and demand to help the ETF keep its market price in line with its NAV.

Therefore, if the ETF is trading at a value higher than the aggregate value of the underlying securities the ETF owns, arbitrageurs will buy the underlying securities, use them to create units of the ETF (i.e., a block of new shares issued by the ETF company), and then sell the ETF shares on the open market for a profit. But if the ETF is trading at a price lower than the value of the underlying securities the ETF owns, arbitrageurs will buy ETF shares on the open market and then redeem those units in exchange for the securities the ETF owns. Arbitrageurs can then sell those securities and make a profit.

Action on the horizon

The ETF phenomenon continues to grow momentum. For the first time in 2020, active ETF launches began to outpace passive and that trend continues.9

It’s not surprising then that more and more investors see active ETFs as an advantageous and cost-effective option for their portfolios. That demand has been met with supply, as indicated by the new fund launches shown in Figure 2. With a nimble manager at the helm, an active ETF offers many of the same benefits of a passive ETF such as liquidity and tax efficiency, but with the potential for alpha and downside protection — a combination that is increasingly recognized by individual and institutional investors.

1 Morningstar Direct Asset Flows.

2 Investopedia.com; April 15, 2024.

3 SEC.gov; accessed November 2021.

4 An exemptive order can “conditionally or unconditionally exempt persons, transactions, or securities (or classes thereof) from any Exchange Act provision, rule or regulation,” SEC.gov.

5 Morningstar Direct Asset Flows as of April 24, 2024.

6 Morningstar Direct Asset Flows as of April 24, 2024.

7 An ETF’s tax efficiency can be derived from certain structural elements, including turnover in passive strategies are typically lower than that in active; there also can be structural tax benefits from in-kind redemptions. When assets are delivered from the ETF via an in-kind transfer, no capital gains are realized. This can allow investors more control over the timing of their tax liabilities based on when they generally sell their position. Please consult your own tax advisor or financial professional for more detailed information on tax issues as they relate to your specific situation.

8 Morningstar Direct as of March 31, 2024.

9 Morningstar Direct Asset Flows as of April 24, 2024.

Investors interested in the fund should consider the investment objective, risks, charges, and expenses of the fund carefully before investing. To obtain a prospectus that contains this and other information about the fund, investors should contact their financial representatives or visit im.bnymellon.com/etf. Read the prospectus carefully before investing.

ETF shares are listed on an exchange, and shares are generally purchased and sold in the secondary market at market price. At times, the market price may be at a premium or discount to the ETFs per share NAV. In addition, ETFs are subject to the risk that an active trading market for an ETF’s shares may not develop or be maintained. Buying or selling ETF shares on an exchange may require the payment of brokerage commissions.

ETFs trade like stocks and are subject to investment risk, including possible loss of principal. The risks of investing in ETFs typically reflect the risks associated with the types of instruments in which the ETF invests. Diversification cannot assure a profit or protect against loss.

The ETF will issue (or redeem) fund shares to certain institutional investors known as “Authorized Participants” (typically market makers or other broker-dealers) only in large blocks of fund shares known as “Creation Units.” BNY Mellon Securities Corporation (“BNYMSC”), a subsidiary of theBNY Mellon, serves as distributor of the fund. BNYMSC does not distribute fund shares in less than Creation Units, nor does it maintain a secondary market in fund shares. BNYMSC may enter into selected agreements with Authorized Participants for the sale of Creation Units of fund shares.

All investments involve risk including loss of principal. Certain investments involve greater or unique risks that should be considered along withthe objectives, fees, and expenses before investing.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment.

Past performance is no guarantee of future results.

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation ofany particular investment, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions. Please consult a legal, tax or financial professional in order to determine whether an investment product or service is appropriate for a particular situation. Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as ofthe date of this publication and subject to change. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

BNY Mellon Investment Management is one of the world’s leading investment management organizations, encompassing BNY Mellon’s affiliated investment management firms and global distribution companies. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporationand may also be used as a generic term to reference the corporation as a whole or its various subsidiaries generally. BNY Mellon ETF Investment Adviser, LLC is the investment adviser of the BNY Mellon ETFs and BNY Mellon Securities Corporation is the distributor of the ETF funds; both are subsidiaries of BNY Mellon.

Equities are subject to market, market sector, market liquidity, issuer, and investment style risks to varying degrees. Small and midsized company stocks tend to be more volatile and less liquid than larger company stocks as these companies are less established and have more volatileearnings histories. Investing in foreign denominated and/or domiciled securities involves special risks, including changes in currency exchange rates, political, economic, and social instability, limited company information, differing auditing and legal standards, and less market liquidity.These risks generally are greater with emerging market countries.

© 2024 BNY Mellon Securities Corporation, distributor, 240 Greenwich Street, 9th Floor, New York, NY 10286.

MARK-535313-2024-04-24