December 2023

The Federal Reserve (the Fed) raised interest rates multiple times in 2023 – greatly impacting bond yields. Eric Hundahl, BNY Mellon Investment Management Head of Portfolio Strategy, says turning to longer-dated bonds could benefit investors.

Highlights

- We believe the door is wide open for the Fed and other central banks to cut rates in 2024

- Longer maturity bonds may yield higher returns than shorter maturity bonds in 2024

- Stock / Bond correlations need to normalize for long-term bonds to be advantageous for balanced portfolios

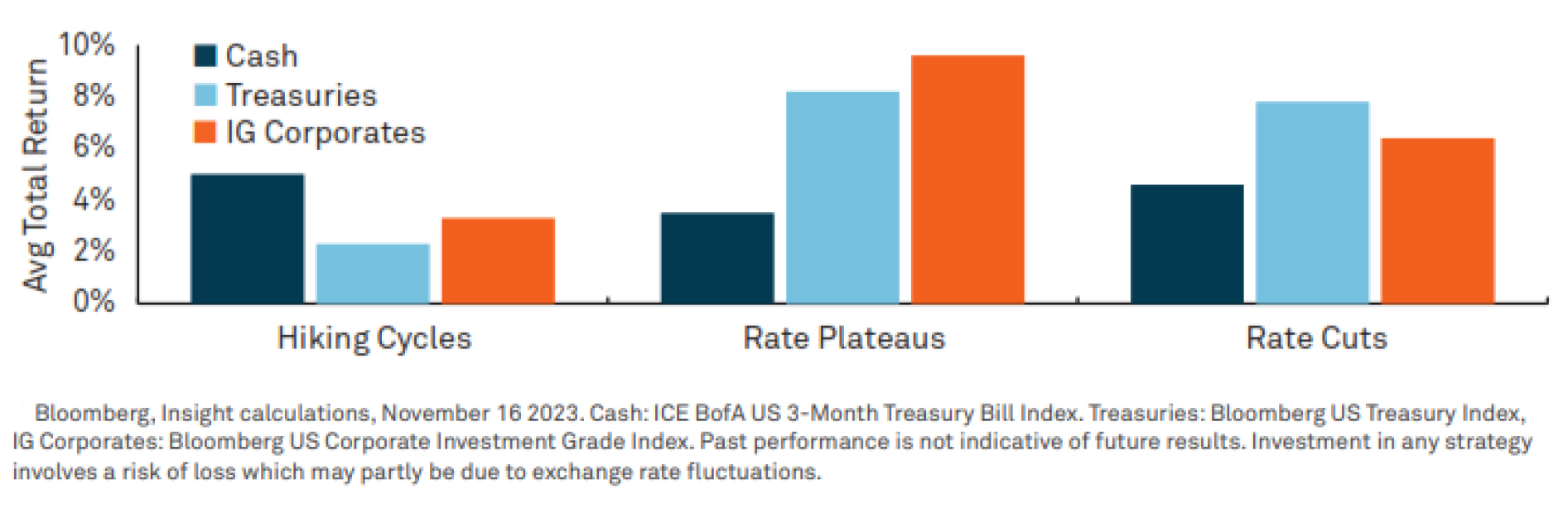

Some viewed cash as king in 2023 thanks to numerous interest rate hikes, but many believe the Fed is unlikely to raise rates much further – creating an environment where investors may realize higher returns from longer-dated bonds.

“One of the surprises of this year was the rapid rise in interest rates, particularly on the back end of the curve, largely driven by supply and demand dynamics at the Treasury,” says Eric Hundahl, BNY Mellon Investment Management Head of Portfolio Strategy. “I do think it will present an opportunity for investors that were largely sitting in cash to extend duration, to move further out on the curve at the end of this year (2023) and then going into 2024.”

3 Hurdles to fixed income

The yield curve is expected to normalize in 2024, with longer maturity bonds yielding higher returns than shorter maturity bonds. However, there are some hurdles investors will need to overcome before this happens.

- Confidence the Fed’s ability to deliver on its own projections of rates

- Rate volatility needs to come down

- Improved stock/bond correlation

“We just don't need upward pressure for the Fed to be done, but we actually need rate volatility to come down,” says Hundahl. “Bonds really haven't been an effective hedge to the equity risk in portfolios this year as the stock/bond correlation has been too high.” Furthermore, Hundahl notes, “We think investors should start thinking about, if they haven't already, is increasing duration in their balanced portfolios.”

All investments involve risk, including the possible loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing.

Bonds are subject to interest rate, credit, liquidity, call and market risks, to varying degrees. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes and rate increases can cause price declines.

Equities are subject to market, market sector, market liquidity, issuer, and investment style risks to varying degrees.

Asset allocation and diversification cannot assure a profit or protect against loss.

BNY Mellon Investment Management is one of the world’s leading investment management organizations, encompassing BNY Mellon’s affiliated investment management firms and global distribution companies. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the corporation as a whole or its various subsidiaries generally.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions.

Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances. Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change.

The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Asset allocation and diversification cannot assure a profit or protect against loss.

Not FDIC-Insured | No Bank Guarantee | May Lose Value

© 2023 BNY Mellon Securities Corporation, distributor, 240 Greenwich Street, 9th Floor, New York, NY 10286

MARK-472075-2023-12-20