March 2024

As America heads down the proverbial road to the White House, the ballots cast on November 5 will inevitably impact a wide range of policies that will have far-reaching economic effects. Eric Hundahl, BNY Mellon Investment Management Head of Portfolio Solutions, says the groundwork is being laid for a predictably volatile news cycle, but markets will likely be more focused on the health of the economy.

Highlights

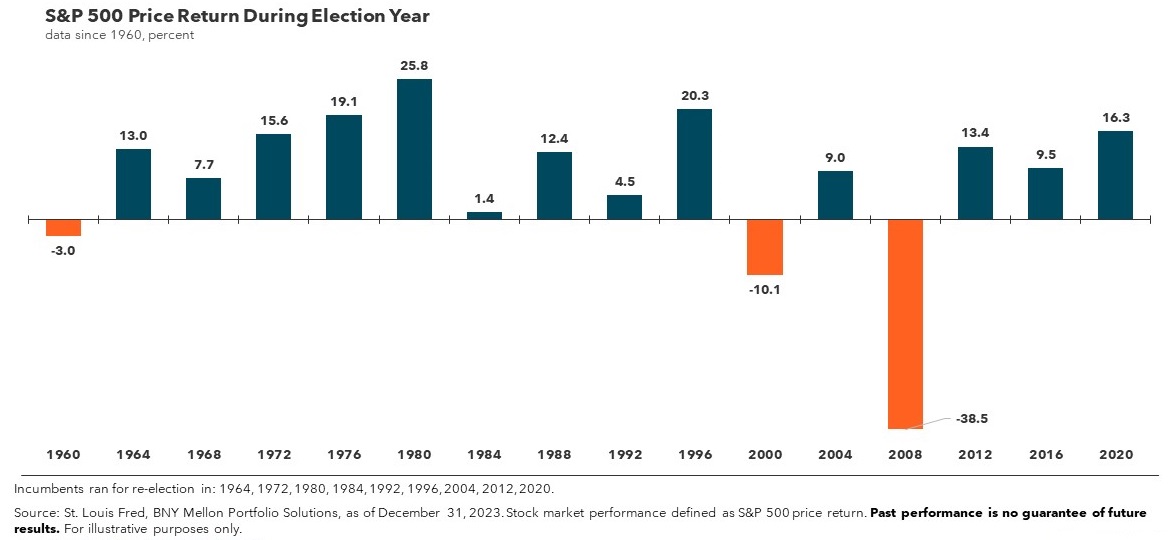

- Stocks tend to perform well when an incumbent U.S. president runs for re-election

- Empirical data suggests incumbent presidents tend to extend fiscal stimulus into election years

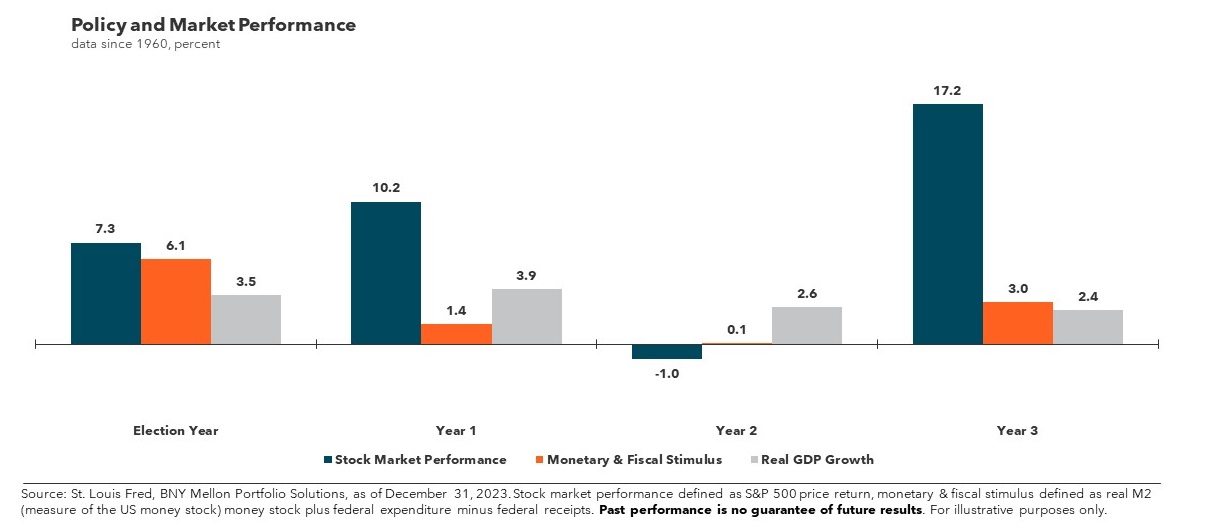

- Markets show strong growth during election years, but the strongest performance tends to come in the incumbent’s third year

As plausible as the sun rising in the east and setting in the west, the U.S. presidential elections are likely to add noise to the investing cycle. “They (elections) add an extra layer of uncertainty to the market and the markets don't like uncertainty, and political uncertainty is no exception,” says Hundahl. “It just tends to add volatility over the short term and has very minimal impact over the medium and long term.”

Stock market patterns

The stock market seems to have bipartisan views when it comes time for an incumbent president’s bid for re-election. Whether a Democratic or Republican candidate, the stock market tends to favor the predictability that comes with more of the same.

“The markets generally prefer the incumbent winning because they had spent the last four years adjusting and understanding and getting to know the policies of the incumbent president,” says Hundahl. “If an incumbent does lose, you tend to see more volatility immediately after the election as the market readjusts to the policies and the behaviors of the new president.”

While the stock market has shown growth during election years, the strongest performance has historically been in the third year of the incumbent’s presidency. “We tend to see more fiscal spending leading up to a re-election,” says Hundahl. “We're certainly seeing that this year in the U.S., but we also see a little bit looser monetary policy, and that's consistent where the Fed (the Federal Reserve) and other central banks are signalling that we'll have rate cuts this year.”

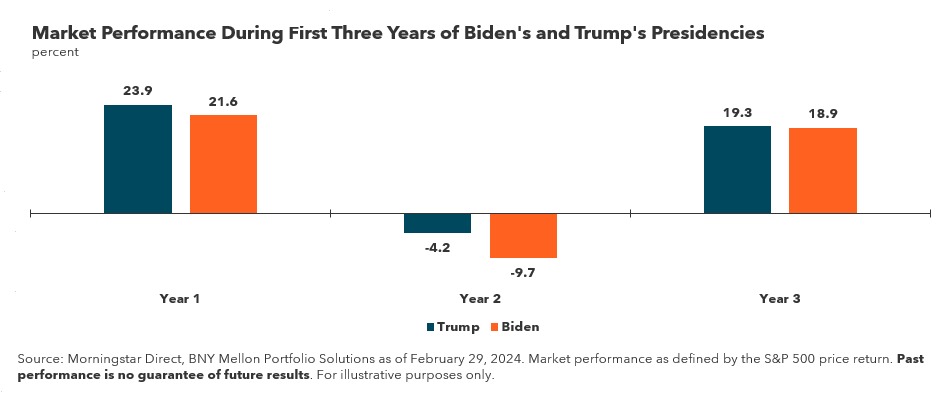

Economic achievements

President Biden and former President Trump both have experience leading the country. Here is how the market performed their first three years as president.

Elections have consequences

Whether team red or blue is victorious this fall, there will be an impact on numerous key issues. Elections dictate everything from how and where the government spends money to regulations and foreign policy.

“U.S.-China relations will continue to be stressed regardless of whether it's Trump or Biden,” notes Hundahl. For example, former President Trump implemented tariffs on more than $300 billion in Chinese imports. While under review, President Biden has kept the tariffs. Whether the tariffs remain could impact manufacturing at home and abroad.

Many eyes are also on the 2017 Trump-era Tax Cuts and Jobs Acts (TCJA), due to expire in 2025. The Biden administration hasn’t confirmed whether these tax cuts will be extended. The TCJA resulted in lower tax brackets and higher standard deduction amounts.

Another area where President Biden and former President Trump differ is climate and energy. “Biden has clearly shown that he wants to lean into renewable energy whereas Trump is taking almost a complete opposite approach,” notes Hundahl. For example, late last year the Biden administration announced the U.S. would pledge $3 billion to the Green Climate Fund. Former President Trump says he would retract the offer.

Besides the U.S. presidential election, there are other forces that should be on investors’ radar. “I still think that the macro themes will be driving the market this year,” says Hundahl. “Things like domestic growth, inflation, can we hit the soft landing?”

All investments involve risk, including the possible loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing.

BNY Mellon Investment Management is one of the world’s leading investment management organizations, encompassing BNY Mellon’s affiliated investment management firms and global distribution companies. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the corporation as a whole or its various subsidiaries generally.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions.

Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances. Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change.

The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Not FDIC-Insured | No Bank Guarantee | May Lose Value

© 2024 BNY Mellon Securities Corporation, distributor, 240 Greenwich Street, 9th Floor, New York, NY 10286

MARK-515459-2024-03-19