Fixed Income Strategies

BE INTENTIONAL

Fixed income strategies intentionally constructed for today’s market opportunity.

FIXED INCOME:

STRATEGIES FOR

SHIFTING MARKETS

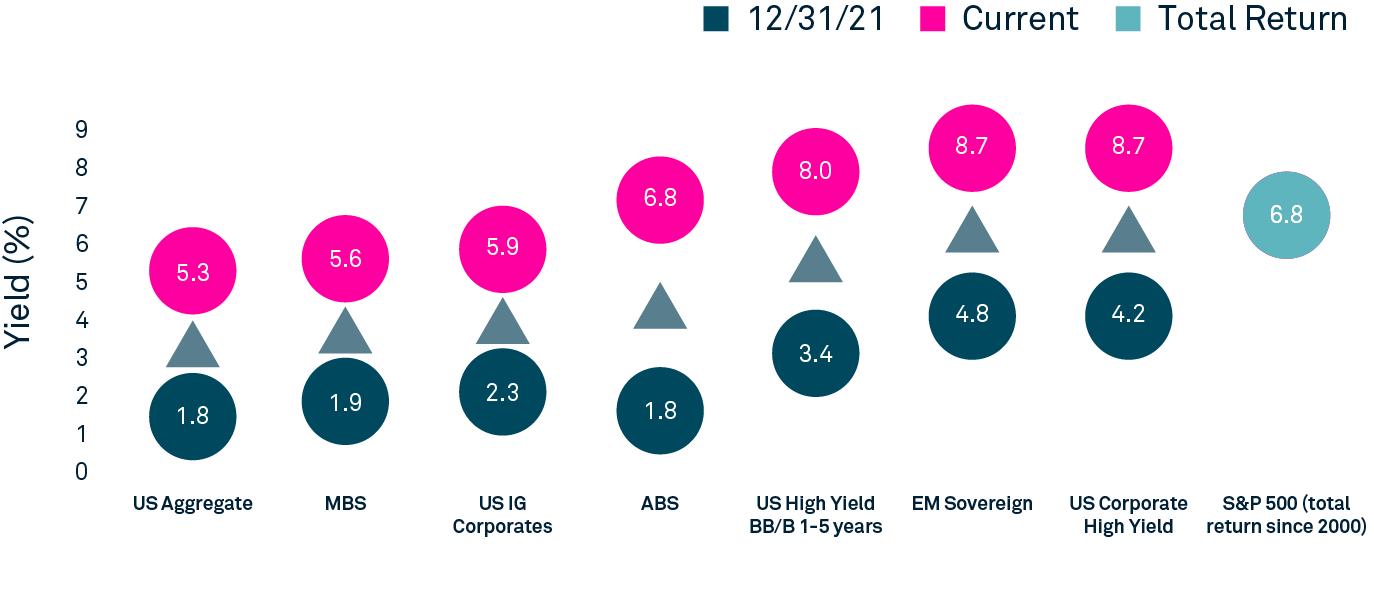

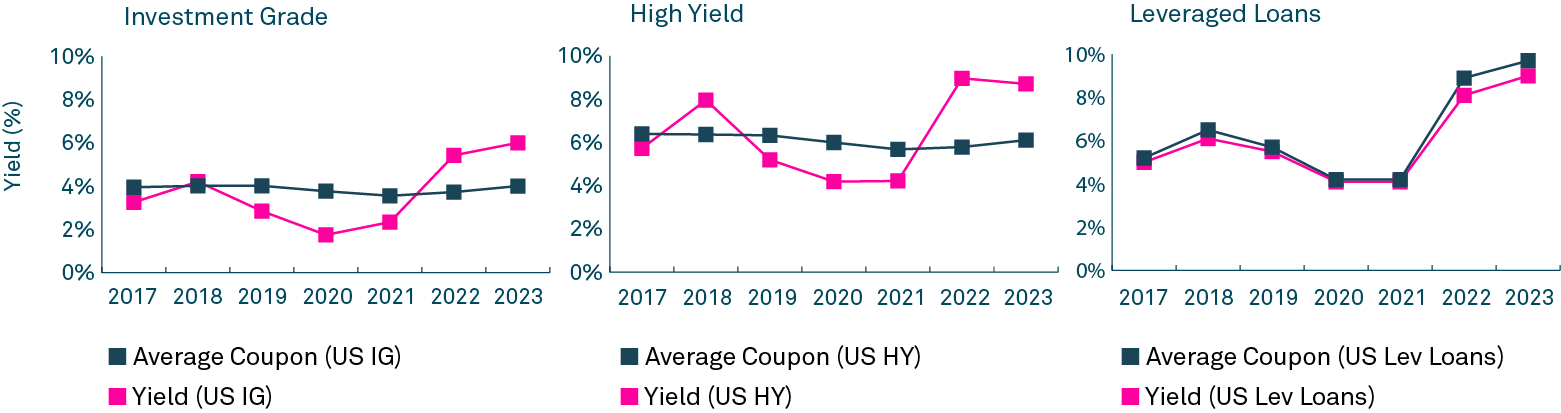

As we move into the next stage of the Federal Reserve cycle, we are entering a pivotal time for fixed income. In our view, investors may be well-served by the attractive yields and the contractual cash flows now available in intermediate-term fixed income, where high quality debt can be an important component of an investor’s portfolio allocation. Now may be an ideal time to start considering extending duration. We believe that in this environment, potential opportunity may be available to bond investors in a variety of core fixed income strategies offered by BNY Mellon Investment Management.

In our newly launched video program, THE SHIFT, we provide valuable perspectives for financial advisors in the ever-evolving market landscape. As market paradigms shift, it’s essential to adapt and explore new investment approaches. Join Ralph Divino, Product Strategist at BNY Mellon Investment Management, to discover five reasons to consider fixed income in 2024.

EXPLORE THE SERIES

New market paradigms require new investment strategies. Navigate the changing investment landscape with THE SHIFT.

Episode 1 | THE SHIFT

2024: A pivotal time for fixed income?

How can fixed income advisors stay focused on the shifting markets in order to capitalize on potential opportunities in fixed income in 2024?

Episode 2 | THE SHIFT

Time to beat the dash from cash?

With a record amount of cash sitting on the sidelines, will 2024 be a potential inflection point for investors to deploy that cash into fixed income potential?

Episode 3 | THE SHIFT

Higher Yields May Present an Attractive Opportunity for Bonds

Considering the yields from fixed income are approaching long-term equity returns, should investors allocate a larger portion to fixed income in the current market environment?

Episode 4 | THE SHIFT

Corporate credit – possible risks and potential opportunities ahead?

Is the increase in demand for investment grade corporate credit indicative of a positive outlook for the credit markets?

Episode 5 | THE SHIFT

International markets may offer unique opportunities in 2024

Could global bond markets be poised for another year of potentially strong performance? And how are active managers capitalizing on the opportunity?

Episode 6 | THE SHIFT

Stay active—we believe it’s a bond picker’s market

Why is it important for investors to stay active, considering the various opportunities within fixed income and the potential value across different sectors?

HOW CAN YOU POTENTIALLY SEEK TO UNLOCK

DIVERSIFICATION AND INCOME IN 2024?

We believe the time for fixed income has arrived. Explore five reasons to consider fixed income today.

THE FIXED INCOME

MARKETS OF TODAY?

Carefully risk managed through a focus on high-quality bond issues, our BNY Mellon Core Plus Fund and BNY Mellon Global Fixed Income Fund seek to offer a balance of income, opportunity, and diversification with an aim to maximize the potential for consistent returns.

OUR

INSIGHTS

OUR FUNDS

BNY Mellon

Core Plus Fund

Morningstar Rating™ as of 05/31/24 for the Class I shares; other classes may have different performance characteristics. Overall rating for the Intermediate Core-Plus Bond. Fund ratings are out of 5 Stars: Overall 4 Stars (554 funds rated); 3 Yrs. 4 Stars (554 funds rated); 5 Yrs. 4 Stars (526 funds rated); 10 Yrs. 4 Stars (374 funds rated).

BNY Mellon

Global Fixed Income Fund

Morningstar Rating™ as of 05/31/24 for the Class I shares; other classes may have different performance characteristics. Overall rating for the Global Bond-USD Hedged. Fund ratings are out of 5 Stars: Overall 4 Stars (106 funds rated); 3 Yrs. 4 Stars (106 funds rated); 5 Yrs. 5 Stars (99 funds rated); 10 Yrs. 4 Stars (60 funds rated).

WHAT’S BEHIND OUR INTENTIONAL

FIXED INCOME SOLUTIONS?

In building a balanced portfolio, investors typically seek stability, dependability, and diversification. At BNY Mellon Investment Management, we do not believe in chasing shortcuts to success. In navigating uncertainty, rigorous discipline and consistency count.

Active management

Our fixed income funds are actively managed by seasoned investors with extensive track records, looking to unlock hidden opportunities around the world.

Fundamental research

Our investment manager, Insight Investment, prides itself on rigorous bottom-up research with analysts covering both credit and sovereign issuers and issues. Insight’s value comes from knowing its investment universe inside and out, as well as making informed allocation decisions driven by intense research.

Full spectrum

Whether you are looking for a solution that provides core fixed income exposure plus the opportunity to capture alpha from securities outside the “core” category or the potential to capitalize on trends outside of the US, we have a range of strategies across the fixed income universe to suit your needs.

INTERESTED IN

THESE FUNDS?

For Financial Professionals: Book a portfolio consultation

BNY Mellon PinPoint is our robust consultation service for advisors. Using a powerful dynamic analytical tool, our investment professionals will work with you to address your clients’ needs, including specific asset classes and funds.

Learn more about PinPointInsight Investment is a leader in global fixed income and liability-driven investing with a rich history of innovation across fixed income markets. Our investment teams specialize across corporate and structured credit, government and municipal bonds, stable value, emerging market debt, liquidity solutions and currencies.

In contrast to the traditional focus on maximizing return and minimizing volatility, our approach prioritizes the certainty of meeting investors’ chosen objectives by diagnosing and managing risks to a desired outcome. We focus on consistency of returns by taking only compensated risks, seeking sustainable sources of income and aiming to exploit pricing inefficiencies across the full fixed income universe.

- $825.9bn in assets under management 7

- Offices in London, New York, Boston, San Francisco, Dublin, Frankfurt, Manchester, Sydney and Tokyo

- 285 investment professionals with an average of 19 years industry experience8

INVESTMENT MANAGEMENT

Established in 1784, BNY Mellon is America’s oldest bank and the first company listed on the New York Stock Exchange (NYSE: BK). Today, BNY Mellon powers capital markets around the world through comprehensive solutions that help clients manage and service their financial assets throughout the investment life cycle. BNY Mellon had $47.8 trillion in assets under custody and/or administration and $2 trillion in assets under management as of December 31, 2023. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation. Additional information is available on www.bnymellon.com. Follow us on LinkedIn or visit our Newsroom for the latest company news.

Regional consultant map7 As of 12/31/2023

8 As of 12/31/2023

GLOSSARY/DISCLOSURES

Investors should consider the investment objectives, risks, charges, and expenses of a mutual fund carefully before investing. Contact a financial professional or visit im.bnymellon.com to obtain a prospectus, or a summary prospectus, if available, that contains this and other information about the fund, and read it carefully before investing.

All investments involve risk, including loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Asset allocation and diversification cannot assure a profit or protect against loss.

Bonds are subject to interest rate, credit, liquidity, call and market risks, to varying degrees. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes and rate increases can cause price declines. High yield bonds involve increased credit and liquidity risk than higher rated bonds and are considered speculative in terms of the issuer’s ability to pay interest and repay principal on a timely basis. Investing in foreign denominated and/or domiciled securities involves special risks, including changes in currency exchange rates, political, economic, and social instability, limited company information, differing auditing and legal standards, and less market liquidity. These risks generally are greater with emerging market countries.

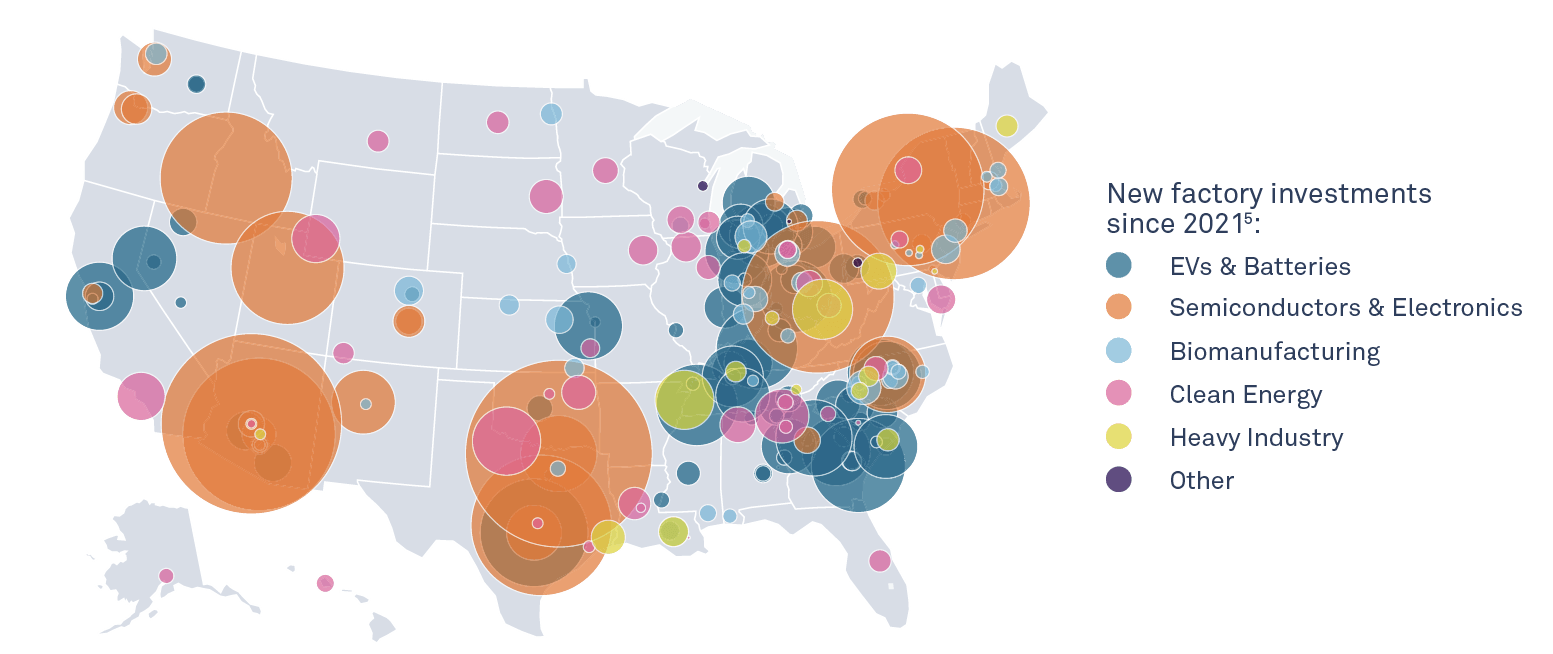

A leveraged loan is one that is extended to companies or individuals that already have considerable amounts of debt or a poor credit history. Lenders consider leveraged loans to carry a higher risk of default, and as a result, a leveraged loan is more costly to the borrower. CapEx Supercycle refers to an extended period during which companies are significantly increasing plant, equipment or machinery often lasting several years or even decades. During it, investors may aim to capitalize on the upward trend by investing in the asset or sector experiencing strong growth. Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health. A collateralized loan obligation (CLO) is a single security backed by a pool of debt. Often these are corporate loans that have a low credit rating or leveraged buyouts made by a private equity firm to take a controlling interest in an existing company. An illiquidity premium is the explanation for a difference in yield or total return between investments that have similar qualities except liquidity, or the ability to trade on a daily basis.

The ICE Bofa US 3 Month Treasury Bill Index measures the performance of US dollar denominated US Treasury Bills. The Bloomberg US Treasury Index, IG Corporates measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. The Bloomberg US Corporate Investment Grade Index is a broad-based benchmark that measures the investment grade, fixed-rate, taxable, corporate bond market. The Bloomberg US Aggregate Index is a broad-based benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The S&P 500 Index is an unmanaged index that tracks the performance of the 500 largest US companies. The Bloomberg US Mortgage Backed Securities (MBS) Index tracks fixed-rate agency mortgage backed pass-through securities guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC). Bloomberg US Corporate Bond Index measures the investment grade, US dollar-denominated, fixed-rate, taxable corporate bond market. Bloomberg US Corporate High Yield Bond Index measures the US dollar-denominated, high yield, fixed-rate corporate bond market. Bloomberg US Asset-Backed Securities (ABS) Index is the ABS component of the Bloomberg US Aggregate Bond Index, a flagship measure of the US investment grade, fixed-rate bond market. The Bloomberg US High Yield (1-5 Year) (BB/B) Index measures that part of the market with maturities of five years or less. The Bloomberg Emerging Markets Aggregate Index measures the performance of hard currency Emerging Markets (EM) debt, including fixed and floating-rate US dollar-denominated debt issued from sovereign, quasi-sovereign, and corporate EM issuers Investors cannot invest directly in an index. The Credit Suisse Leveraged Loan Indextracks the investable market of the U.S. dollar denominated leveraged loan market. It consists of issues rated “5B” or lower, meaning that the highest rated issues included in this index are Moody’s/S&P ratings of Baa1/BB+. All loans are funded term loans with a tenor of at least one year and are made by issuers domiciled in developed countries. The MarketVectorTMUS Business Development Companies Liquid Index (MVBIZD) tracks the performance of the largest and most liquid Business Development Companies.

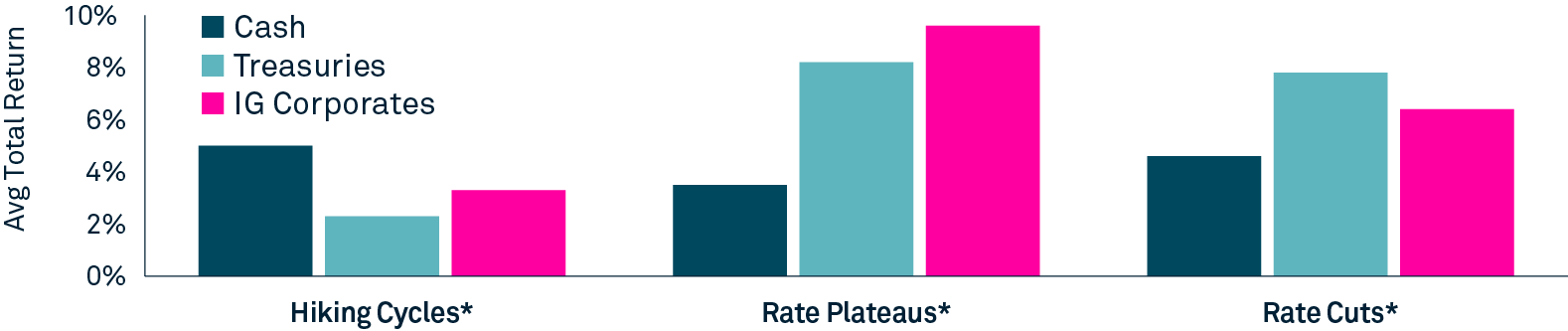

HIKING CYCLE: The first two columns in the chart below show the start and end dates of the Fed hiking rates. The pace and size of rate cuts is detailed in the larger table below. Cycle lengths may vary.

PLATEAU: The third column shows the period between “date of last hike” and “last day before cut” and represents a plateau, or when the Fed was on pause (neither hiking nor cutting).

RATE CUTS: The last column indicates when the easing (cutting of rates) cycle began.

| Date of First Hike (Hiking Cycle) |

Date of Last Hike (Hiking Cycle) |

Last Day Before Cut (Plateau) |

Date of First Cut (Rate Cuts) |

| 3/29/1988 | 2/24/1989 | 6/4/1989 | 6/5/1989 |

| 2/4/1994 | 2/1/1995 | 7/5/1995 | 7/6/1995 |

| 6/30/1999 | 5/16/2000 | 1/2/2001 | 1/3/2001 |

| 6/30/2004 | 6/29/2006 | 9/17/2007 | 9/18/2007 |

| 12/17/2015 | 12/19/2018 | 7/30/2019 | 7/31/2019 |

| 3/16/2022 | 7/26/2023 |

Hiking Cycles are the period where the Federal Open Market Committee (FOMC) increases the range of the federal funds rate, which determines the overnight interest rate at which commercial banks borrow and lend their excess reserves to each other.

Interest Rate Plateau is the period where the Federal Open Market Committee (FOMC) stops increasing the range of the federal funds rate.

Interest Rate Cut Cycle is the period where the Federal Open Market Committee (FOMC) decreases the range of the federal funds rate.

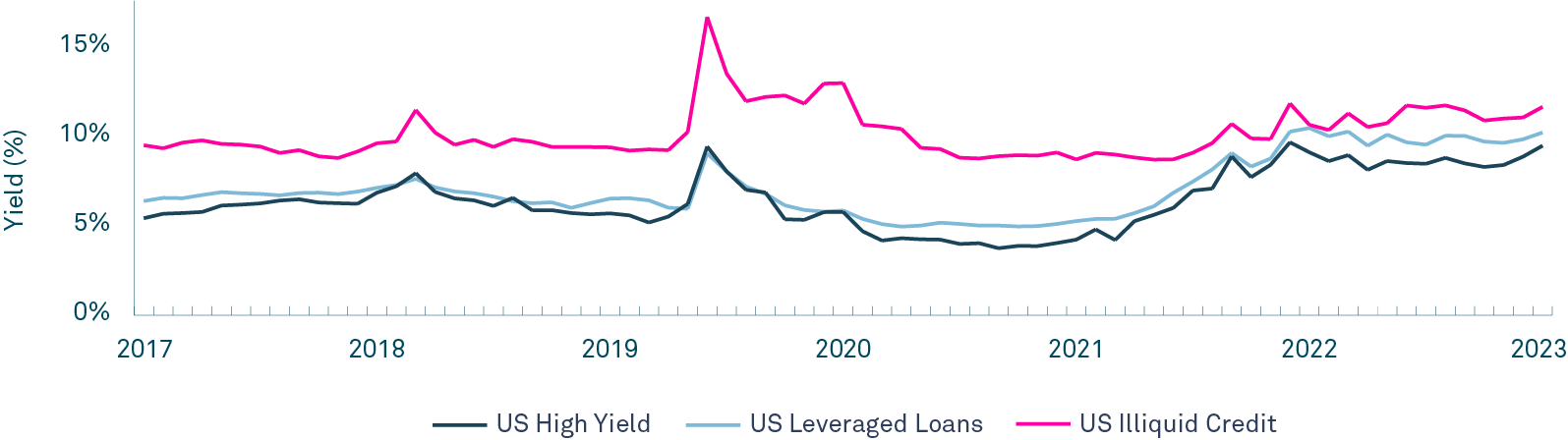

Illiquid credit (or private debt) represents part of the broader alternative credit space, referring to those non-traditional asset classes where there is limited ability to sell prior to maturity. The illiquidity premium is the additional return that investors expect if an asset cannot be sold easily or quickly. Illiquidity is considered an investment risk since you can’t sell the asset quickly if needed. It can also be an opportunity risk if better investments emerge while the investment is tied up.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions.

Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances. Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change.

The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons.

References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

BNY Mellon Investment Management is one of the world's leading investment management organizations encompassing BNY Mellon's affiliated investment management firms and global distribution companies. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the Corporation as a whole or its various subsidiaries generally. BNY Mellon Investment Advisor, Inc., Insight Investment and BNY Mellon Securities Corporation are subsidiaries of BNY Mellon.

© 2024 BNY Mellon Securities Corporation, distributor, 240 Greenwich Street, 9th Floor, New York NY, 10286.

Not FDIC-Insured | No Bank Guarantee | May Lose

MARK-496697-2024-02-08