The renowned tax advantages of municipal bonds are just one of multiple features that may make this asset class attractive in the current market.

As the Federal Reserve continues to tread the line between curbing inflation and preventing recession, markets seem likely to remain volatile for the foreseeable future. This is precisely the type of environment in which municipal bonds may be well placed to prosper.

Through our investment firm, Insight Investment, BNY Mellon Investment Management is defining modern municipal bond investing by offering an institutional pedigree in seeking best risk-adjusted return opportunities.

Why choose municipal bonds?

While muni bond prices are feeling the price pressures of rising rates, along with other bond market sectors, there are five key reasons why an allocation in muni bonds may make sense amid higher rates.

Attractive income

Munis have the potential to offer appealing tax-equivalent yields compared to other fixed-income options – and have done so consistently.1

Returns performance

Over the past five years, munis have offered a similar return to US aggregate bonds.2

Diversification

With historically low default rates, munis have potential to offset volatility from higher-risk investments within a portfolio.

Tax exemption

Most munis are exempt from federal taxes; some are exempt from state and local taxes too.

Stability

Municipal bonds have experienced a significantly lower default rate than corporate bonds over the past four decades.3

Past performance is no guarantee of future results

Why is now the time for munis?

Like all fixed-income assets, munis were affected by the global uncertainty and inflationary pressures of early 2022, resulting in a rare sell-off. At the same time, issuers have continued to bring new large muni deals to market, reducing prices further.4

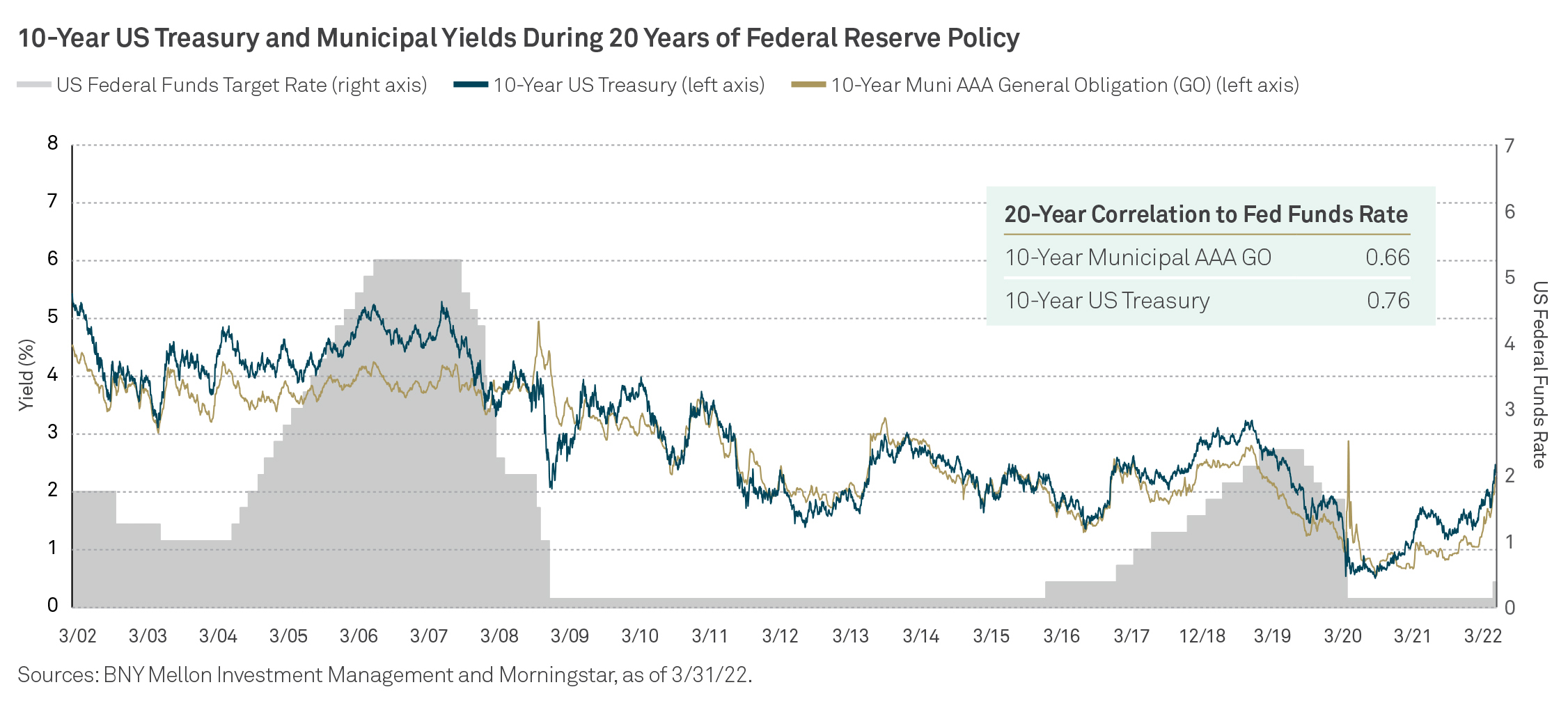

Muni’s relatively low correlations to rising interest rates and volatile markets may make them an especially attractive option at present, as inflationary pressures shrink the global economy.

Three reasons why Muni fundamentals remain compelling right now

- Strong credit ratings across many states may mean reduced risk

- States financial reserves have reached all-time highs of $195bn5 as a result of Federal stimulus and record tax receipts from 2021

- Moody’s municipal rating activity during 2021 was the most positive since 2007

Approach

Spotlight: BNY Mellon Opportunistic Municipal Securities Fund

We believe the best way to preserve capital and earn consistent after-tax returns is to make precision-focused decisions to best risk-adjusted return opportunities. We employ proprietary systems designed for both taxable and tax-exempt fixed income markets.

Insight Investment employs deep specialist expertise in fixed income and institutional-level experience to seek out customized solutions for each investor to uncover value.

Our funds

BNY Mellon

Opportunistic Municipal

Securities Fund

Morningstar Overall Rating

(270 funds rated)*

Class I DMBVX

The primary goal of the fund is to seek high current income exempt from federal income tax. In pursuit of that goal, it may allocate up to 30% of the portfolio in Municipal names rated below investment grade.

Morningstar Category:

Municipal National Intermediate

Morningstar Rating™ based on risk-adjusted returns as of 6/30/2022 for the fund's Class A, I and Y shares; other classes may have different performance characteristics. Overall rating for the Municipal National Intermediate category. Fund ratings are out of 5 stars: Overall 4 stars Class A and 5 stars Class I and Y (270 funds rated); 3 Yrs. 4 stars Class A and 5 stars Class I and Y (270 funds rated); 5 Yrs. 4 stars Class A and 5 stars Class I and Y (231 funds rated); 10 Yrs. 4 stars Class A and 5 stars Class I (extended rating) and Y (extended rating) (168 funds rated).

BNY Mellon

AMT Free Municipal

Bond Fund

Morningstar Overall Rating

(270 funds rated)*

Class I DMBIX

This fund seeks to be a Municipal core bond offering within a portfolio, pursuing as high a level of current income exempt from federal income tax as is consistent with the preservation of capital.

Morningstar Category:

Municipal National Intermediate

Morningstar Rating™ based on risk-adjusted returns as of 6/30/2022 for the fund's Class A, I and Y shares; other classes may have different performance characteristics. Overall rating for the Municipal National Intermediate category. Fund ratings are out of 5 stars: Overall 4 stars Class A and Y and 5 stars Class I (270 funds rated); 3 Yrs. 3 stars Class A and 4 stars Class I and Y (270 funds rated); 5 Yrs. 4 stars Class A, I (231 funds rated); 10 Yrs. 4 stars Class A and 5 stars Class I (168 funds rated).

BNY Mellon

High Yield Municipal

Bond Fund

Morningstar Analyst Rating

(193 funds rated)*

Class A DHYAX

The primary goal of the fund is to seek high current income exempt from federal income tax.

Morningstar Category:

High Yield Municipal

Morningstar Rating™ as of August 31, 2022 for the Class A class shares; other classes may have different performance characteristics. Overall rating for the High Yield Municipal category. Fund ratings are out of 5 Stars: Overall 3 Stars (193 funds rated); 3 Yrs. 2 Stars (193 funds rated); 5 Yrs. 3 Stars (169 funds rated); 10 Yrs. 3 Stars (107 funds rated).

Meet the team

DANIEL BARTON

Head of Research,

Municipal Bonds,

Insight North America, LLC

DANIEL RABASCO

Head of Research,

Municipal Bonds,

Insight North America, LLC

THOMAS CASEY

Senior Portfolio Manager,

Insight North America, LLC

JEFFREY BURGER

Senior Portfolio Manager,

Insight North America, LLC