Unless investment is ramped up – significantly – the world cannot meet desired net zero targets by 2050, according to a paper jointly written by BNY Mellon Investment Management and Fathom Consulting. And this is more about redeploying capital than new investment.

The research undertaken by BNY Mellon Investment Management’s chief economist Shamik Dhar and Brian Davidson, head of climate economics at Fathom, looks at existing global spending commitments, highlighting key areas of necessary advancement. There are significant hurdles the world needs to overcome on the road to net zero. With any transition, especially one of this size and scale, comes not just risk but opportunity. Analysis of investment needs by sector and by country shows that the net zero transition should offer opportunities to informed investors. Here we outline some of the paper’s key points.

Implications for investors

Excerpts from the report: An investor’s guide to net zero.

1.

The nature of around US$100 trillion worth of investment will be very different in the net zero scenario compared to business as usual – this creates opportunities and risks.

2.

The firms which profit most from the transition will not necessarily be the ones making most of the green investment.

3.

Mining activity is set to increase significantly as demand for metals and minerals used for transition-related technology (i.e., lithium) soars.

4.

Incumbents from all sectors, but especially energy and utilities, should play a key role in making net zero a reality; but if they don’t do the green investment, new players will.

Investors can do more to ensure the funds they manage are aligned with the Paris climate goal, and that the companies in which they invest are making the investments necessary to turn these pledges into reality.

Shamik Dhar

Chief Economist, BNYM

Arguably one of the greatest challenges today is to reach net zero emissions by 2050, the most widely accepted way for the goal of the Paris Climate Accord to be met. Investment in ‘greening’ the world’s capital stock is anticipated to be around US$100 trillion, according to the paper. It goes on to state:

- This equates to around a fifth of the total anticipated global investment over the next 30 years, or 3% of cumulative GDP.

- This investment is not about the cost of stopping climate change – it’s about the transition away from economic activity which produces large amounts of greenhouse gas emissions.

- The longer the transition is delayed the larger the amount of spending needed will be.

As the world transfers resources from the production of polluting capital to clean, it has the potential to be the largest redeployment of capital in history, say Dhar and Davidson. It could be just as, if not more, transformational than the US Marshall Plan1 or China’s rise in the 1990s/2000s. Get it right and the payoff to society, and far-sighted investors, can be substantial, the paper’s authors assert.

Our report, An investor’s guide to net zero by 2050, shows massive capital investment in lower-carbon infrastructure is needed for the world to comply with the Paris climate goals. But there are obstacles.

For one, not everyone agrees with the capital spending estimates of what it will take to “green” the world.

It is complicated by things such as technological progress the rate GDP growth and the fact there is no consensus on precisely what should be considered ‘green’ investment, the report’s authors say. For example, if industrial-scale lithium-ion batteries become the primary source of electricity storage, much of the gas infrastructure would be rendered useless and scrapped, resulting in a different level of investment to reach net zero than if hydrogen was part of the future energy mix and gas infrastructure could be retained and repurposed, say the report’s authors. Likewise, the report reads, the ability to use existing aircraft will depend on which low-carbon aviation technology becomes established.

| Cumulative values between now and 2050 | USD trillion 2020 prices |

|---|---|

| Economy-wide investment | $396.6 - $597.0 |

| Green investment | $61.4 - $166.1 |

| Stranded assets | $4.2 - $22.4 |

Source: BNYM/Fathom Consulting.

Date as of September 2022

Model output ranges following adjustments to capital stock to GDP ratio, depreciation rates, GDP growth rates and the clean capital share of total capital.

Levelized cost of energy

Median values, USD per megawatt hour, 2020

In some cases, the cost of building and operating clean capital may be cheaper than the status quo, the report reads. But in other cases, clean capital may be more expensive.

Source: BNYM/Fathom Consulting.

Date as of September 2022.

According to the report:

Some corporates must either absorb significant losses or will need to be compensated for these necessary losses. This is the greatest challenge in meeting the Paris climate goal. Our analysis also shows the amount of assets that are stranded rises the longer the transition gets delayed.

The sectors that need most of the investment to achieve net zero by 2050, are, it seems, at least in part, being shunned by some investors for the very same reasons.

According to the paper, around US$20 trillion of polluting assets will likely need to be scrapped or retrofitted: these are referred to in the report as ‘stranded assets’. Energy, utilities and airline sectors face some of the most significant costs in scrapping polluting assets, say the report’s authors. They purport that half of all corporate investment required for net zero by 2050 must be spent by firms in the energy and utilities sectors - even though their combined market capitalisation is just 6% of the total.

Some highlights from the report:

1.

Green investment in the energy sector should benefit firms that produce battery storage, grid infrastructure and piping. Green hydrogen seems likely to play a big part in the transition.

2.

Transition-related spending by households on things like electric cars and low-carbon heating systems, such as heat pumps, are set for a huge rise in the net zero 2050 scenario.

3.

Widespread adoption of hydrogen as a fuel and means of electricity storage could mean much of the existing gas power plant and pipeline infrastructure could simply be repurposed.

S&P 500 green investment by sector, in net zero scenario

S&P 500 transition risks by sector, z scores

The report’s authors have created a new and unique methodology and used it to score 24 stock market sectors on their transition risks. How quickly decarbonization is likely to happen in each sector and how problematic, from an economic point of view, that is likely to be.

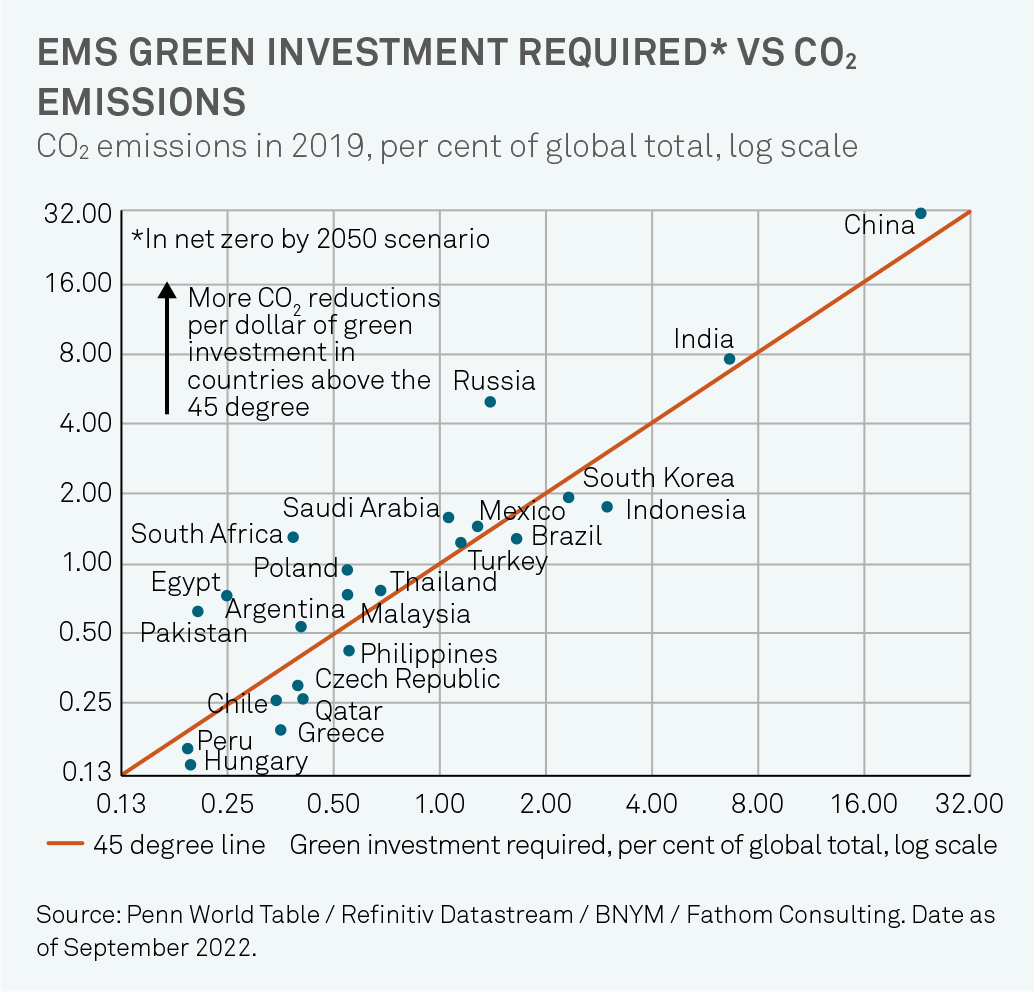

needed in the BRICS (Brazil, Russia, India, China and South Africa) than in the G7, the research shows. China needs

more green investment than any other country, according to the report.

it reads:

There are a few reasons for this. First, the country is large and already accounts for more than 15% of global GDP. Second, it is expected to grow faster than most economies between now and 2050 and more investment, including green investment, will be needed to support this growth. Third, a higher-than-average share of electricity production in China comes from fossil fuels and the country also has an above-average CO2 intensity of GDP.

The report states:

1.

Each dollar of green investment in an EM may achieve more decarbonization than the equivalent amount spent in an advanced economy.

2.

India, China, South Korea and Indonesia are expected to grow faster than the global average and currently use a lot of coal for electricity generation. Consequently, they require a larger share of green investment than their current share of global GDP.

3.

Around a third of investment will need to be spent in the US and EU combined.

Firms that supply green capital goods to households are also set to benefit. The bottom line is that not all of the $100 trillion is green investment will be done by the listed equities or the corporate sector,

the report argues:

They may do a lot of the heavy lifting but much of it will probably need to be done by households and governments, by, for example, purchasing electric cars, buying new, green heating systems and insulating their homes and buildings. Funding for this should come from a range of sources including earnings, tax revenues and bank loans.

Clever and clear-sighted policy can facilitate this process, the authors note. Investment in new

technologies and green capital can help reduce costs, the authors discuss.

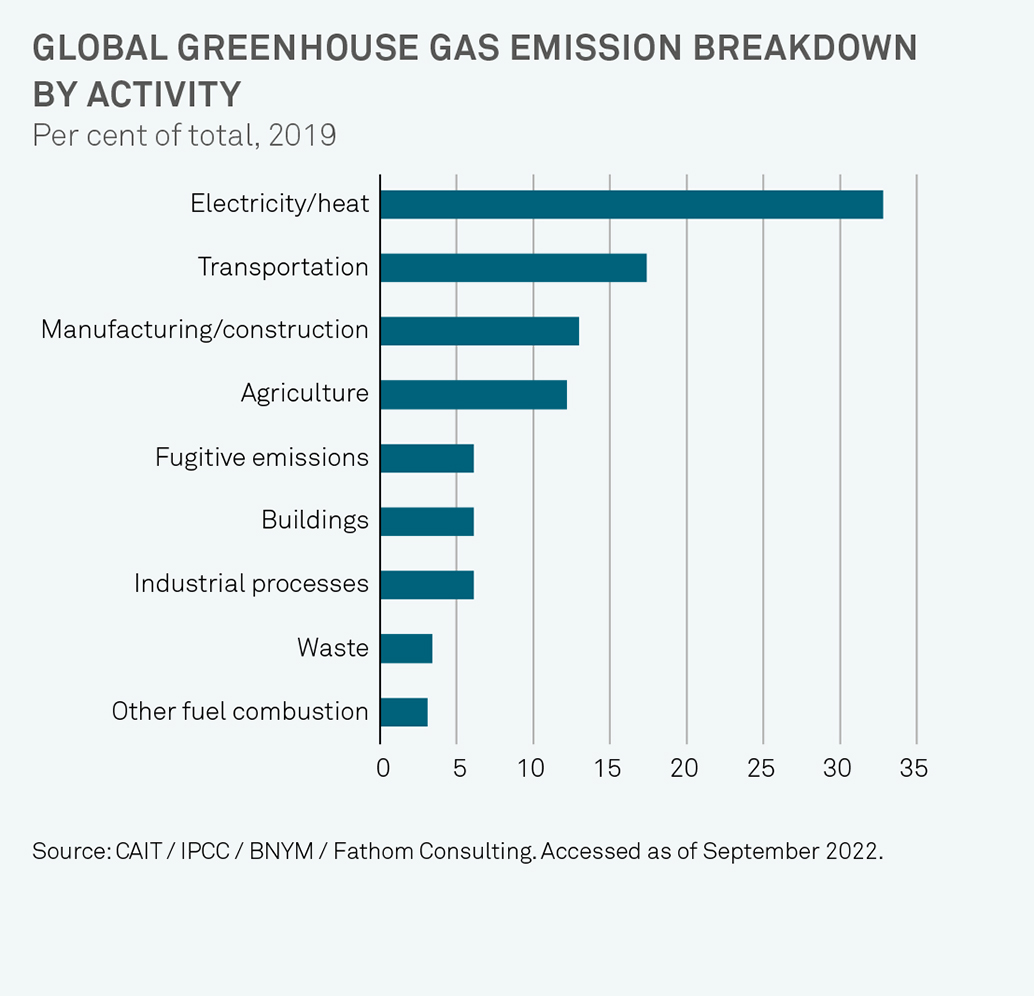

Global greenhouse gas emission

breakdown by activity

Percent of total, 2019

Source: CAIT/IPCC/BNYM/Fathom Consulting.

Accessed as of September 2022.

Some of the low-hanging fruit has not yet been picked. One example is the switch from coal-powered generation to renewables: financing this switch can provide a wide-ranging impact, including cost savings for households on their electricity bills, leading to wider social benefits. Such investment doesn’t just make sense for the climate, it makes business sense too.

Shamik Dhar

Chief Economist, BNYM

BNY Mellon Global Economics

and Investment Analysis Team

View our team biographies to learn more.

Glossary – key terms

Clean Capital: Capital that is not directly responsible for generating greenhouse emissions and will not need replacing in a net zero scenario.

Climate Change: Warming of the planet caused by greenhouse gases is one of the most serious challenges facing humanity and efforts to halt global warming are at the heart of many Responsible Investment initiatives.

Decarbonization: Stopping or lowering the amount of carbon gases released in the atmosphere by burning fossil fuels.

G7: An inter-governmental political forum consisting of Canada, France, Germany, Italy, Japan, the United Kingdom and the United States.

Green Investment: Supports businesses and practices committed to the conservation of natural resources and reducing pollution.

Low-Carbon Infrastructure: Generates fewer carbon emissions compared to traditional infrastructure and includes projects using renewable energy, such as solar and wind.

Net Zero: The balance between the amount of greenhouse gases produced and the amount removed from the atmosphere.

Paris Climate Accord: The legally binding international treaty on climate change which came into force in November 2016 (not 2015 when it was agreed). It covers climate change mitigation, adaptation and finance. Its goal is to limit global warming to well below 2 degrees Celsius above pre-industrial levels and preferably limit the increase to 1.5 degrees Celsius.

Stranded Assets: Assets that are worth less than expected due to unanticipated or premature write-downs, devaluation or conversion to liabilities.

S&P 500 (The Standard and Poor's 500): Widely regarded as the best single gauge of large-cap US equities. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization.

References

1. This was an American initiative enacted in 1948 to provide foreign aid to Western Europe.

2. Cumlative investment between now and 2050 under business as usual and net zero scenarios.

3. Total green investment by each S&P 500 sector by 2050, net zero scenario.

4. Property plant and equipment 2021.

The conclusions and views expressed in this paper are derived from that research and are the opinion of the authors and do not constitute advice. All charts and data tables are provided for illustrative purposes only and are not indicative of the past or future performance of any BNY Mellon product.

Fathom is a leading consultancy specialising in the global economy, geopolitics and financial markets. Based in London and Washington DC, Fathom provides independent, data-driven research and bespoke consultancy for clients in government, corporate and financial institutions, and policy groups. Fathom Consulting is not affiliated with BNY Mellon.

FATHOM AND BNY MELLON INVESTMENT MANAGEMENT PARTNERSHIP

Since 2019, Fathom Consulting has provided bespoke macroeconomic modelling and scenario analysis for BNY Mellon IM's quarterly economic and investment outlook publication, Vantage Point.

Quarterly meetings are held to decide the key questions that will inform developments over the forecast horizon so that Fathom can conduct detailed scenario analysis that is theoretically founded, empirically driven and consistent with BNY Mellon IM's house views. This helps to inform stakeholders of the outlook for the economy and markets, as well as the risks.

Fathom also engages in other bespoke projects for BNY Mellon IM, such as the work and analysis involved in the production of this research. BNY Mellon IM hired Fathom Consulting to provide expertise on the economics of climate change and undertake certain elements of this project. The final output, presented in this report, reflects the efforts of both parties. The modelling framework and report conclusions were developed in collaboration, while Fathom's proprietary climate data and tools were used to develop the sectoral risk framework presented in this report.