April 2024

Now may be the time to diversify beyond mega-cap technology stocks.

The S&P 500 index has hit a series of all-time highs in 2024 but returns have been led by a handful of large growth stocks — the Magnificent Seven — whose performance has been driven by the promise of future growth from artificial intelligence. In our view, they are attractive businesses, but investors get plenty of exposure to them through broad US large-cap mandates.

These new record highs would suggest that the entire US equity market is expensive. However, lack of market breadth has been the key story of the recent equity rally. The performance dispersion has led to a disproportional rise in the valuations of the Magnificent Seven relative to the rest of the market. However, value opportunities exist in the US equity market for those prepared to look. Our value and income strategies seek to provide diversification to the S&P 500 index and those Magnificent Seven stocks.

VALUATIONS

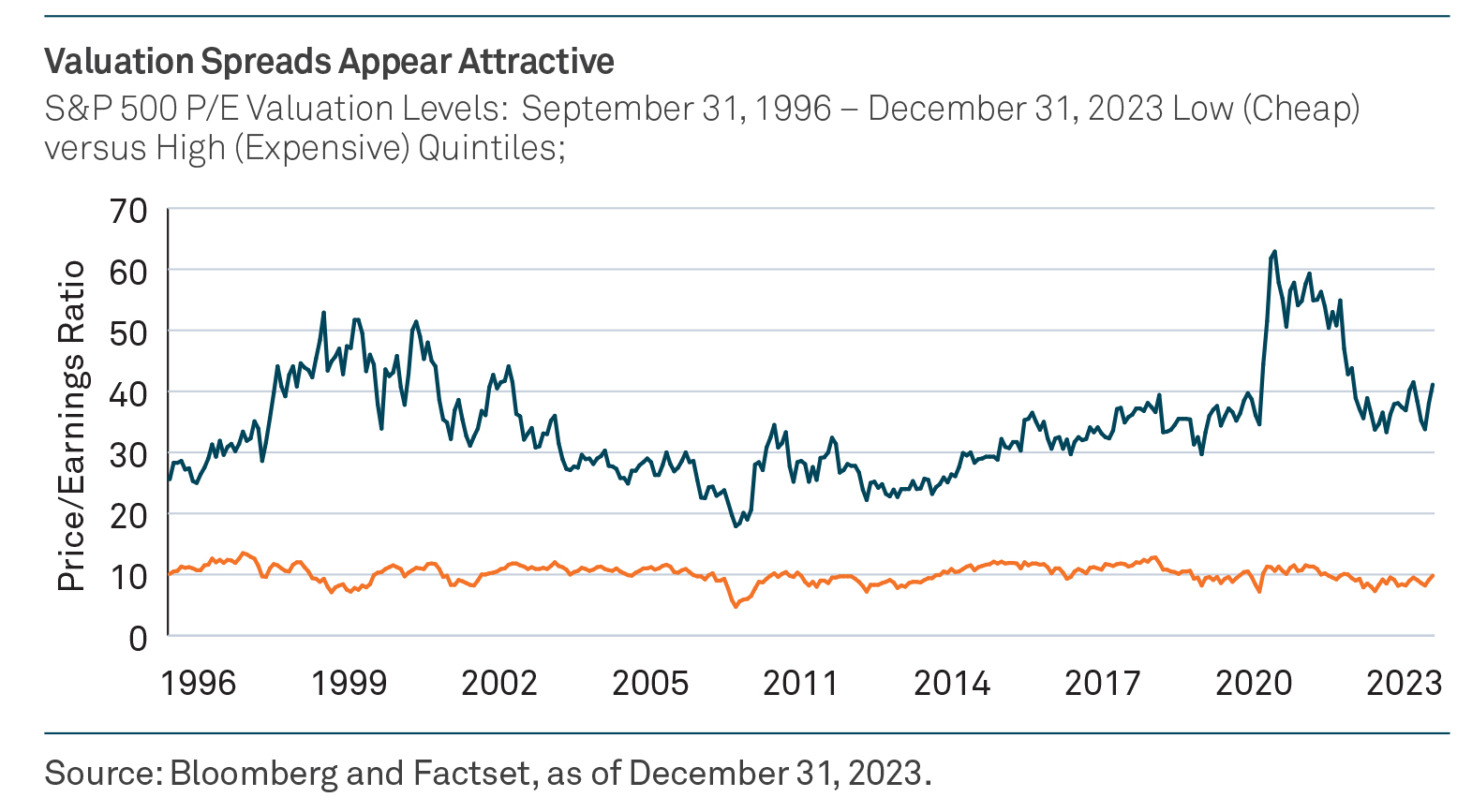

Growth investing flourished over the last decade owing to a combination of low interest rates, low inflation, and central-bank quantitative easing. But in the current environment of higher rates and inflation, US value stocks look quite inexpensive—as cheap as they were during the dot-com bubble in the late 1990s and early 2000s. Not coincidentally, the dot-com bubble was also characterized by extended valuations while index returns were dominated by a narrow set of stocks whose market capitalization grew significantly.

The chart below displays the wide gap between the most expensive and the cheapest quintiles of stocks in the S&P 500 based on price to earnings (P/E) valuation levels. The cheapest quintile appears inexpensive historically relative to the most expensive quintile. But the cheapest quintile also represents value relative to its own history, with a P/E of 9.5 compared with an historic average of approximately 10, also shown in the chart below.

Against this backdrop, we believe there is significant opportunity in quality companies that trade at high free-cash-flow yields and low P/E multiples that look attractive from an intrinsic valuation perspective. Additionally, we think there is ample opportunity to diversify into those low P/E stocks to offer some balance to the expensive names that are populating the S&P 500 index.

SECTORS

Energy and financials are two sectors where the team is seeing value opportunities. Energy accounts for just 4.6% of the S&P 500 market capitalization but 11.1% of the S&P 500 index’s income as of December 31, 2023. Similarly, the financials sector comprises 21.6% of the S&P 500’s income but only 13.2% of the index’s market capitalization. By contrast, the Magnificent Seven stocks constitute 28.3% of the S&P 500 index by market capitalization but generate just 16.9% of the income.

In our view, energy companies tend to have good balance sheets and generate a significant amount of free cash flow with minimal net debt with a balanced oil supply and demand, leading to sustainability of attractive oil prices. Energy stocks are also appealing from a dividend perspective. There are multiple opportunities in the energy space that are delivering significant cash back to shareholders in the form of dividends. Within financials, we see opportunities in insurance companies and select banks. We believe the stocks are inexpensive, have good risk versus reward, and carry high dividend yields that are both sustainable and have the potential to grow.

DIVIDEND GROWTH

While current dividend payout ratios in the US are low relative to those historically, we believe these ratios have room to increase. Dividend-paying stocks may be an overlooked option for investors looking to hedge against inflation. This is a key difference between equity and fixed-income yields: equity income does not have fixed coupons. Companies with pricing power—the ability to pass price increases along to consumers—may have a distinct advantage. In addition to pricing power, another competitive advantage is the ability to pay steady dividends. We think the US is poised to show material dividend growth over the next five to ten years relative to the current low payout ratios.

CONCLUSION

Outside of the Magnificent Seven, prices and valuations for the rest of the S&P 500 have faced pressure amid a surge in inflation and the Federal Reserve’s aggressive rate-hiking cycle. However, we believe there are multiple reasons why investors may want to look for opportunities to diversify beyond mega-cap technology companies by looking for value and income stocks.

Important Information

All investments involve risk, including the possible loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing.

BNY Mellon Investment Management is one of the world’s leading investment management organizations, encompassing BNY Mellon’s affiliated investment management firms and global distribution companies. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the corporation as a whole or its various subsidiaries generally.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions.

Past performance is not necessarily indicative of future results. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. Analysis of themes may vary depending on the type of security, investment rationale and investment strategy. Newton will make investment decisions that are not based on themes and may conclude that other attributes of an investment outweigh the thematic structure the security has been assigned to.

Issued by Newton Investment Management North America LLC (“NIMNA” or the “Firm”). NIMNA is a registered investment adviser with the US Securities and Exchange Commission (“SEC”) and subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand “Newton” or “Newton Investment Management.” Newton currently includes NIMNA and Newton Investment Management Ltd (“NIM”) and Newton Investment Management Japan Limited (“NIMJ”).

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

This material (or any portion thereof) may not be copied or distributed without Newton’s prior written approval.

© 2024 BNY Mellon Securities Corporation, distributor 240 Greenwich Street, 9th Floor, New York, NY 10286

MARK-515119-2024-03-18