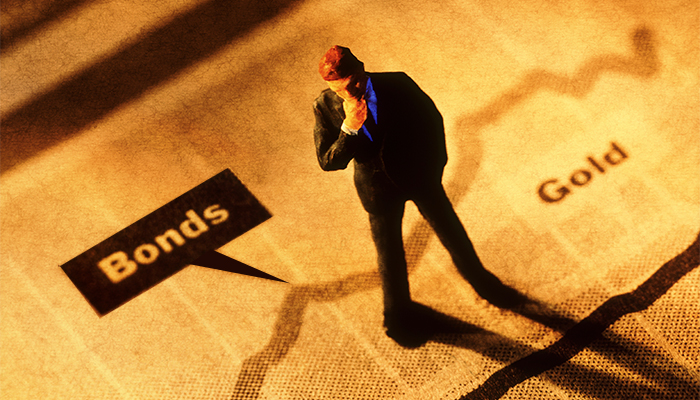

The 5Ws of downside risk

What is downside risk? We break down the who, what, where, when and why of this financial risk.

10 Everyday economic indicators

Is a recession on its way? Inflation and GDP growth are traditional economic indicators. Here, we highlight some less...

Explore Insights

A variety of timely topics and trends designed to help you learn more and be an informed investor.

All investments involve risk, including the possible loss of principal.

This material has been distributed for informational purposes only. It is educational in nature and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this communication and subject to change. Forecasts, estimates and certain information contained herein are based upon proprietary research and are subject to change without notice. Certain information has been obtained from sources believed to be reliable, but not guaranteed. Please consult a legal, tax or investment advisor in order to determine whether an investment product or service is appropriate for a particular situation. All investments involve risk, including the possible loss of principal. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

BNY Mellon Investment Management is one of the world's leading investment management organizations and one of the top U.S. wealth managers, encompassing BNY Mellon's affiliated investment management firms, wealth management organization and global distribution companies. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the Corporation as a whole or its various subsidiaries generally. BNY Mellon Investment Adviser, Inc. and BNY Mellon Securities Corporation are companies of BNY Mellon.

DRD-37799-2018-10-03