September 2023

Geopolitical tensions and the end of China’s zero-Covid policy continue to keep Asia in the headlines, according to Walter Scott. Here, investment managers Des Armstrong and Tom Miedema share highlights from their two-week trip to Taiwan and Shanghai, China.

Our last trip to Taiwan and China was in 2019. Given the somewhat extreme media headlines, we expected things to have changed materially, however that wasn’t the case. There seems to be a disconnect between how life is portrayed in the media and what we experienced. Despite the long Covid lockdown, it is still a vibrant, digitized economy with much optimism.

Small country, big tech success

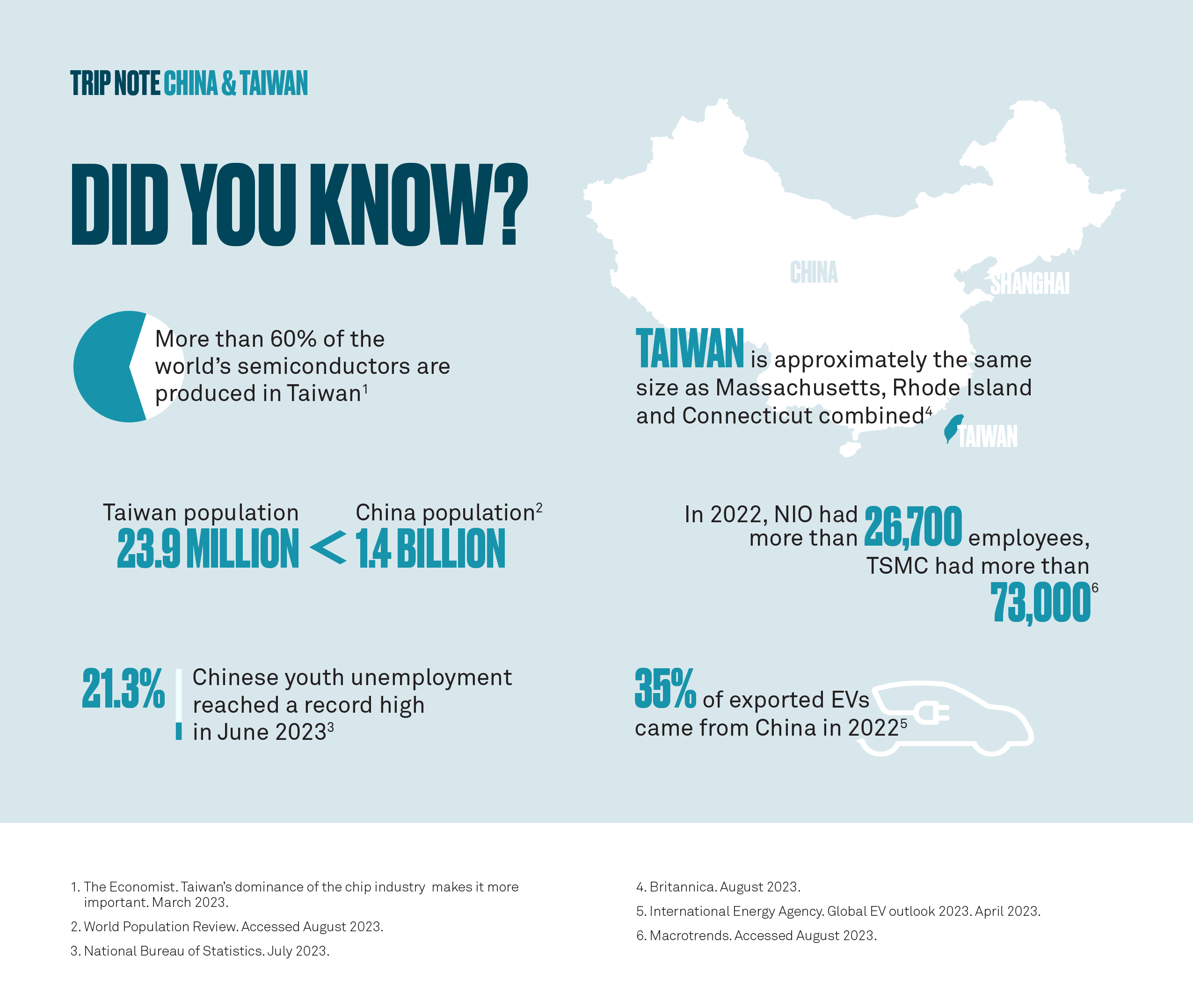

Even though Taiwan is a tiny island with a small population and very little in the way of natural resources, the country is a success story. The people and entrepreneurs have led Taiwan forward over the last couple of decades with a heavy focus on technology.

Taiwan has carved out an area for itself in the tech industry with the Taiwan Semiconductor Manufacturing Company (TSMC) at the center of it. The company has become incredibly strategic and is a global leader in the semiconductor industry. TSMC is a big part of an ecosystem that’s critical to global supply chains.

It’s evident that having a geopolitically diverse supply chain is becoming increasingly important. TSMC is building in Arizona, Japan and now Europe. This will provide customers some flexibility in terms of where chips are manufactured. This year TSMC will be delivering 3-nanometer1 technology and in 2025, all being well, it will deliver 2-nanometer technology. These advancements should help the company stay technologically relevant and ahead of its peers.

Supply chains and geopolitics

The world is on a clear path to derisking supply chains, but it’s likely to be a decades-long process. It’s difficult to image anything that’s going to derail that trend. Chinese companies are well aware of this movement and are working towards that, too.

At the company meetings we had, the derisking of supply chains was obviously not news to them. There is a geopolitical consideration forcing their hands in many ways.

We’re starting to see global companies invest in areas like India and other parts of south-east Asia and Mexico. The extended lockdowns in China have made these companies aware that there was an over-concentration of their supply chain in China. We’ve already seen TSMC commit to building overseas capacity and Foxconn building capacity in India, for example, but it will be incredibly difficult to recalibrate supply chains overnight. It’s going to be challenging for many of these companies to quickly duplicate the value-add in terms of manufacturing output, efficiency, and flexibility that has been built over the last 30 years.

Pockets of economic strength

There are certain aspects of the economy that are doing well in China, such as renewables and electric vehicles (EV). If you look at the EV penetration in China, it’s about 30 to 35%. We met with the Tesla of China, NIO, which has established a network of charging stations across the country. We view this as a great example of where China is leading the rest of the world.

We also visited Hang Lung’s major mall in Shanghai, Plaza 66. The last time we were there, around five years ago, it was very quiet. However, sales were high thanks to ultra-VIPs doing discreet shopping. During this trip we were surprised by how lively the mall was. Speaking to the leasing manager there, she confirmed the customer base is now younger and remains highly engaged in luxury fashion.

China’s economy, however, is not firing on all cylinders with youth unemployment and real estate woes among the country’s challenges. The government is wary of stimulating the economy only to create another bubble and then suffer the consequences. This is a government that’s willing to take pain for a long time, even if it means slower economic growth, to get the outcome it wants.

Overall, we learned there is a huge amount of value-add being generated in corporate China. Companies like Cathay Biotech and battery materials company Putailai are great examples of not just great Chinese companies, but emerging global leaders in their respective fields. The idea that China doesn’t have a role to play in the future is too black and white. We believe China is a manufacturing powerhouse that isn’t going away nor is Taiwan’s electronic prowess.

1. A nanometer is the measurement used to describe the scale of the lines that form the transistors in a semiconductor chip.

IMPORTANT INFORMATION

All investments involve risk, including the possible loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing. Company information is mentioned only for informational purposes and should not be construed as investment or any other advice. The holdings listed should not be considered recommendations to buy or sell a security.

BNY Mellon Investment Management is one of the world’s leading investment management organizations, encompassing BNY Mellon’s affiliated investment management firms and global distribution companies. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the corporation as a whole or its various subsidiaries generally.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions.

Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances. Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change.

The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Walter Scott & Partners Limited (“Walter Scott”) is an investment management firm authorized and regulated in the United Kingdom by the Financial Conduct Authority in the conduct of investment business. Walter Scott is a subsidiary of The Bank of New York Mellon Corporation.

Not FDIC-Insured | No Bank Guarantee | May Lose Value

© 2023 BNY Mellon Securities Corporation, distributor, 240 Greenwich Street, 9th Floor, New York, NY 10286

MARK-421965-2023-09-05