May 2023

ETFs turned the big 3-0 in 2023! When the first exchange-traded fund (ETF) launched on January 22, 1993,1 few could have imagined how popular this form of investing would become. By 2022, global ETF assets rocketed to almost US$10 trillion.2

The 90s were an era memorable for beanie babies, fanny packs, “the Macarena” and…. ETFs! While there was just one U.S. ETF in 1993, that number reached nearly 1,000 in 2009.3

ETFs have come a long way from “plain vanilla” access to select, and well-known indices to actively-managed ETFs, fixed income offerings as well as specialist “baskets” following a defined theme. Today, US ETF launches outpace mutual funds.4 More than 400 new ETFs were launched in 2022, accounting for 72% of all fund launches when compared to mutual funds.5

ETFs popularity extends beyond the US borders. By 2022 there were more than 8,750 ETFs trading around the world.6

Understanding ETFs

Since their introduction, investors have found plenty of uses for ETFs given their ability to offer a direct way to quickly invest in a diversified set of securities and asset classes. In many ways, an ETF is like a hybrid between a stock and a mutual fund. Like a mutual fund, an ETF can be actively managed or built to track the performance of an index. Similar to stocks, an ETF can be bought or sold on an exchange with varying share prices throughout the day.

ETFs are comprised of many underlying assets, such as stocks, bonds and commodities across an array of industries. Investors can also utilize ETFs as long-term core holdings or as an expression of tactical asset-allocation views.

Advantages of ETFs

The appeal of ETFs and their use by investors ranges widely from those who utilize them as cost-effective tools for diversification, to those who use them as the base for core portfolios.

Here are some potential benefits of investing in ETFs:

Liquidity – Dependent on composition and trading volume of underlying securities, ETFs can be created and redeemed on demand.

Transparency – Investors can see what they own daily (as opposed to quarterly), at the conclusion of each trading day.

Tactical allocation – Quick and easy to transact, ETFs can be bought and sold the same as a single stock.

Moderately low transaction costs – ETFs are considered more cost effective than mutual funds because they typically have lower expenses. However, since buying or selling ETF shares on an exchange may require the payment of brokerage commissions, trading activity may increase the cost of ETFs.

US tax efficiency - Investors are generally not affected by the liabilities related to the redemptions made by other shareholders.7

How ETFs work: Step-by-step

The ETF ecosystem comes together in a seamless manner to facilitate buying and selling ETF shares. Like many industries, each party plays a critical role to ensure the supply chain can efficiently meet the demand of investors for all listed ETFs.

Here are a few key terms to help understand how ETFs work.

Authorized Participant – A large broker/dealer that acts as a bridge between the exchange and the issuer. They help ETFs trade at prices close to the market value/ net asset value (NAV) of their portfolio holdings. Shares are issued/redeemed to Authorized Participants in large blocks, known as “creation units.”

Market Maker – A dealer that buys or sells at specified prices at all times; also known as liquidity providers.

Premiums and Discounts – Due to surges in either demand or supply- an ETF can sometimes trade at either discount or premium to the value of its underlying assets. ETFs generally trade close to their NAV due to the creation/redemption function. When trading at a premium, Authorized Participants will create more shares to add supply to the market and vice versa.

Primary Market – Market where ETF shares are created and redeemed.

Secondary Market – An exchange where ETFs are traded, such as the New York Stock Exchange.

- Buyer initiates request, which is often done through a brokerage account

- The order goes through a Market Maker, which can be done on the Stock Exchange or in the over the counter (OTC) market

- If new shares are needed, a Market Maker will work with an Authorized Participant to place an order to create new ETF shares with the ETF Issuer

- ETF Issuer creates new shares of the ETF

- ETF shares go back to the Authorized Participant

- Authorized Participant sends ETF shares back to the Market Maker

- Market Maker sends the shares to the Buyer

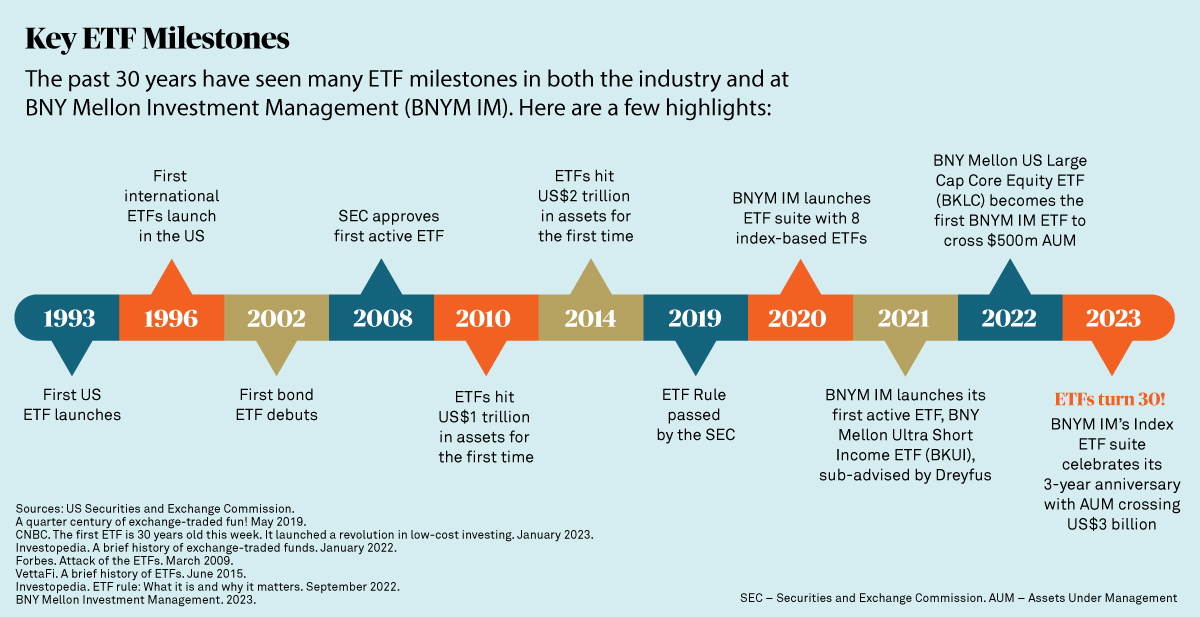

History of ETFs

ETFs have evolved considerably over the years, changing the investment landscape. Here are some of the ways ETFs have grown to become a mainstream investment vehicle.

1 Investopedia. A brief history of exchange-traded funds. Accessed August 2019.

2 Statista. Development of assets of global exchanged traded funds (ETFs) from 2003 to 2022. February 2023.

3 Investopedia. A brief history of exchange-traded funds. Accessed August 2019.

4 ETFGI. As of June 2022.

5 Morningstar. As of December 31, 2022.

6 Statista. Development of assets of global exchanged traded funds (ETFs) from 2003 to 2022. February 2023.

7 ETF tax efficiency can be derived from certain structural elements, including: turnover, which in passive strategies is typically lower than in active; in-kind redemptions, in which no capital gains are realized. This can allow investors more control over the timing of their tax liabilities based on when they generally sell their position. Please consult your own tax advisor or financial professional for more detailed information on tax issues as they relate to your specific situation.

Disclosures

ETFs trade like stocks, are subject to investment risk, including possible loss of principal. The risks of investing in the ETF typically reflect the risks associated with the types of instruments in which the ETF invests. Diversification cannot assure a profit or protect against loss.

Investors should consider the investment objectives, risks, charges and expenses of a fund carefully before investing. To obtain a prospectus, or a summary prospectus, if available, that contains this and other information about a fund, contact your financial advisor or visit im.bnymellon.com/etf. Please read the prospectus carefully before investing.

Recent market risks include pandemic risks related to COVID-19. The effects of COVID-19 have contributed to increased volatility in global markets and have affected certain countries, companies, industries and market sectors more dramatically than others.

ETF shares are listed on an exchange, and shares are generally purchased and sold in the secondary market at market price. At times, the market price may be at a premium or discount to the ETF’s per share NAV. In addition, ETFs are subject to the risk that an active trading market for an ETF’s shares may not develop or be maintained. Buying or selling ETF shares on an exchange may require the payment of brokerage commissions.

Bonds are subject to interest rate, credit, liquidity, call and market risks, to varying degrees. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes and rate increases can cause price declines. High-yield bonds involve increased credit and liquidity risk than higher rated bonds and are considered speculative in terms of the issuer’s ability to pay interest and repay principal on a timely basis. Equities are subject to market, market sector, market liquidity, issuer, and investment style risks to varying degrees. Small and midsized company stocks tend to be more volatile and less liquid than larger company stocks as these companies are less established and have more volatile earnings histories. Investing in foreign denominated and/or domiciled securities involves special risks, including changes in currency exchange rates, political, economic, and social instability, limited company information, differing auditing and legal standards, and less market liquidity. These risks generally are greater with emerging market countries. Past performance is no guarantee of future results.

This material has been provided for informational purposes only and should not be construed as tax advice, investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions. Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances. Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change.

This information contains projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or expectations will be achieved, and actual results may be significantly different from that shown here. The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

BNY Mellon Investment Management is one of the world’s leading investment management organizations, encompassing BNY Mellon’s affiliated investment management firms, and global distribution companies. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the Corporation as a whole or its various subsidiaries generally.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

©2023 BNY Mellon Securities Corporation, distributor, 240 Greenwich St., New York, NY 10286.

MARK-386889-2023-05-24