The release of ChatGPT has brought excitement – and fears – of artificial intelligence to the forefront. Newton Investment Management equity research analyst Brian Byrnes says some companies may be well-situated to monetize the technology, but barriers to widespread adoption exist.

Highlights

- Companies with clean, modernized data stacks may be best positioned to leverage AI

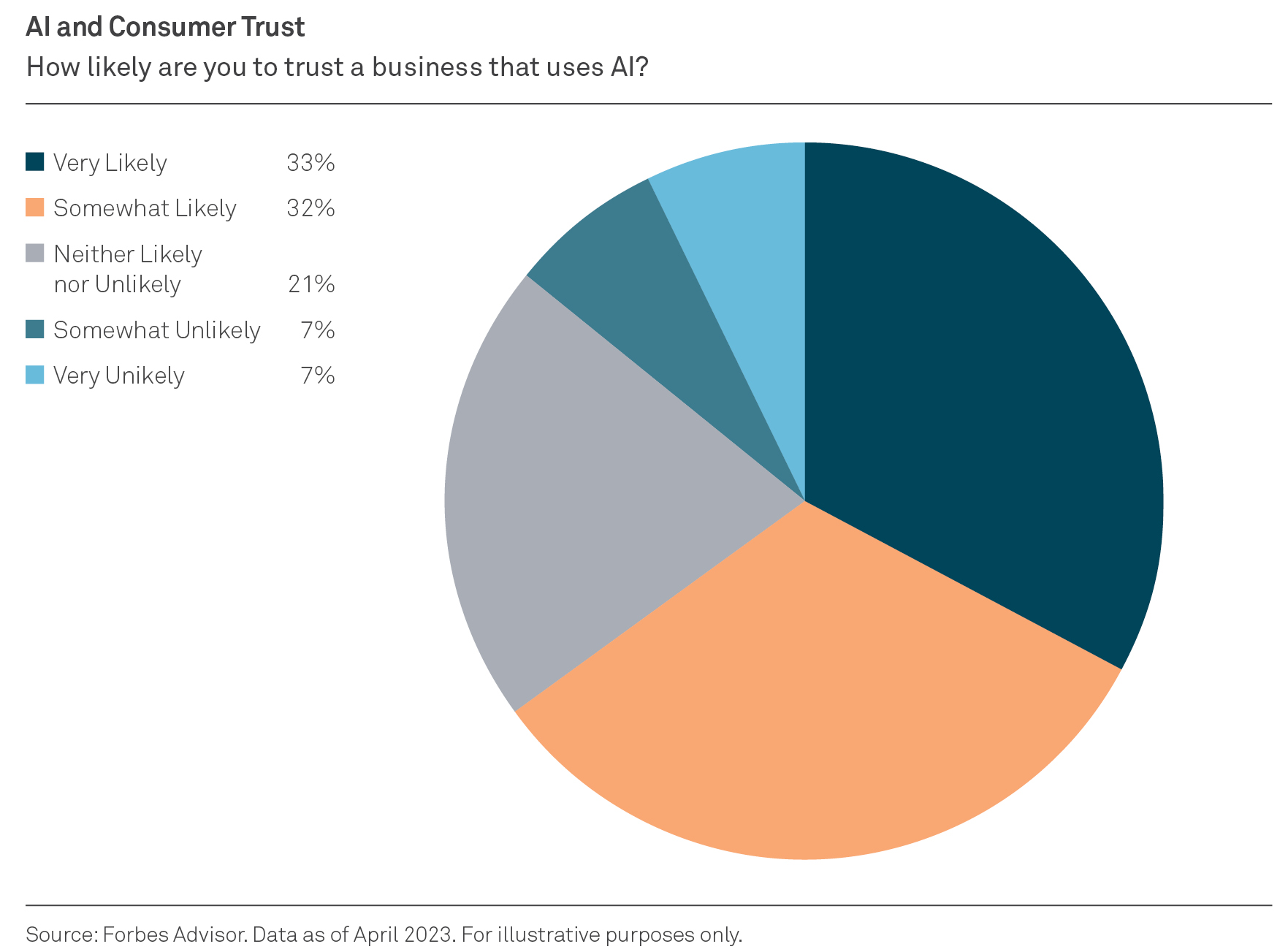

- Earning trust from businesses and customers is key for acceptance

- Concerns around content used for “bot” training and proposed regulations may slow adoption

OpenAI’s release of ChatGPT in November 2022 ignited a renewed interest in artificial intelligence (AI) chatbots. Since then, AI has seemingly become synonymous with anything cool as companies rush to embed the technology.

Is AI nothing more than hype? Will it be the basis of the next “tech bubble?” “People call this a new paradigm in technology and it very well could be,” says Newton Investment Management equity research analyst Brian Byrnes, who points out that AI technology isn’t new, but rather the general populations’ exposure to it is.

“AI has been in the works for years. When ChatGPT was released to the public and all of a sudden we can all experience AI firsthand,” notes Byrnes. “Now we are getting a flurry of consumers experimenting with the technology, developers working with data and models, and companies investing in the technology.”

As with most technologies, AI chatbots like ChatGPT are only going to get better. With improved infrastructure such as graphic processing units (GPUs), cleaner and more robust data and more companies building high fidelity models, AI may begin infiltrating much of our digital lives, predicts Byrnes.

Companies positioned to potentially benefit

Monetization and adoption of AI technology may follow the hype. Companies that find the ideal use case for AI and get to market fast could profit, Byrnes notes. He predicts organizations that own customer data or are building the compute infrastructure behind the scenes, could be among the first to realize the potential financial benefits of AI.

“Those who have good, clean data are going to be the winners in this market,” says Byrnes. Companies that own that data, it can be used to train customized AI models that can in return be embedded in various applications.”

Customer Relationship Management software, for example, may be able to leverage AI to provide sales executives better information on current and prospective customers. Byrnes says such software may be able to factor in which potential buyers have the highest propensity to buy your product or predict when a current customer is likely to churn off your platform. “Embedding AI tools into current applications could disrupt a lot of software programs and productivity tools,” says Byrnes. “It could redefine the way we work and search.”

If AI continues to take off and workloads move to the cloud, certain tech giants could benefit.“We are already seeing GPU providers and cloud service providers generating AI revenue.”

What’s needed for an AI boom

Trust can be a major barrier for adoption of any technology. The big concerns involve the risk of data security and data integrity.

“I think there’s a little hesitation on enterprises to move their data into these large language models to mine select insights,” says Byrnes. “Are companies really going to put their data into these models and provide customers with answers that are wrong with no ability to check them?”

This fear isn’t unique to AI. “When the public cloud was first starting, many organizations were skeptical of working in it,” reminds Byrnes. “Over time perception of cloud safety improved. Firms built trust.”

A similar scenario could play out for AI if companies and people see a benefit from allowing their data to be put safely into an AI model, similar to what the cloud did for costs and better computational power, says Byrnes.

Barriers to adoption

As far back as April 2021, the European Commission proposed the Artificial Intelligence Act (AI Act) to regulate the technology.1 In June 2023, the European Union inched closer to passing a draft of the law that will restrict what is deemed some of AI’s riskiest uses, such as facial recognition.2 AI regulation in the US is in the works, too, although still in the early stages.3

Numerous AI experts and industry executives have voiced concerns over the rapid development and adoption of the technology. In March 2023, Tesla CEO Elon Musk and Apple co-founder Steve Wozniak were among the key AI figures who signed an open letter calling for a pause on training AI systems more powerful than GPT-4.4

“These experts are calling for a pause in AI because they don’t really know what these systems are doing under the hood,” says Byrnes. “The AI systems could be smarter than humans and make connections through data we never can. Could AI be used for bad things?”

Concerns over the content used to train AI models is also being called into question. Not just about the accuracy of content, but who owns the copyright of that data and photos.

“There is a lot of conversation today around how AI language systems are being trained with the internet and potentially using misinformation,” says Byrnes. “There are also concerns about these models hallucinating (producing a false response). There are not enough humans to check every output.”

Currently there are at least a handful of community sites seeking compensation from developers using their data for bot training.5

Is AI poised to take over the world like some headlines propose? Byrnes compares AI to autonomous vehicles. “We thought by now autonomous cars would be all over the road, but we still have a ways to go.”

1 European Parliament. EU AI Act: first regulation on artificial intelligence. June 2023.

2 The New York Times. Europeans take major step toward regulating AI. June 2023.

3 The New York Times. In the US, regulating AI is in its ‘early days.’ July 2023.

4 The Future of Life Institute. Pause giant AI experiments: An open letter. March 2023.

5 Wired. Stack Overflow will charge AI giants for training data. April 2023.

All investments involve risk, including the possible loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing.

Newton Investment Management Limited (“NIM” or the “Firm”) is a registered investment adviser with the U.S. Securities and Exchange Commission (“SEC”) and is incorporated in the United Kingdom (Registered in England no. 1371973) and is authorized and regulated by the Financial Conduct Authority in the conduct of investment business, and subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”). The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand “Newton” or “Newton Investment Management” (“Newton”). Newton currently includes NIM, Newton Investment Management North America, LLC (“NIMNA”) and Newton Investment Management Japan (“NIMJ”).

BNY Mellon Investment Management is one of the world’s leading investment management organizations, encompassing BNY Mellon’s affiliated investment management firms and global distribution companies. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the corporation as a whole or its various subsidiaries generally.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions.

Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances. Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change.

The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Not FDIC-Insured | No Bank Guarantee | May Lose Value

© 2023 BNY Mellon Securities Corporation, distributor, 240 Greenwich Street, 9th Floor, New York, NY 10286

MARK-415778-2023-08-14