August 2024

Roads full of potholes may be annoying for drivers and open gas wells could be dangerous, but there may be potential benefits to deteriorating infrastructure — investment opportunities.

What is listed infrastructure?

There isn’t a single definition of infrastructure, but there are numerous examples of it. The roads we drive on, the bridges we drive over and the buildings we work in are all considered infrastructure. Infrastructure is spread broadly across many sectors including transportation, energy storage, communication, utilities, water and renewable generation.

Listed-infrastructure securities are typically issued by companies with hard-asset owning business models in heavily regulated industries, with contracts that allow them to pass inflationary pressures on to their end consumers. We believe there are three key characteristics required to meet the criteria to be considered infrastructure:

- Stable cash-flowing business model with dividend payments

- Hard assets with an owner who collects rent

- Regulatory oversight

For example, we do not believe data center real estate investment trusts (REITs) are infrastructure due to the lack of regulatory oversight leading to regulatory unpredictability. The absence regulatory oversight creates the potential for oversupply leading to risks to existing rents, cash flows and any dividends.

Why consider investing in infrastructure?

We’ve seen ongoing interest in flows going into infrastructure, creating what we believe are great opportunities. There are several factors driving this, including the simple fact that our infrastructure is aging. There are roads, bridges and railroads in desperate need of renovation and investment.

We’re also seeing significant regulatory support in infrastructure through the Inflation Reduction Act (IRA), Infrastructure Investment and Jobs Act (IIJA) and Creating Helpful Incentives to Produce Semiconductors Act (CHIPS Act). Furthermore, there is a growing demand for electricity in everything from powering vehicles to artificial intelligence (AI), shedding light on the increasing importance-and opportunity- investing in infrastructure may offer.

Potential infrastructure investment opportunities

Publicly listed infrastructure (sometimes referred to simply as public infrastructure) and private infrastructure investments offer similar attributes and results over the long term, which may include:

There is one big difference between publicly listed infrastructure and private infrastructure – liquidity. Publicly listed infrastructure gives access and exposure to those that may have less capital to allocate while maintaining liquidity, whereas with private infrastructure, money could be locked up for many years.

What to look for in infrastructure

There is a lot of attention on infrastructure due to the favorable benefits an allocation historically provides through a market cycle along with the tailwinds from the electrification trend, deglobalization and the growth of AI driving electricity demand. However, it’s important investors help to ensure that the infrastructure allocations made in their portfolios are designed to deliver the desired outcomes they wish such as: diversification, yield from stable cash flows, downside protection and risk-adjusted returns.

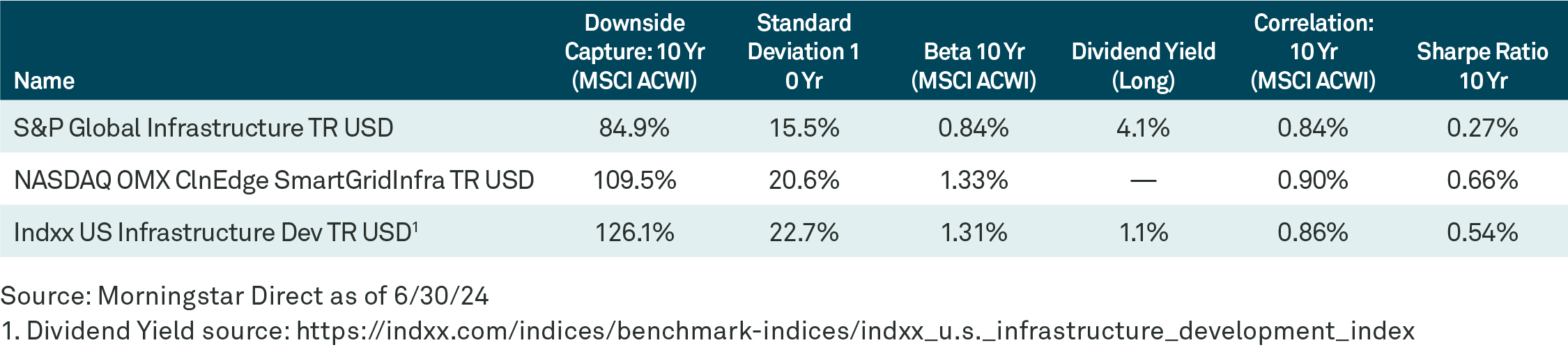

Investors may get caught off guard by investing in products they believe are purely infrastructure if the market turns and more cyclically exposed investments underperform. The hard-asset owning business models of infrastructure investments have historically resulted in lower-beta exposure to the global equity market with lower downside capture. This is not the case for all benchmarks being classified as infrastructure.

It is important to be aware of what exposures investors are getting from their infrastructure allocation, to look under the hood at the characteristics to ensure they are getting the defensive exposure that infrastructure has long provided.

TERMS

The S&P Global Infrastructure Index is designed to track 75 companies from around the world chosen to represent the listed infrastructure industry while maintaining liquidity and tradability. To create diversified exposure, the index includes three distinct infrastructure clusters: energy, transportation, and utilities.

The Nasdaq OMX Clean Edge Smart Grid Infrastructure Index (QGRD) is designed to act as a transparent and liquid benchmark for the smart grid and electric infrastructure sector. The Index includes companies that are primarily engaged and involved in electric grid; electric meters, devices, and networks; energy storage and management; connected mobility; and enabling software used by the smart grid and electric infrastructure sector (including both pure play companies focused on the smart grid sector and diversified multinationals with smart grid sector exposure).

The Indxx U.S. Infrastructure Development Index is designed to measure the performance of companies that provide exposure to infrastructure development in the United States. This includes companies involved in the construction and engineering of infrastructure projects; the production of infrastructure raw materials, composites and products; producers/distributors of heavy construction equipment; and companies engaged in the transportation of infrastructure materials (collectively, “U.S. Infrastructure Development Companies”), as defined by Indxx. The index has been backtested to January 31, 2011 and has a live calculation date of February 17, 2017.

IMPORTANT INFORMATION

All investments involve risk, including the possible loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment.

BNY Investments is one of the world’s leading investment management organizations, encompassing BNY’s affiliated investment management firms and global distribution companies. BNY, BNY Mellon and Bank of New York Mellon are the corporate brands of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions.

Past performance is not necessarily indicative of future results.

Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Analysis of themes may vary depending on the type of security, investment rationale and investment strategy. Newton will make investment decisions that are not based on themes and may conclude that other attributes of an investment outweigh the thematic structure the security has been assigned to.

Issued by Newton Investment Management North America LLC (“NIMNA” or the “Firm”). NIMNA is a registered investment adviser with the US Securities and Exchange Commission (“SEC”) and subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand “Newton” or “Newton Investment Management.” Newton currently includes NIMNA and Newton Investment Management Ltd (“NIM”) and Newton Investment Management Japan Limited (“NIMJ”).

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements.

Investment Products: Not FDIC Insured / No Bank Guarantee / May Lose Value

This material (or any portion thereof) may not be copied or distributed without Newton’s prior written approval.

© 2024 BNY Mellon Securities Corporation, distributor, 240 Greenwich Street, 9th Floor, New York, NY 10286.

MARK-582235-2024-07-26