July 2023

Tech companies aren’t just those focused on the digital world, which means your investments are likely more exposed to the technology sector than you think. In fact, every company can be considered a “tech” company, according to Newton global investment strategist George Saffaye.

Highlights

- Technology is infiltrating a wide range of companies not traditionally associated with the sector

- Cybersecurity, artificial intelligence (AI), healthcare and transportation are among the fast-growing tech sectors

- The number of tech companies in the S&P 500 is growing every year

When you hear tech company, what do you think of? While AI, cell phones and software businesses may be top of mind, the definition can be far more expansive. Technology is used for everything from shopping and booking vacations to reading the news and connecting with friends – and it’s reshaping the economy.

“This is how the world is working, the technological revolution is underway,” says Newton global investment strategist George Saffaye. “Companies not embedding technology into their business are going to be at a big disadvantage.”

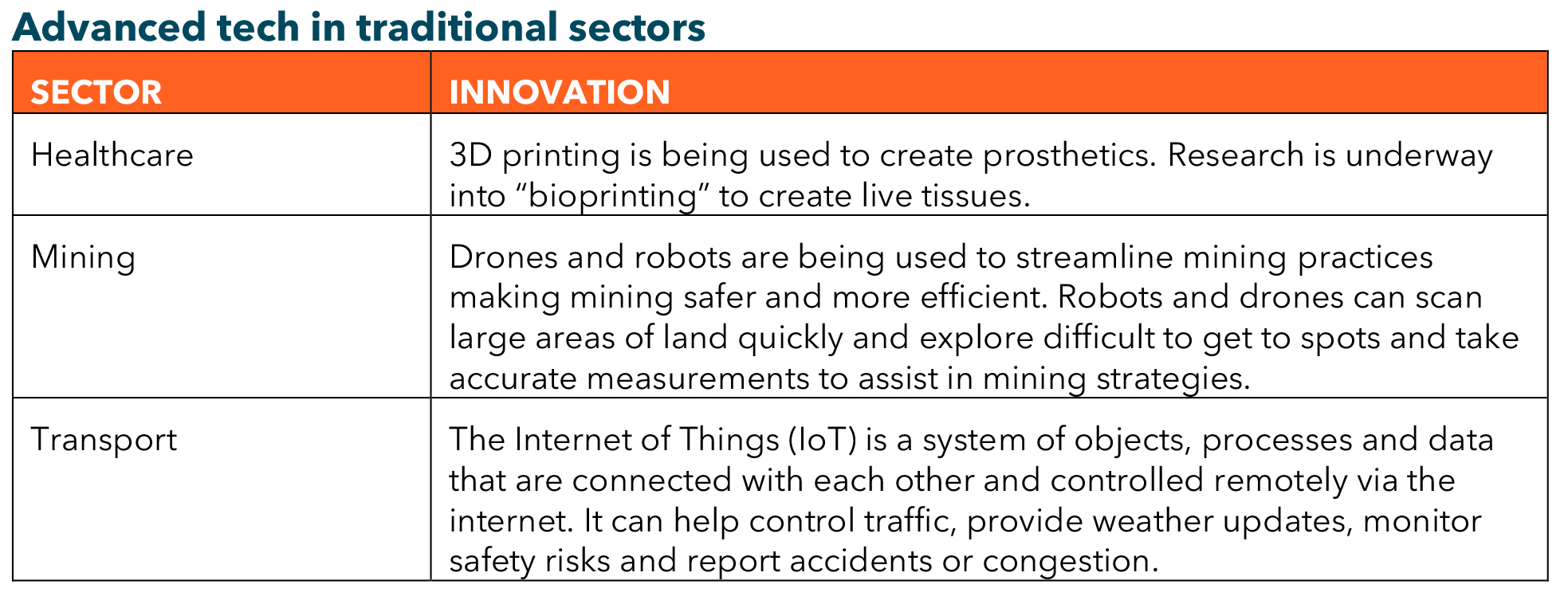

While not all companies are tech-focused, all need tech to remain competitive and relevant in today’s world, according to Saffaye. Traditional companies, like car manufacturers, are using advanced technological practices or updating offerings to reflect tech advancements. In the case of cars, this could be evolving to produce electric vehicles.

“Technology is becoming the lifeblood to how the world works, operates and intertwines. That is the ubiquity of technology. It is hard to escape,” he says.

If technology has become omnipresent it begs the question; how prevalent is it in our investments? How can we determine the winners – and losers – in this evolution?

Growth areas

Cybersecurity is a fast-expanding area. In 2022 the global cyber security market was worth US$173.5bn and is expected to reach US$266.2bn by 2027.1 This is why many funds today invest in this area.

AI is another growth area finding its way into all kinds of companies. “It doesn’t take us 20 years to adopt new technologies anymore, it can be done in days,” says Saffaye.

“For example, AI-based chat function, ‘ChatGPT’ blew adoption rates right out of the door. It took them two months to get to a 100 million users – that’s insane!”

By comparison, it took Netflix three and half years to reach one million in paid subscribed users.2 Since launching in November 2022, ChatGPT has been implemented by several traditional companies including Coca-Cola, Expedia and Octopus Energy.3

The fast rate of adoption means that new tech investment opportunities are continuously cropping up. Take for example, Electric Vertical take-off and landing vehicles (eVTOLs).

eVTOLs (sometimes called air or flying taxis) are essentially aircrafts that can hover and fly, and they take off and land vertically. They are greener and quieter than classic helicopters because they are electric powered.

While not yet an investment reality, Saffaye says, “The efficiencies are extensive with enormous benefits, led by improved and new services, time savings, and so much more. It may soon be a powerful investment opportunity.”

Embracing technology may prompt privacy concerns. With scams designed to take advantage of the world’s shift to digital platforms, it is natural to be wary.

“In terms of technology and user data – privacy is over. You are never going to win that battle no matter how you try to hide yourself,” says Saffaye. This may make some shun the digital world on a personal level but for investment professionals, it can be an opportunity.

How exposed are we?

Saffaye explains the prominence of technology in the economy can’t be ignored.

“If you go back to the S&P 500 – the US stock market index – in 1980, tech was among the smallest sectors at less than 10% and energy was the largest at 25% plus of the index,” he says. “Fast forward to today, that has completely reversed and more. Tech is now almost 30% of the S&P 500.” And that’s just counting the obvious “tech companies.”4

There are several ways investments and funds can be exposed to technology. When considering your exposure to tech through your investments, Saffaye offers points to be mindful of:

- Are your investments diverse and not concentrated?

- Remember: Traditional companies likely rely on technology, potentially exposing your investments to technology too!

“There are a number of more traditional companies revolutionizing what they’re doing by engaging with new technology. Just because a company has been around for longer, doesn’t mean that they can’t be disruptive with technology.”

Disruption can be good

The emergence of technologies that disrupt traditional practices is fast becoming the “new normal” in business. As a result, investment opportunities in tech will continue to open up; both in innovative tech and traditional companies.

“Society tends to want to protect existing infrastructure and jobs. Technology doesn’t discriminate – it doesn’t care,” explains Saffaye. “What technology cares about is making something function better.”

He highlights Amazon as a disruptive company. Providing goods “with extraordinary diversity, access and cost efficiency” to consumers at such a fast rate is at the precipice of putting, what Saffaye calls, “Mom and Pops companies” out of business.

“That’s were technology conflicts with society,” he explains. Although Saffaye stresses technology can and should be utilized by “Mom and Pops” too.

1 Markets and markets.com Cyber security market size. August 2022.

2 The Indian Express. ChatGPT hit 1 million users in 5 days. February 2023.

3 The New York Times. How big tech camouflaged wall street’s crisis. March 2023.

4 Times of India. How popular companies use ChatGPT for enhanced services. June 2023.

All investments involve risk, including the possible loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing.

“Newton” and/or the “Newton Investment Management” brand refers to the following group of affiliated companies: Newton Investment Management Limited (NIM) and Newton Investment Management North America LLC (NIMNA). NIM is incorporated in the United Kingdom (Registered in England no. 1371973) and is authorized and regulated by the Financial Conduct Authority in the conduct of investment business. Both Newton firms are registered with the Securities and Exchange Commission (SEC) in the United States of America as an investment adviser under the Investment Advisers Act of 1940. Newton is a subsidiary of The Bank of New York Mellon Corporation.

BNY Mellon Investment Management is one of the world’s leading investment management organizations, encompassing BNY Mellon’s affiliated investment management firms and global distribution companies. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the corporation as a whole or its various subsidiaries generally.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions.

Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances. Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change.

Past performance is no guarantee of future results.

The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Not FDIC-Insured | No Bank Guarantee | May Lose Value

© 2023 BNY Mellon Securities Corporation, distributor, 240 Greenwich Street, 9th Floor, New York, NY 10286

MARK-402325-2023-07-13