Types of mutual funds

Many types of mutual funds are out there for you to invest in. But choosing an investment really depends on some key criteria: your investment objective, your current income, your age, and your risk tolerance level.

Understanding Risk & Diversification

There is no opportunity without risk. When you invest, you have to be prepared for risk. There is simply no avoiding it. But there is a way to minimize risks to a level you can tolerate.

What Is Asset Allocation and Why Is It Important?

Asset allocation is the collection of investments that you own – and it is distinctly yours. It is a personalized plan designated to meet your individual goals.

![]()

Types of Mutual Funds

Many types of mutual funds are out there for you to invest in. But choosing an investment really depends on some key criteria: your investment objective, your current income, your age, and your risk tolerance level. A financial professional can best help you clearly define your investment objectives and help determine a mix of investments consistent with those objectives.

WHAT IS AN EQUITY FUND?

An equity mutual fund invests primarily in stocks and entitles the holder to a share of the company's potential success through dividends and/or capital appreciation. There are many types of equity mutual funds, including those with different styles (growth, value, blend, index), market capitalizations (small-, mid- and large-cap) and regional focus (e.g. domestic, international, global).

WHY CONSIDER EQUITY FUNDS IN MY PORTFOLIOS?

Equity mutual funds can be used to invest in specific sectors, industries, and countries. Whether you want to invest in pharmaceutical stocks or international companies, equity mutual funds come in different sizes and varieties to help you create the portfolio you desire.

WHAT ARE THE RISKS AND BENEFITS?

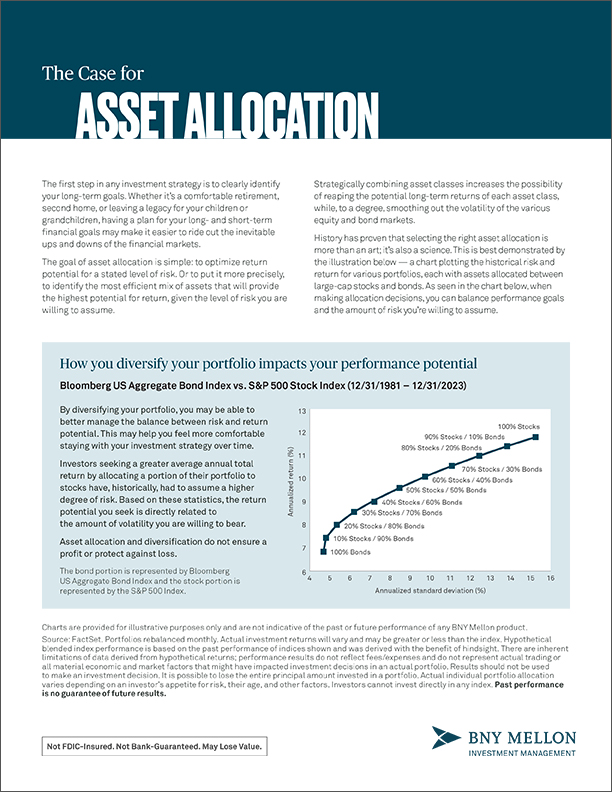

Strategically combining asset classes increases the possibility of reaping the potential long-term returns of each asset class, while aiming to smooth out the volatility of the various equity markets. Like all securities, equity mutual funds are subject to market or systematic risk. This is because there is no way to predict what will happen in the future or whether a certain asset will increase or decrease in its value.

Equity funds are subject generally to market, market sector, market liquidity, issuer and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund's prospectus.

WHAT IS A GROWTH FUND?

Growth funds consist of stocks of companies that are expected to "grow" their earnings, or profits, faster than the overall market. These stocks can be issued by companies in new or expanding industries, or in well-established industries.

WHAT TYPES OF STOCKS DO GROWTH MANAGERS LOOK FOR?

Growth managers search for stocks of companies with above-average historical earnings, earnings growth rates, and earnings forecasts. These companies are typically well-managed and have demonstrated sustained patterns of profitability. Given their earnings growth potential, growth stocks tend to be relatively expensive. Investors are often willing to pay more for them and thus push prices up.

WHY CONSIDER GROWTH-STYLE PRODUCTS FOR MY PORTFOLIO?

Depending on your time horizon and risk tolerance, tapping into the growth potential of these stocks through growth mutual funds could help you pursue your need for capital appreciation, particularly for long-term goals such as retirement or college.

WHAT ARE THE BENEFITS AND RISKS?

Growth stocks may provide potential for returns that exceed the overall market's returns, but they can also be more volatile. Growth companies are expected to increase their earnings at a certain rate. If these expectations are not met, a stock's price may decline, even if earnings do increase. In addition, growth stocks typically lack the dividend yield that can cushion stock prices during market downturns.

WHAT IS A VALUE FUND?

Value funds search for bargains - stocks that are considered undervalued. These can be strong companies that are considered to be inexpensively priced relative to their perceived value. Value managers expect the market will recognize the potential value of these stocks and that their prices will rise.

WHAT TYPE OF STOCKS DO VALUE MANAGERS LOOK FOR?

Value managers seek companies that are temporarily out of favor because of short-term developments, like earnings disappointments or competitive threats. They also look for signs that these short-term problems are being addressed by management, and that a company's growth potential may eventually be realized. As a result, these stocks typically have lower price-to-earnings ratios, which means the portfolio managers are paying lower prices for the company's earnings.

WHY CONSIDER VALUE INVESTING IN MY PORTFOLIO?

A stock with a bargain price may offer a greater long-term potential for growth than an expensive growth stock. Value stocks may offer greater protection against loss than growth stocks because, depending on market conditions, an inexpensive stock may not decline as much as an expensive one.

WHAT ARE THE BENEFITS AND RISKS?

Value stocks may outpace the returns of other equity investments in some economic conditions and may also be less volatile. They're typically sensitive to the economic cycle. Stocks often favored by value funds are cyclical stocks - stocks in industries that tend to rise and fall in line with the economy.

Value stocks involve the risk that they may never reach what the manager believes is their full market value, either because the market fails to recognize the stock's worth or the manager misgauged that worth. They also may decline in price, even though in theory they are already undervalued. Because different types of stocks tend to shift in and out of favor depending on market and economic conditions, the fund's performance may sometimes be lower or higher than that of other types of funds (such as those concentrated in growth stocks.)

WHAT IS A BLEND FUND?

In equity investing, there are two main management styles - growth and value. While both offer a long-term approach to capital appreciation, they differ in how they pursue that goal. Blend investing combines both approaches.

WHY CONSIDER BLEND INVESTING IN MY PORTFOLIO?

Because it is difficult to determine which style the market will favor, a blend fund may be a smart core equity strategy. The growth and value styles of investing have contrasting characteristics which allows a blend portfolio to maintain diversification in any market environment. Over the long term, you'll potentially benefit by not having to guess which investment style will do better.

Growth and value stocks have taken turns outperforming each other over time. A blended approach offers you the opportunity to take advantage of whichever style is in favor.

Diversification in a Volatile Market |

||

| Growth | Value | |

| Companies with... | Consistently stronger earnings history | Earnings shortfalls, or a company that is out of favor with investors |

| Stock prices... | Valued on high growth earnings estimates | Are considered undervalued compared with intrinsic worth |

| Style tends to perform best in... | Faster growing economic environments | Slower growing economic environments |

| Stock selection focuses on... | Growth of earnings potential | Growth potential relative to current price |

WHAT ARE THE BENEFITS AND RISKS?

Because blend funds may invest in both growth and value stocks, they'll be affected by economic conditions depending on their specific holdings and may also be affected by weighting and performance of that style.

WHAT IS AN INDEX FUND?

Index funds seek to match the returns of a specific market index, like the S&P 500, by investing in all of the stocks in an index or a representative sampling of those stocks. Index fund managers hope to pursue the stock market's long-term growth potential.

HOW ARE INDEX FUNDS DIFFERENT FROM ACTIVELY MANAGED FUNDS?

Index funds are "passively" managed, as opposed to a typical fund that may be "actively" managed.

- Active management hinges on security selection to maximize growth -the portfolio manager is looking at stocks, and their relative valuations, every day and making buy, sell and hold decisions based on fundamental and/or technical analysis.

- Passive management aims to simply match the performance of an index. Passive managers do this by buying either all the stocks in the index or a representative sampling of the stocks in the index, with weightings substantially similar to those of the index.

WHY CONSIDER INDEX FUNDS IN MY PORTFOLIO?

When investing for long-term goals, like retirement or college, index funds may help you form the foundation of an equity portfolio designed to pursue capital appreciation over time. Index funds may also complement actively managed equity funds that you choose to include in your portfolio. Since many investors are attracted to the distinctive investment philosophies and strategies offered by a wide range of actively managed funds, it may be a good idea to combine equity and bond portfolios with a core investment in an index fund.

Potentially higher after-tax returns

With index funds, you may be able to keep more of what you earn from your investments than you would from some funds that trade more actively. The relatively limited buying and selling of securities can mean lower portfolio turnover, which can potentially limit year-end capital gain distributions and tax liability.

Lower costs

Index funds generally have lower costs than actively managed funds. Fund managers don’t have the expense of research to determine the fund's holdings. Also, trading costs may be lower because index managers often do not buy and sell holdings as frequently as active managers do. As a result of keeping portfolio turnover low, trading expenses are usually lower. An indexing strategy does not attempt to manage market volatility, use defensive strategies or reduce the effects of any long-term periods of poor stock performance.

Performance Correlation

While the value of index funds will rise and fall with the underlying index, investors can feel confident that performance is unlikely to vary much from the index (before fund expenses). Keep in mind that you cannot invest directly in any index.

Diversification

Broad-based index funds do not favor or emphasize a particular company or sector. Holdings are widely diversified, which may help to reduce investment risk relative to funds that invest in fewer companies or sectors. Asset allocation and diversification cannot ensure a profit or protect against loss in declining markets.

WHAT ARE THE BENEFITS AND RISKS?

Because index funds attempt to match the performance of a particular market index, they'll generally be affected by economic conditions in the same way as the overall market. When the economy is strong, for example, large-company stocks may benefit from rising earnings. A large-company index fund, such as a fund that seeks to match its performance to the S&P 500, may in turn benefit from the growth of these large companies. Because index fund managers only invest in the stocks that make up the relevant index, they may have less flexibility than other fund managers to be defensive in down markets. That's why the performance of an index fund tends to rise and fall in sync with the overall market.

Like any equity investing, indexing is not a "get in and get out" strategy. It's designed to work best over the long term, when the cost advantages it offers, potentially, can be maximized through compounding.

WHAT IS A GLOBAL OR INTERNATIONAL FUND?

Global and international funds generally seek capital appreciation or income by investing in stocks or bonds of companies in foreign markets. Some funds may target specific regions or countries, while others may focus on developed or emerging markets.

The difference between the two is that a global fund can invest in U.S. markets, whereas an international fund generally only invests in non-U.S. securities.

WHY CONSIDER INTERNATIONAL INVESTING IN MY PORTFOLIO?

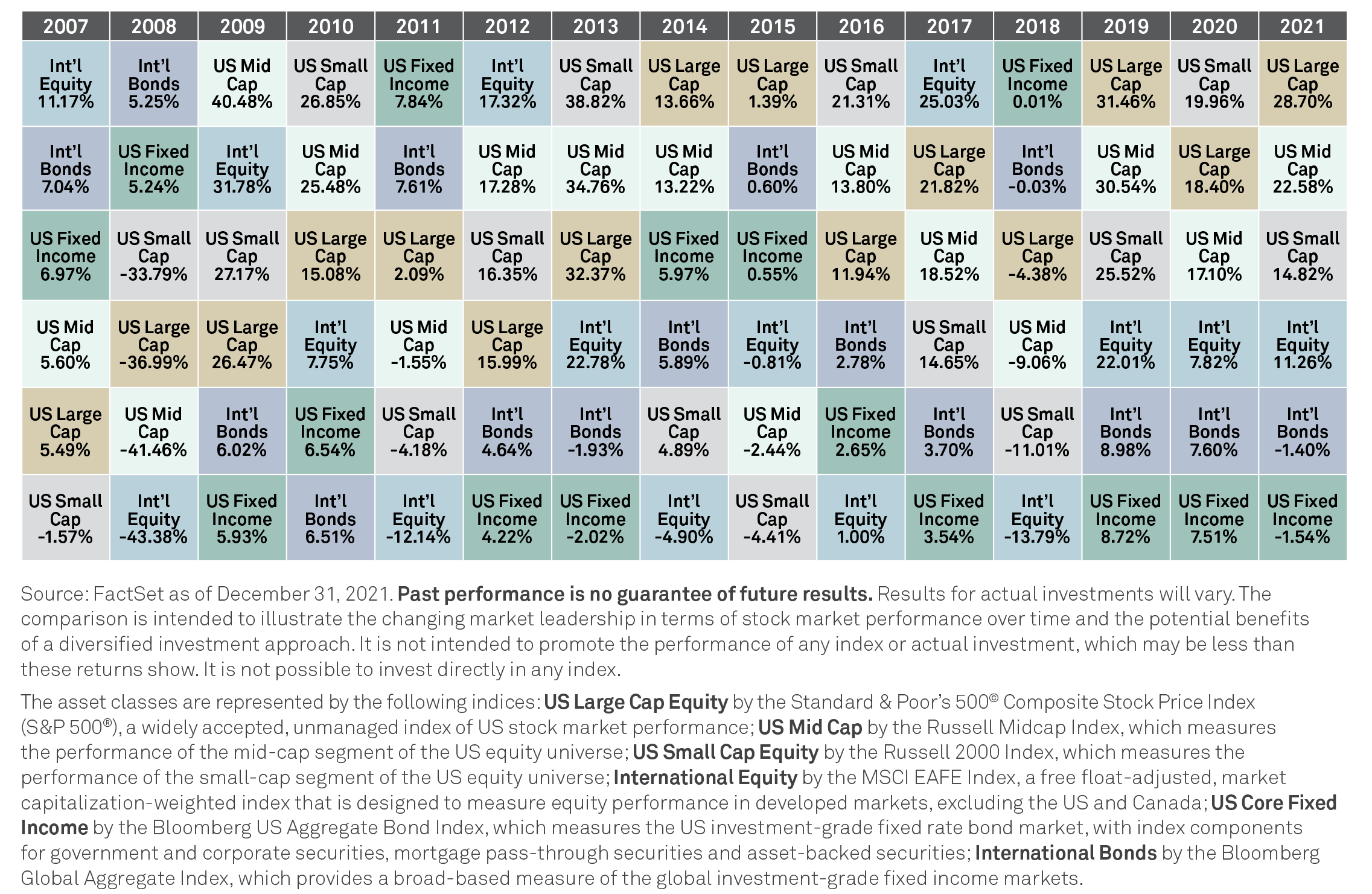

Consider adding an international element to your portfolio can help increase diversification. Economic and market conditions are continually changing. Sometimes they favor domestic stocks or bonds while at other times they favor foreign investments. By diversifying among different geographic locations, it may be possible to reduce the impact of any one country's market performance on a portfolio's overall returns.

Adding global exposure to an investment portfolio can provide increased investment opportunity as well as return potential that may not be available through the U.S. market alone.

- Diversification – By investing in a variety of international securities, you may be able to reduce the risks associated with investing in a single market, economy, country or currency. Since different countries can follow different economic cycles, positive performance in one might help offset underperformance in another.

- Opportunity – With today's global economy, opportunities aren't only found in the U.S. market – some of the strongest opportunities may at times be found abroad. In the past, a growth-oriented portfolio mainly focused on the United States for industry-lending companies. Today, such companies are spread throughout the globe, and investors maintaining a purely domestic-oriented portfolio may be limiting themselves on both diversification and growth potential.

WHAT ARE THE POTENTIAL BENEFITS AND RISKS?

In today's global economy, opportunities aren't only found in the U.S. market. By diversifying among different geographic locations, it may be possible to reduce the impact of any one country's market performance on a portfolio's overall returns. But remember that investing internationally involves accepting the risks of changes in currency exchange rates, political, economic and social instability, a lack of comprehensive company information, differing auditing and legal standards, and potentially less market liquidity. These risks are generally greater with emerging market countries than with more economically and politically established foreign countries. As a result, investors can expect more volatile returns with dramatic shifts in performance over short-term periods. Of course, an international investment should be considered a supplement to an overall investment program and is appropriate only for those investors willing to undertake the risks involved.

WHAT IS A TAXABLE BOND FUND?

A taxable bond fund is made up of many individual bonds. The type of bonds in the fund depend on the investment objective and policies of the particular fund. The difference between a taxable bond fund and a municipal bond fund is that taxable bond funds are subject to state and federal taxes, whereas a municipal bond fund is generally exempt from federal income tax and, if you live in the issuing state, state and local taxes. Bonds are subject to interest-rate, credit, liquidity, call and market risks, to varying degrees. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes and rate increases can cause price declines. Municipal income may be subject to state and local taxes. Some income may be subject to the federal alternative minimum tax for certain investors. Capital gains, if any, are taxable.

Some taxable bond funds invest in a wide variety of bonds which may include bonds issued by the U.S. government, mortgage- and asset-backed securities, corporate bonds and foreign bonds. Government bonds and some mortgage-backed bonds are backed by the full faith and credit of the U.S. government, meaning timely payment of principal and interest are guaranteed. While the U.S. government guarantees the timely payment of principal and interest on these bonds, the market value and the share price of these bonds are not guaranteed.

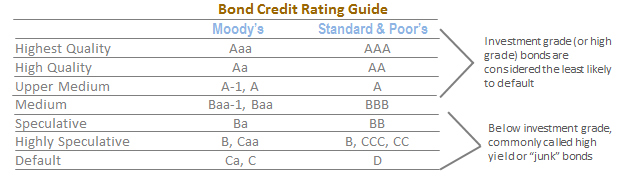

Corporate bonds carry credit ratings which help indicate the likelihood that the issue will pay interest and repay principal on a timely basis. The two main categories of corporate bonds are investment grade and below investment grade or "junk bonds."

WHY CONSIDER BOND FUNDS IN MY PORTFOLIO?

A major benefit of a taxable bond fund is that most pay monthly income. Because individual bonds generally pay interest only twice a year, bond funds – comprised of many bonds paying income at different points – may be helpful for individuals requiring current income on a regular basis.

Most taxable bond funds have relatively low investment minimums, allowing investors to establish a diversified portfolio of bonds. Because of the high face value of individual bonds, investors would need a much higher investment to build a diversified portfolio on their own.

Asset allocation is another important but often overlooked benefit. Stocks and bonds often react differently to economic and market events, and a portfolio that includes both asset classes helps to increase diversification and may help manage the overall volatility of the portfolio. Of course, asset allocation and diversification does not guarantee a profit or protect against loss.

This is not intended to be a recommendation for a specific portfolio allocation.

Consult your financial professional about your individual situation.

IMPORTANT CONCEPTS ABOUT BONDS

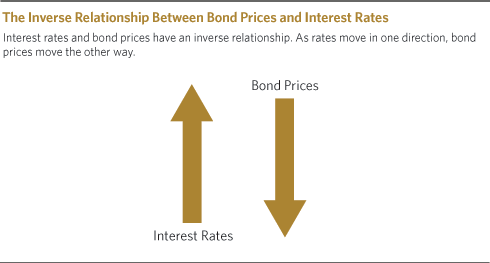

- The relationship of bond prices and interest rates: Bonds fluctuate in value. This is true for bond funds as well. One major factor affecting bond prices is the movement of interest rates. Bond prices and interest rates have an inverse relationship — as one rises, the other falls. This is known as interest-rate risk.

The same is true for bond funds. The movement of interest rates would affect the prices of bonds in the fund's portfolio, which would in turn affect a fund's share price. Short-term bonds, and bonds close to maturity, generally are affected by interest-rate changes to a lesser degree than longer-term bonds.

WHAT OTHER RISKS ARE ASSOCIATED WITH BOND FUNDS?

- Credit risk. This relates to any privately issued bond. Credit quality refers to a company's ability to make principal and interest payments in a timely manner. Independent rating agencies like Standard & Poor's and Moody's have their own ratings systems, but generally the higher the rating assigned, the greater the likelihood that the issuer will meet these obligations.

Fund ratings are statements of opinion, not statements of fact or recommendations to buy, sell or hold the shares of a fund. Standard & Poor's (S&P) believes that, with a Principal Stability Rating of AAA, the fund has an extremely strong capacity to maintain principal and stability and to limit exposure to principal losses due to credit, market, and/or liquidity risks. For more information on the rating methodology visit www.standardandpoors.com. Moody's Investors Service rates money market mutual funds 'Aaa-mf' if, in Moody's opinion, a fund has a very strong ability to meet the dual objectives of providing liquidity and preserving capital. This rating, which is derived from a combination of Moody's assessment of a fund's Portfolio Credit Profile, Portfolio Stability Profile, and other qualitative factors, is not intended to consider prospective performance of a fund. For more information on the rating methodology visit www.moodys.com.

- Prepayment risk. Prepayment risk generally applies to mortgage-backed and many asset-backed bonds. Many kinds of mortgage securities, for example, may be paid early (prior to the bond's maturity date) when homeowners decide to refinance their mortgages when interest rates decline. Prepayment causes bond funds to reinvest proceeds at lower prevailing rates, potentially reducing performance.

- Liquidity risk. When there is little or no active trading market for a bond, it can be more difficult to buy or sell the security at or near its fair value. In such a market, the value of such securities, and a bond fund's share price, may decline dramatically.

Municipal bond funds invest in debt obligations issued by state and local municipalities to raise money for projects like new roads and schools.

The difference between a municipal bond fund and a taxable bond fund is that municipal bond funds are generally exempt from federal income tax and, if you live in the issuing state, state and local taxes. Taxable bond funds are subject to state and federal taxes.

WHY CONSIDER MUNICIPAL BOND FUNDS IN MY PORTFOLIO?

If you're considering purchasing a municipal bond fund, you should always take into account the taxable equivalent yield. The taxable equivalent yield is the yield an investor would have to earn on a taxable investment to equal a certain tax-free yield.

WHY IS YIELD STILL NOT THE COMPLETE PICTURE?

While yield is an important figure that can help you estimate your income stream, it should not be the only factor – total return is equally as important. It gives a more complete picture of a fund's performance because it reflects all income distributions, as well as any increase or decrease of the fund's net asset value (NAV).

WHAT CAN AFFECT NET ASSET VALUE?

- Interest Rate Changes. Usually called "average portfolio maturity," this shows the average number of years until the bonds in the portfolio mature and become payable. The portfolio maturity will determine the level of impact a change in interest rates will have on a bond's price. Municipal bonds generally can be expected to gain in value if interest rates decline and decrease in value if rates rise. In a rising interest-rate environment a longer maturity could hurt the fund's NAV, since bonds in the portfolio may lose value because newly issued bonds would be paying higher yields.

- Credit Quality Changes. Municipal bonds are rated by credit quality - their ability to pay interest and principal payments in a timely matter. Credit quality can range. To compensate investors who invest in lower quality, higher risk bonds, a higher yield might be paid. But the lower credit quality means there could be a higher risk of the issuer missing an interest payment, or even defaulting on the bond. This increased risk could negatively impact a fund's NAV, if credit issues arise.

Issue Selection. Municipalities can issue bonds for any number of different reasons. Issue selection refers to the particular circumstances surrounding the specific municipal bond issuance that could affect the price of the bond, and in turn, a fund's NAV. For example:

- What is the fiscal health of the state or municipality?

- What are the risks involved in the underlying municipal project?

WHAT OTHER RISKS ARE ASSOCIATED WITH MUNICIPAL BOND FUNDS?

Bond mutual funds are subject generally to interest rate, credit, liquidity and market risks to varying degrees. These risks are described in the fund's prospectus.

WHAT IS A MONEY MARKET FUND?

A money market fund invests in short term investments, like certificates of deposit (CDs) and treasury bills. The fund's net asset value is usually $1 a share and its interest rate can go up or down.

WHY CONSIDER A MONEY MARKET FUND IN MY PORTFOLIO?

If you need to keep your investment liquid and readily available, a money market fund might be right for you. They aim to preserve capital and generate short-term income with minimal risk. While their returns may be low, relative to the potential of other asset classes, they may help you maintain your principal investment at a lower risk. A good example of someone who might consider a money market fund is a parent whose child is approaching college age. Transferring the money they’ve saved and invested to pay for college to a money market fund might be a good way to preserve what they have and have easy access to it.

WHAT ARE THE BENEFITS AND RISKS?

Money market funds offer short-term income and stability with a minimal risk of principal loss. But, the interest on a money market fund is typically lower than other fixed income investments.

An investment in a money market fund is not a bank deposit. It is not insured or guaranteed by the FDIC or any other government agency. Although the fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the fund. Returns on money market funds run the risk of not keeping pace with inflation.

WHAT ARE ALTERNATIVE INVESTMENTS?

An investment that is not one of the three traditional asset types (stocks, bonds and cash). Most alternative investment assets are held by institutional investors or accredited, high-net-worth individuals because of their complex nature, limited regulations and relative lack of liquidity. Alternative investments include hedge funds, managed futures, real estate, commodities and derivatives contracts.

WHAT ARE REAL ASSETS?

Real assets are an asset class generally for investors who are particularly concerned about inflation, currency prices or other macroeconomic factors. These real assets might include gold, oil or real estate.

![]()

Understanding Risk & Diversification

There is no opportunity without risk. When you invest, you have to be prepared for risk. There is simply no avoiding it. But there is a way to help minimize risks to a level you can tolerate.

WHAT IS THE RIGHT LEVEL OF RISK FOR YOU?

First, let’s define risk. Risk is the price you pay to pursue opportunity. In the investment world, risk is the chance that the value of your investment will decline: taking less risk will generally result in lower returns whereas assuming higher levels of risk may generate higher potential returns over the long-term.

The important thing is to understand how much you can stand to lose — because, while there are strategies to limit risk through your investment choices, you can't eliminate it completely. Your investment portfolio should be crafted to provide the right balance of risk and return opportunities so that you can achieve your goals and be able to sleep at night.

Your risk tolerance is different from everyone else’s. How you decide to invest in order to minimize risk to a level where you are comfortable will be influenced by your personality, financial situation and your stage in life.

What is your personality? Are you naturally cautious or do you have to fortitude to weather the ups and downs in the markets?

What are your finances like? Do you have enough assets to provide a safety net in the event of a down market? Or do you rely on your investments to meet current needs, such as generating a cash flow?

Where are you in your life? Are you young, with many years ahead of you to recoup potential losses, or do you intend to tap your assets in the near future and need to protect the value of your nest egg?

DIVERSIFICATION: A TIME-TESTED STRATEGY TO HELP MANAGE RISK

One method to managing risk is to spread your investable dollars over a variety of investment types — because different kinds of investments perform better at different times.

To seek diversification, most experts recommend that you spread your investments among many different asset classes —cash, stocks, bonds, mutual funds, real estate, or perhaps alternative investments — as well as industry, style and country. By picking investments with diverse characteristics, you can help balance the returns of different holdings; that if one drops in value it may be balanced out by others that are performing well.

Diversification cannot assure a profit or protect against loss.

UNDERSTANDING DIFFERENT TYPES OF RISK

Below we briefly outline some of the most common investment risks. However, one of the least considered types of risk is behavioral risk — the personal emotions that rise and fall with the ups and downs of the market. Behavior risk is usually greatest in down markets as investors watch the value of their investments fall. It is important to understand what level of risk you can tolerate and how much you can afford to lose — and invest accordingly. Otherwise, you might be inclined to sell when a stock is falling and lock in a loss.

- Market risk — the most commonly understood risk — is the possibility of losing money because of a decline in market value. Because market fluctuations are how investors realize gains, volatility is essential for returns. The more volatile an investment the more dramatic price changes will be — both up and down.

- Inflation risk is the danger that your money will not grow as fast as the rate of inflation, which means a dollar will not be worth as much tomorrow as it is today. Inflation risk may well be the most important concern for the long-term investor.

- Credit risk is the risk that a company will default on its debt obligations. Government bonds are typically considered the safest and offer the lowest returns. Corporate bonds come in a range of risks, from investment grade to junk bonds.

- Interest-rate risk results from the relationship between securities and interest rates. Bond investments tend to drop in price as interest rates rise and gain value when interest rates decline.

- Foreign investment risk includes exposure to political events, currency exchange rate changes, and other conditions that affect the value of investments traded or located in foreign countries.

- Market-timing risk is when you try to beat the market by buying investments when prices are at their lowest and selling at their peak. Being wrong about either a dramatic rise or a sudden fall in prices can mean a significant loss to you.

![]()

What is Asset Allocation and Why is it Important?

Asset allocation is the collection of investments that you own - and it is distinctly yours. It is a personalized plan designed to meet your individual goals.

Using the Power of Asset Allocation to Help Meet Your Goals

An easy analogy to help you understand asset allocation is to think of a recipe. Each ingredient is part of a whole and when combined together, they create just the right mixture. If you leave one ingredient out, the end result won't taste quite right.

Asset allocation is similar in that if your portfolio does not include the right combinations of stocks, bonds and other asset classes, it may not deliver the results you are looking for — it may be too risky or underperform, so you are unable to achieve your investment objectives. The ingredients in your asset allocation plan should be carefully chosen to deliver the right balance of risk and return, and periodically reviewed to make sure it remains properly aligned with your goals.

Everyone is different. Your cousin may have the fortitude and youth to invest aggressively, seeking higher returns with the understanding that he or she has the time needed to recuperate from any losses. Your grandfather will probably avoid risk because he can’t afford to lose what he already has. Your neighbor may have more latitude because he has built up his savings and has a safety net. You, however, may be naturally cautious — concerned that you do not have the wherewithal to remain disciplined during times of market volatility — and may decide to take a moderate stance.

Over time, your strategy will change. Your asset allocation — whether you are conservative or aggressive — should be based on what you want from your investments. And as the years pass, those goals will change. When you are young you need to save up for a big goal, such as purchasing a new home. During your high-earning years, you may be able to invest more income or you may need it to send a child to college. And as you near retirement, you may become more concerned about protecting your savings and generating a reliable flow of income.

How Asset Allocation Works

Markets are cyclical. What's hot today — whether it's asset class (such as stocks or bonds) region (such as emerging markets), a market sector (such as technology), or an investment style (such as value investing) — will eventually fall out of favor.

So rather than attempting to invest in the most rewarding asset class, asset allocation sets a specific goal, spreading your investments across different types of assets and positioning you to take advantage of opportunities as they appear. Let’s say you decide the right mix is 60% U.S. stocks, 30% bonds and 10% cash. If the U.S. stock market rises in value and you realize investment gains, the stock portion of your total portfolio will become larger. This means you will need to rebalance your portfolio, selling off the extra gains, buying more of the rest of your portfolio and resetting it back to your 60/30/10 allocation. In this way you can capture market gains, diversify to minimize risk, and always remain focused on your goals.

Keeping your portfolio on course

Considerations for developing your asset allocation strategy

- Why are you investing? What are your goals? Remember, you likely have more than one goal.

- How long do you have to realize those goals?

- What is your current financial situation? Do you feel secure? Do you have a job or a financial safety net?

- What major life events do you foresee, short or long-term, that may impact your strategy?

- How comfortable are you with risk? How much can you afford to lose should the market decline?

- What is your tax bracket? Do you need to minimize the impact of taxes?

- What are your investing preferences? Are there certain investments or assets you wish to include (such as a business or inherited stock) or exclude?

Your asset allocation plan is one of the most important decisions you and your financial professional will make. Your financial professional can help you with your asset allocation plan and financial planning. For more information, contact us at 1-800-645-6561.

Asset allocation and diversification cannot assure a profit or protect against loss.

Definitions:

S&P 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies, widely regarded as the best gauge of large-cap U.S. equities. Indexes do not include any expenses, fees or sales charges, which would lower performance. The indexes are unmanaged and should not be considered an investment. It is not possible to invest directly in an index.

Portfolio turnover is a measure of how frequently assets within a fund are bought and sold by the managers.

Investment grade refers to the quality of a company's credit. To be considered an investment grade issue, the company must be rated at 'BBB' or higher by Standard and Poor's or Moody's. Anything below this 'BBB' rating is considered non-investment grade. If the company or bond is rated 'BB' or lower it is known as junk grade, in which case the probability that the company will repay its issued debt is deemed to be speculative.

Important Disclosures:

Investors should consider the investment objectives, risks, charges, and expenses of a mutual fund carefully before investing. Download a prospectus, or summary prospectus, if available, that contains this and other information about the fund, and read it carefully before investing.

Risks:

All investments involve risk including loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing. Asset allocation and diversification cannot assure a profit or protect against loss.

All investments involve risk including loss of principal. Bonds are subject to interest rate, credit, liquidity, call and market risks, to varying degrees. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes and rate increases can cause price declines. The amount of public information available about municipal securities is generally less than that for corporate equities or bonds. Legislative changes, state and local economic and business developments, may adversely affect the yield and/or value of; municipal securities. Other factors include the general conditions of the municipal securities market, the size of the particular offering, maturity of the obligation, and the rating of the issue. Income for national municipal funds may be subject to state and local taxes. Income may be subject to state and local taxes for out-of-state residents. Some income may be subject to the federal alternative minimum tax for certain investors. Capital gains, if any, are taxable. Equities; are subject to market, market sector, market liquidity, issuer, and investment style risks to varying degrees. There is no guarantee that dividend-paying companies will continue to pay, or increase, their dividend. Investing in foreign denominated and/or domiciled securities involves special risks, including changes in currency exchange rates, political, economic, and social instability, limited company information, differing auditing and legal standards, an d less market liquidity. These risks generally are greater with emerging market countries. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing. High yield bonds involve increased credit and liquidity risk than higher rated bonds and are considered speculative in terms of the issuer’s ability to pay interest and repay principal on a timely basis. Risks of investing in real estate securities are similar to those associated with direct investments in real estate, including falling property values due to increasing vacancies or declining rents resulting from economic, legal, political or technological developments, lack of liquidity, limited diversification and sensitivity to certain economic factors, such as interest-rate changes and market recessions. Real estate investment trusts are subject to risk, such as poor performance by the manager, adverse changes to tax laws or failure to qualify for tax-free pass through of income.

Recent market risks include pandemic risks related to COVID-19. The effects of COVID-19 have contributed to increased volatility in global markets and will likely affect certain countries, companies, industries and market sectors more dramatically than others.

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular investment, strategy, investment manager or account arrangement and should not be used as the primary basis for any investment decisions. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. This material does not take into account the particular investment objectives, restrictions, or financial, legal or tax situation of any specific investor. An investment in an investment product is not suitable for all investors. Please consult a legal, tax or investment professional in order to determine whether an investment product or service is appropriate for a particular situation. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

BNY Mellon Investment Management is one of the world's leading investment management organizations and one of the top U.S. wealth managers, encompassing BNY Mellon's affiliated investment management firms, wealth management organization and global distribution companies. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may also be used as a generic term to reference the Corporation as a whole or its various subsidiaries generally.

BNY Mellon Investment Adviser, Inc, and BNY Mellon Securities Corporation are subsidiaries of BNY Mellon. ©2022 BNY Mellon Securities Corporation, distributor, 240 Greenwich St., New York, NY 10286.

DRD-262854-2022-04-14