- ASSET CLASS

- SHARE CLASS

- MORNINGSTAR

- INVESTMENT FIRM

- SOLUTIONS

- Alternatives

- EQUITY

- FIXED INCOME

- Select a share class

- Morning star categories

- Morningstar Ratings

- Select Investment Firm

- SELECT A SOLUTION

- All Equity

- Global/International - Blend

- Global/International - Growth

- Global/International - Value

- Index - Blend

- Index - Growth

- Large Cap - Growth

- Large Cap - Value

- Large Cap - Blend

- Mid Cap - Blend

- Mid Cap - Growth

- Mid Cap - Value

- Small Cap - Blend

- Small Cap - Growth

- Small Cap - Value

- All fixed income

- Tax Exempt

- Taxable

- Class A

- Class C

- Class D

- Class I

- Class J

- Class K

- Class P

- Class Y

- Class Z

- BASIC Shares

- Investor Shares

- Service Class

- Single Share Class

- Bank loan

- Conservative allocation

- Diversified Emerging Markets

- Emerging Markets Bond

- Foreign Large Blend

- Foreign Large Growth

- Foreign Large Value

- Global Real Estate

- High Yield Bond

- High Yield Municipal

- Inflation-Protected Bond

- Intermediate Government

- Intermediate-Term Bond

- Large Blend

- Large Growth

- Large Value

- Long Government

- Long/Short Equity

- Mid-Cap Blend

- Mid-Cap Growth

- Moderate Allocation

- Multialternative

- Multisector Bond

- Municipal California Intermediate

- Municipal Massachusetts

- Municipal National Intermediate

- Municipal National Short

- Municipal New Jersey

- Municipal New York Intermediate

- Municipal Pennsylvania

- Municipal Single State Intermediate

- Natural Resources

- Nontraditional Bond

- Short-Term Bond

- Small Blend

- Small Growth

- Technology

- Ultrashort Bond

- World Bond

- World Stock

- 5 Star Rated Funds

- 4 Star Rated Funds

- Alcentra

- Amherst Capital

- CenterSquare

- Fayez Sarofim

- Insight Investment

- Mellon Investments Corporation

- Newton

- Newton Investment Management NA

- Walter Scott

- Core

- Diversification

- Income

- Inflation-Minded

- Low Duration Risk

- Tax Efficiency

Featured Perspectives

Meet the manager: Brock Campbell

Brock Campbell has worked for BNY Mellon since 2005 and became portfolio manager on the Global Natural Resources...

Trump vs Biden: More noise in the news than the stock market

The 2024 presidential election is likely to add noise to the investing cycle, says BNY Mellon IM’s Eric Hundahl. Watch...

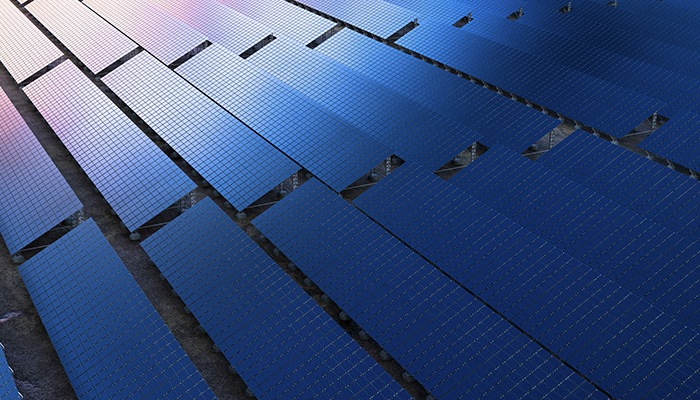

Coming to America: Investing in utilities

Discover the catalysts that may be creating significant tailwinds for US utilities.

AI equity impact: already irrational?

Speculation on the influence of Artificial Intelligence (AI) pervades every corner today. Few industries seem...

Latest Thought Leadership

Recent whitepapers reflecting the philosophy and process of our distinct investment firms.

LEARN MOREInvesting in and for Women

To commemorate the launch of our thematic ETFs, we recently rang the Nasdaq Closing Bell. Joining us in the celebration were Girls Inc. CEO Stephanie J. Hull, Ph.D and active participants of Girls Inc. New York City.

READ MORENeed Help?

Call for sales and product info

(8:30am – 6pm ET, Monday – Friday)

Call for service related info

(9am – 5pm ET, Monday – Friday)

BNY Mellon Regional Consultants

Our commitment to fully servicing the needs of our investment partners is our highest priority. Contact a Wholesaler in your area.

Investors should consider the investment objectives, risks, charges, and expenses of the fund carefully before investing. Download a prospectus, or summary prospectus, if available, that contains this and other information about the fund, and read it carefully before investing. There is no guarantee that any investment strategy or approach will be successful or achieve any particular level of results. All investment products involve risk of principal loss.

The products and services described on this Web site are available only to U.S. residents and the information on this Web site is only for such persons. The information on this Web site is not an offer to sell or a solicitation of an offer to buy, any security, nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase or sale may not lawfully be made.

Financial intermediary and institutional investor activities are serviced by BNY Mellon Institutional Services, a division of BNY Mellon Securities Corporation, distributor of the BNY Mellon Family of Funds. BNY Mellon Investment Management encompasses BNY Mellon’s affiliated investment management firms, wealth management services and global distribution companies.

MARK-487858-2024-01-24